- China

- /

- Electronic Equipment and Components

- /

- SZSE:301391

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks are nearing record highs driven by optimism around potential trade deals and significant AI investments, with growth stocks outperforming value shares for the first time this year. In such a dynamic environment, identifying high-growth tech stocks involves looking for companies that can capitalize on technological advancements and favorable market sentiments while demonstrating resilience amid economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market capitalization of CN¥9.35 billion.

Operations: The company generates revenue primarily through its theater operations across China. It focuses on providing entertainment services, with a significant portion of its income derived from ticket sales and concessions. The financial performance is influenced by factors such as attendance rates and operational costs associated with running the theaters.

Despite its current unprofitability, Hengdian EntertainmentLTD is navigating a promising trajectory with an expected annual revenue growth of 18.1%, outpacing the Chinese market's average of 13.4%. This growth is complemented by an impressive forecast in earnings, set to surge by approximately 124.85% annually. The firm's strategic investments in R&D are pivotal, positioning it to capitalize on emerging trends and enhance its competitive edge as it moves toward profitability within three years. With positive free cash flow and a modest projected return on equity of 15.7%, Hengdian EntertainmentLTD is aligning its operations to leverage future market opportunities effectively.

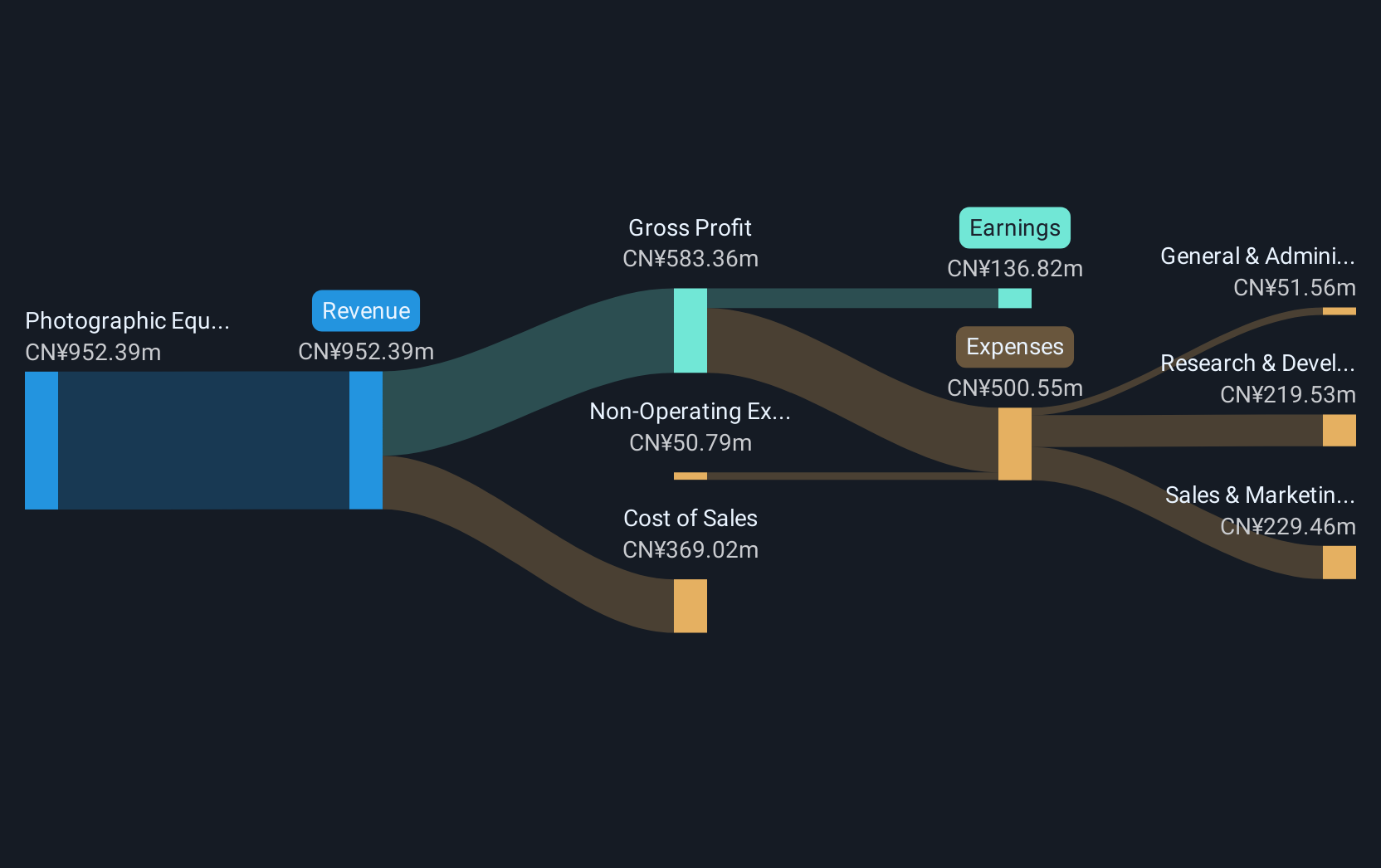

OPT Machine Vision Tech (SHSE:688686)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OPT Machine Vision Tech Co., Ltd. develops and supplies components and software for factory automation worldwide, with a market capitalization of CN¥9.58 billion.

Operations: The company generates revenue primarily from its Photographic Equipment & Supplies segment, which amounts to CN¥831.18 million.

OPT Machine Vision Tech is navigating a challenging yet promising landscape with its revenue growing at 22.6% annually, outpacing the Chinese market average of 13.4%. Despite a recent dip in net profit margins to 14.5% from last year's 23.2%, the company's strategic focus on R&D is robust, positioning it well within the tech sector for future innovations. Notably, OPT repurchased shares worth CNY 4.91 million recently, reflecting confidence in its trajectory despite current volatility in its share price and a forecasted modest return on equity of 9.3% over three years. This blend of aggressive revenue growth and substantial reinvestment in development underscores OPT’s potential to refine its competitive edge moving forward.

- Unlock comprehensive insights into our analysis of OPT Machine Vision Tech stock in this health report.

Learn about OPT Machine Vision Tech's historical performance.

