As global markets experience a mix of volatility and growth, with the technology-heavy Nasdaq Composite facing particular pressure due to competitive concerns in the AI sector, investors are closely watching economic indicators and central bank policies that shape market sentiment. In this dynamic environment, identifying high-growth tech stocks requires careful consideration of their innovation potential and resilience amidst evolving technological landscapes and geopolitical influences.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★★

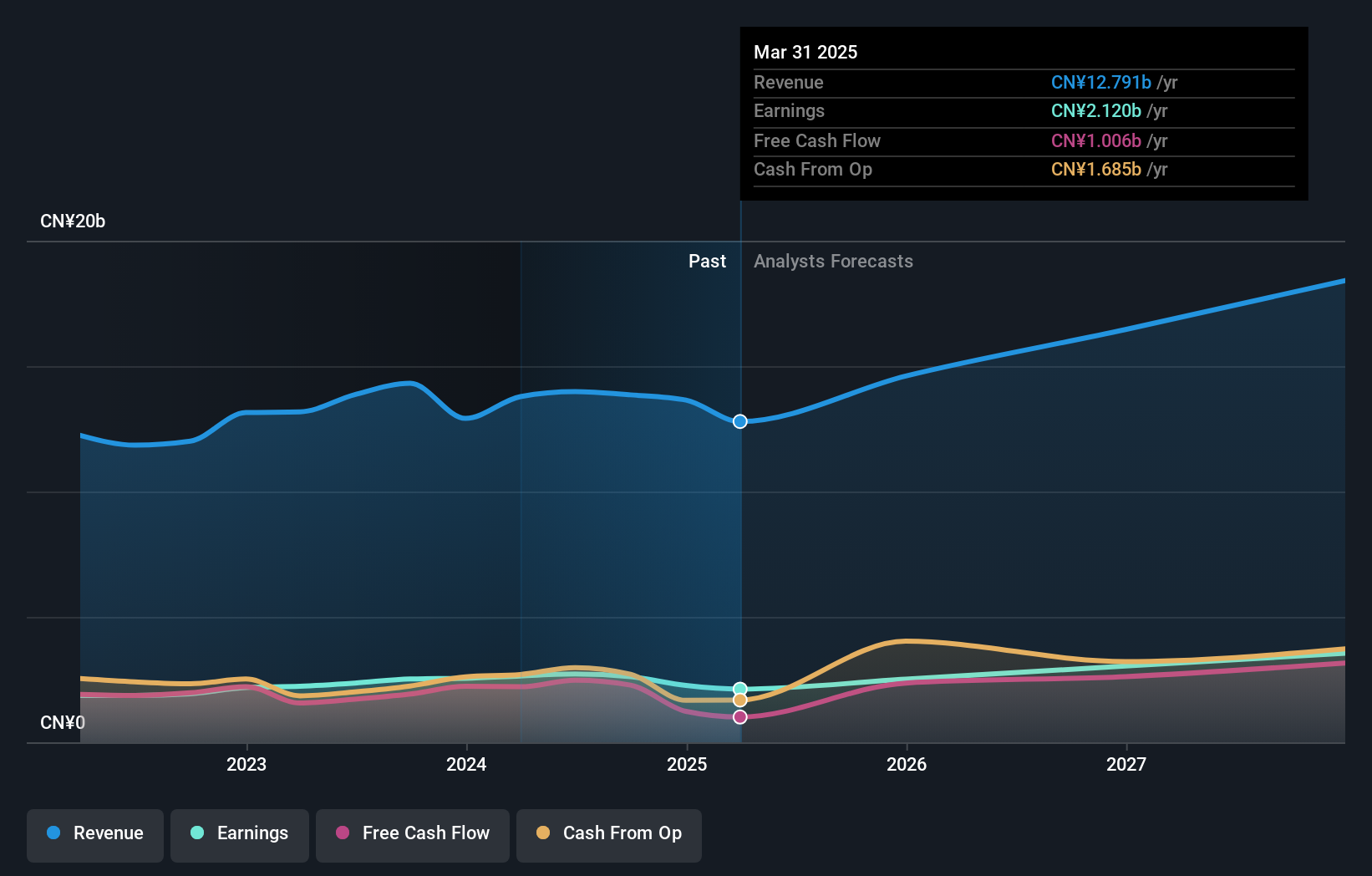

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥72.17 billion.

