- China

- /

- Electronic Equipment and Components

- /

- SZSE:301486

LEPU ScienTech Medical Technology (Shanghai) And 2 Other Emerging Small Caps with Solid Potential

Reviewed by Simply Wall St

In recent weeks, smaller-cap indexes have shown resilience, with the S&P MidCap 400 and Russell 2000 posting gains despite broader market challenges such as trade uncertainties and policy shifts. This environment highlights the potential of emerging small-cap companies in Asia that are navigating these complexities with innovative solutions and growth strategies. Identifying stocks with solid fundamentals and adaptability can be crucial for investors seeking opportunities in today's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Advancetek EnterpriseLtd | 45.83% | 40.81% | 62.96% | ★★★★★★ |

| Soft-World International | NA | -0.79% | 6.29% | ★★★★★★ |

| Miwon Chemicals | 0.10% | 10.79% | 15.77% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Renxin New MaterialLtd | NA | 0.65% | -39.64% | ★★★★★★ |

| Bohai Ferry Group | 5.00% | 7.07% | 5.05% | ★★★★★★ |

| AJIS | 0.78% | 2.14% | -13.06% | ★★★★★☆ |

| China Container Terminal | 45.76% | 2.82% | 16.98% | ★★★★★☆ |

| Kinpo Electronics | 99.44% | 5.80% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company focused on the research, development, manufacture, and commercialization of interventional medical devices globally, with a market cap of HK$8.17 billion.

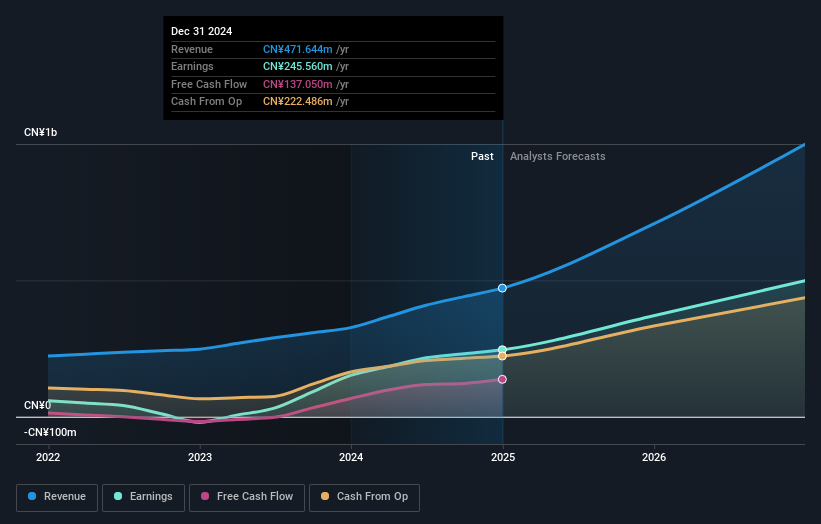

Operations: The primary revenue stream for LEPU ScienTech is its Occluder Business, generating CN¥471.14 million. The company has a market capitalization of approximately HK$8.17 billion.

LEPU ScienTech Medical Technology, a nimble player in the medical equipment sector, has demonstrated impressive earnings growth of 62.1% over the past year, outpacing the industry average of 9.6%. The company's recent annual report highlights a net income surge to CNY 245.56 million from CNY 151.38 million previously, with basic earnings per share climbing to CNY 0.71 from CNY 0.44. Notably debt-free for five years, LEPU's strategic focus on innovative product commercialization seems to be paying off as they forecast continued profit growth between RMB 230 million and RMB 260 million for the upcoming year.

Shantui Construction Machinery (SZSE:000680)

Simply Wall St Value Rating: ★★★★★★

Overview: Shantui Construction Machinery Co., Ltd. provides construction machinery products both domestically and internationally, with a market cap of CN¥14.07 billion.

Operations: The company generates revenue primarily from the sale of construction machinery products. Its financial performance is influenced by the dynamics of both domestic and international markets. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

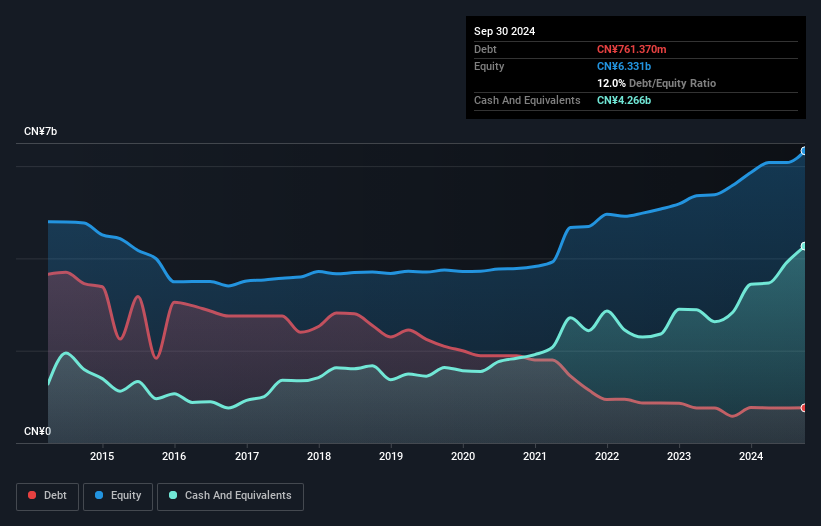

Shantui Construction Machinery, a nimble player in the machinery sector, has shown impressive earnings growth of 44.6% over the past year, outpacing the industry average of 1.7%. The company has significantly improved its financial health by reducing its debt-to-equity ratio from 55.9% to 12% over five years and now holds more cash than total debt. Trading at a substantial discount of 71.2% below estimated fair value, Shantui offers an attractive proposition for investors seeking undervalued opportunities with robust fundamentals and high-quality earnings potential in Asia's dynamic market landscape.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Zesum Technology Co., Ltd. is involved in the research, design, development, manufacture, and sale of precision electronic components in China and has a market capitalization of CN¥6.15 billion.