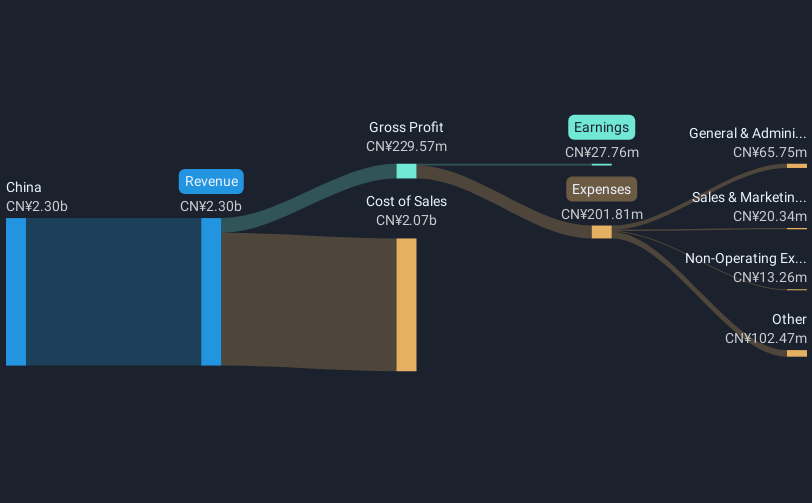

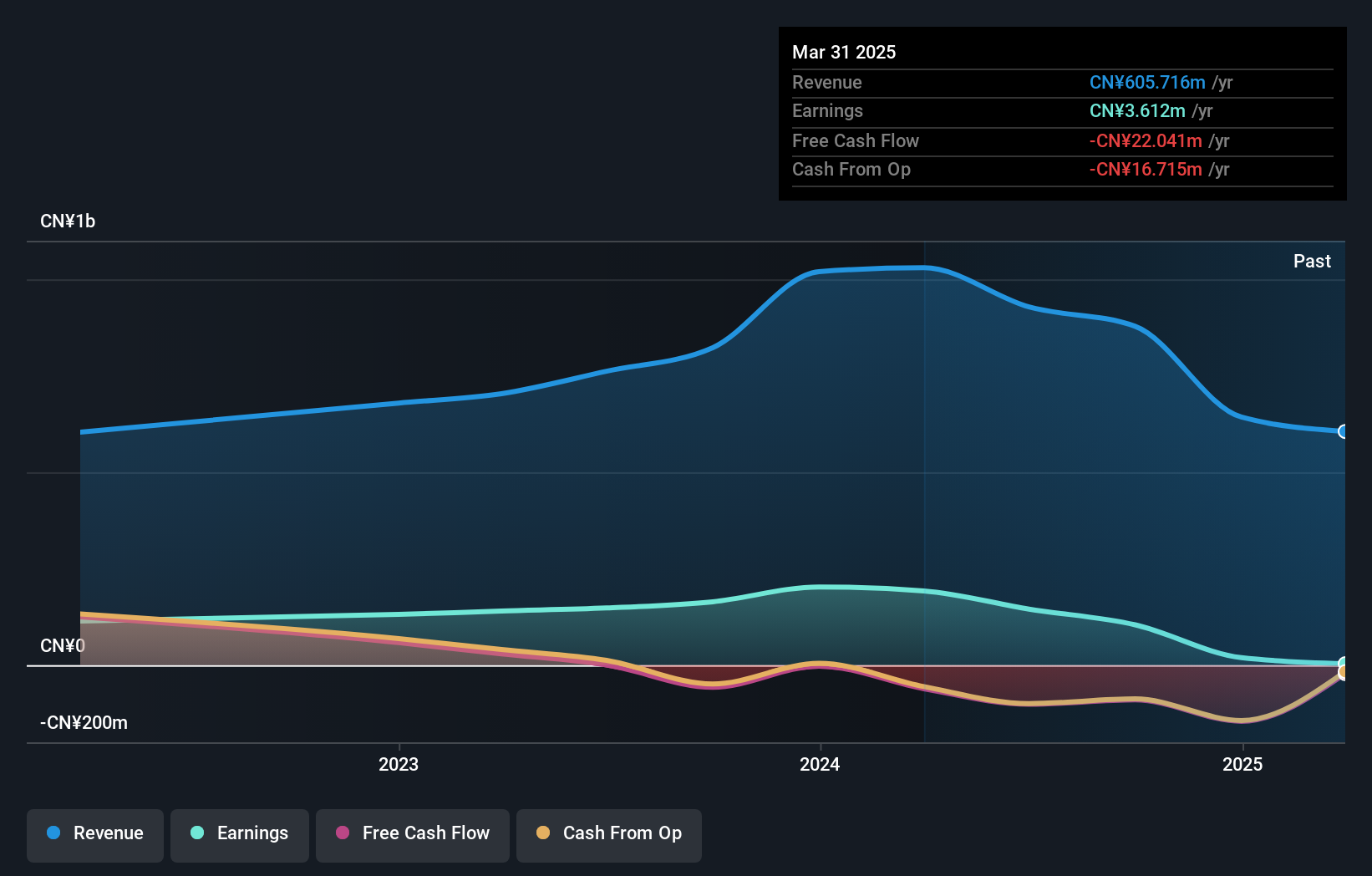

Colorlight Cloud Tech (SZSE:301391)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colorlight Cloud Tech Ltd specializes in the research, development, manufacture, and sale of LED display control systems and related equipment globally, with a market cap of CN¥3.58 billion.

Operations: Colorlight Cloud Tech Ltd generates revenue primarily from the sales of LED display control system equipment, amounting to CN¥878.11 million. The company focuses on producing video processing equipment, play servers, and cloud network players for a global market.

Despite a recent exit from the S&P Global BMI Index, Colorlight Cloud Tech has shown resilience with an impressive annual revenue growth of 36.3%, significantly outpacing the Chinese market average of 13.4%. The company's commitment to innovation is evident in its R&D spending, crucial for maintaining its competitive edge in a rapidly evolving tech landscape. With earnings expected to surge by 47.4% annually, Colorlight's recent decision to repurchase up to CNY 100 million worth of shares underscores confidence in its future prospects and dedication to shareholder value, utilizing both special loan funds and internal resources for these buybacks. This strategic move aligns with their focus on long-term growth amidst market challenges.

- Delve into the full analysis health report here for a deeper understanding of Colorlight Cloud Tech.

Seize The Opportunity

- Discover the full array of 1225 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301391

Colorlight Cloud Tech

Engages in the research and development, manufacture, and sale of LED display control systems, video processing equipment, play servers, and cloud network players worldwide.

Adequate balance sheet with low risk.

Market Insights

Community Narratives