Operations: Baosight Software focuses on delivering industrial solutions in China. The company's revenue streams are primarily derived from software development, system integration, and related services.

Shanghai Baosight Software has recently been added to the SSE 180 Index, reflecting its growing prominence in the tech sector. With a robust forecast of 25.2% annual earnings growth, surpassing both the Chinese market average and its industry's recent performance, Baosight demonstrates strong potential. The company's revenue is also expected to rise by 21.8% annually, outpacing the broader market's 13.3%. This financial trajectory is supported by high-quality past earnings and a notable return on equity projected at 25.6% in three years. As software firms increasingly adopt SaaS models to secure recurring revenue streams, Baosight’s strategic positioning within this trend could further solidify its market standing.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

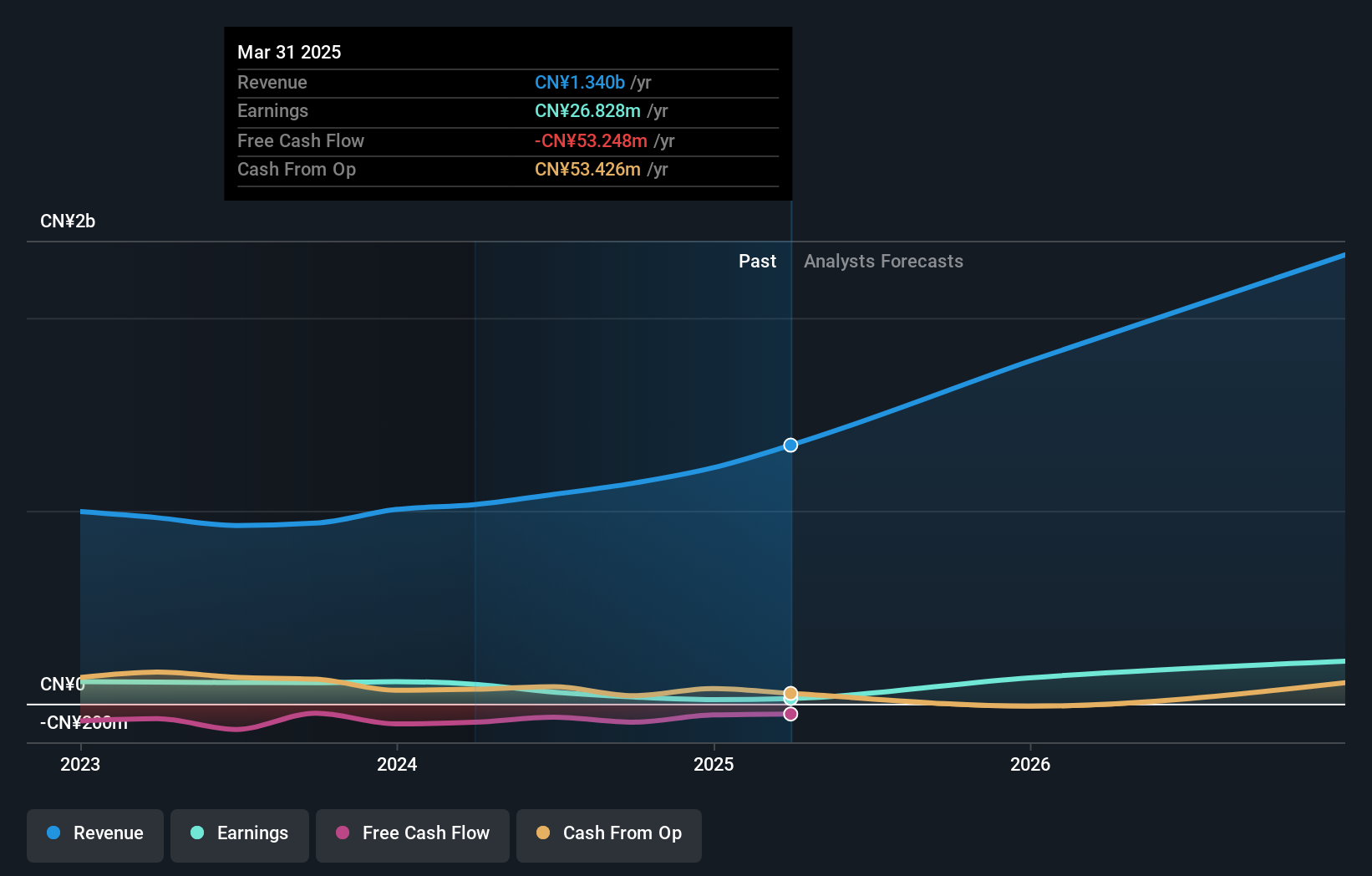

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products, with a market cap of CN¥3.86 billion.

Operations: Bromake New Material generates revenue primarily from electronic components and parts, amounting to CN¥1.14 billion. The company's operations are centered on developing products that enhance the functionality and protection of consumer electronics.

Shenzhen Bromake New Material has demonstrated a robust trajectory in the tech sector, with an impressive annual revenue growth of 33.4% and earnings expansion at 84% per year, significantly outpacing the broader Chinese market's averages. Despite challenges like a lower net profit margin this year at 3%, down from last year’s 11.6%, its commitment to innovation is evident with substantial R&D investments amounting to CN¥5.2M recently. This focus on development could pave the way for future advancements and market competitiveness, particularly as industries increasingly rely on cutting-edge materials for technological innovations.