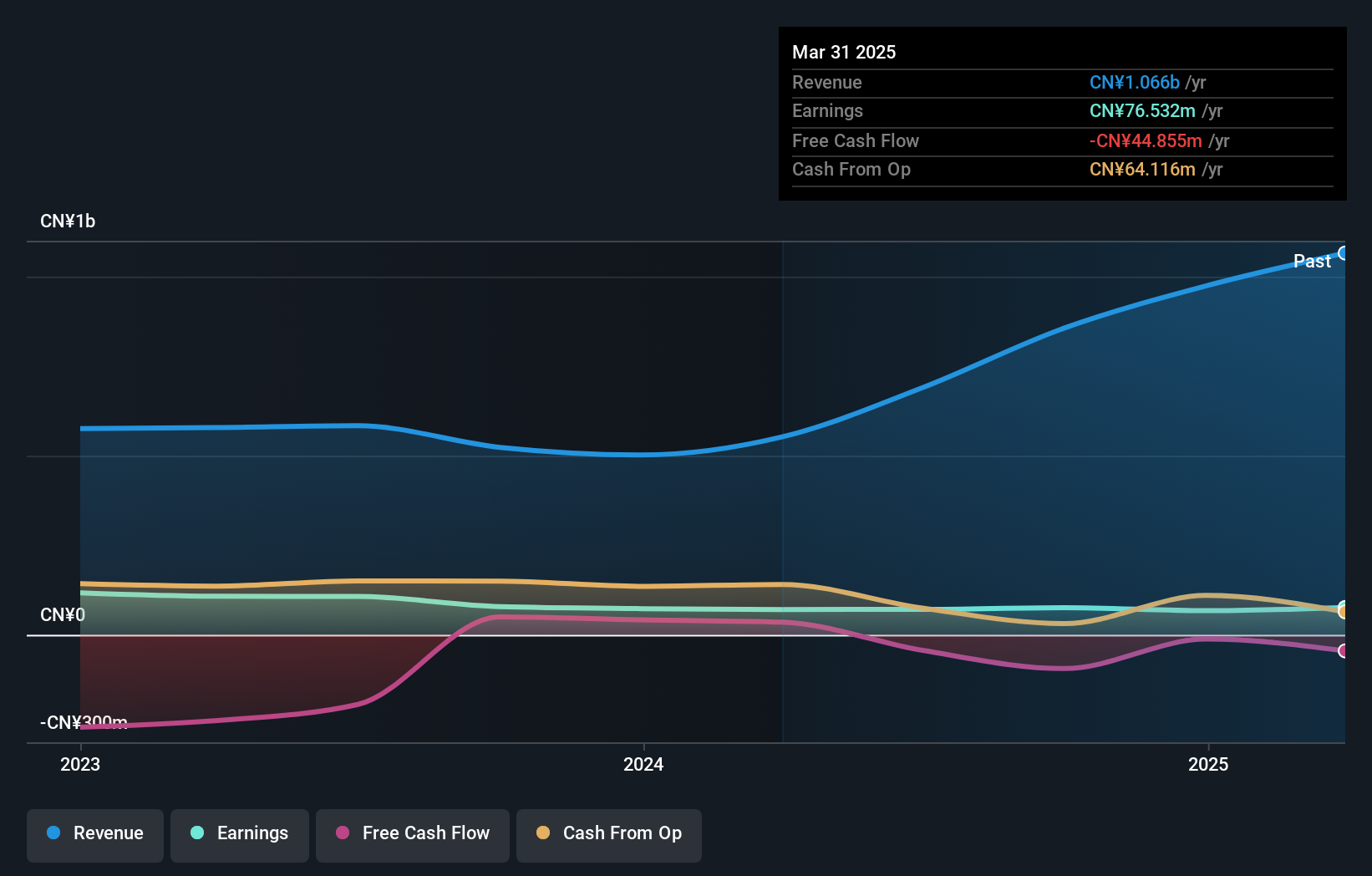

Operations: Shenzhen Zesum Technology generates revenue primarily through the sale of precision electronic components. The company's cost structure includes expenses related to research, design, development, and manufacturing processes. Its net profit margin has shown notable fluctuations recently.

Shenzhen Zesum Technology, a smaller player in the tech scene, shows mixed signals. Its earnings grew by 8% last year, outpacing the electronics industry average of 7.7%. However, profit margins dipped to 7.2% from 12.8%, reflecting some operational challenges. Despite this, its debt-to-equity ratio has impressively reduced from 7.6 to just 0.4 over five years, indicating stronger financial health with more cash than debt on hand. Recent quarterly sales surged to CNY266 million from CNY174 million year-on-year while net income rose to CNY23 million compared to CNY14 million previously; these figures suggest potential for future growth despite volatility concerns.

Summing It All Up

- Embark on your investment journey to our 2655 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301486

Shenzhen Zesum Technology

Engages in the research, design, development, manufacture, and sale of precision electronic components in China.

Flawless balance sheet slight.

Market Insights

Community Narratives