- Get an in-depth perspective on Shenzhen Bromake New Material's performance by reading our health report here.

Learn about Shenzhen Bromake New Material's historical performance.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

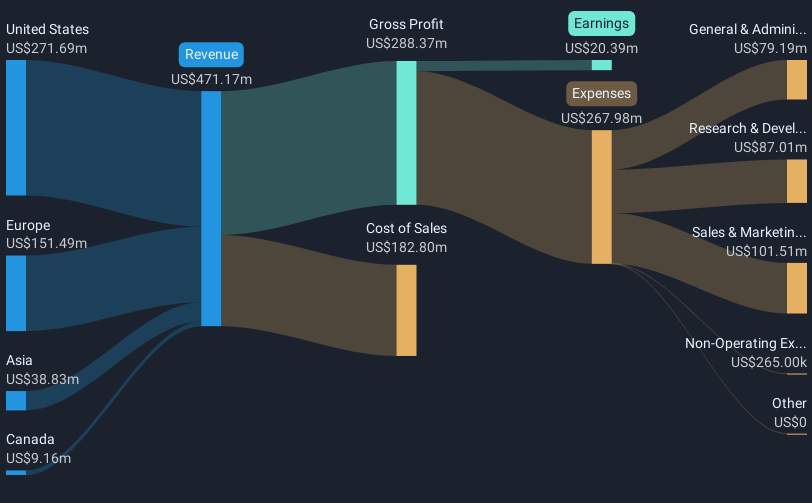

Overview: Kinaxis Inc. offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada with a market capitalization of CA$4.81 billion.

Operations: Kinaxis generates revenue primarily through its software and programming segment, amounting to $471.17 million. The company focuses on providing cloud-based solutions for supply chain management across multiple regions.

Kinaxis, a leader in supply chain management solutions, has been making strategic moves to enhance its market presence and technological capabilities. Recently, the company announced a significant partnership with the University of Ottawa to co-innovate on AI and ML technologies, which underscores its commitment to integrating cutting-edge research into practical applications. This collaboration is part of Kinaxis' broader strategy to empower the next generation of supply chain professionals through its academic program. Financially, Kinaxis has demonstrated robust growth with an annual revenue increase of 12.9% and an impressive earnings growth rate of 42.9% per year, outpacing many competitors in the software industry where earnings grew by 23.9%. These figures highlight not only Kinaxis' strong market position but also its potential for sustained growth driven by innovation and strategic partnerships.

- Take a closer look at Kinaxis' potential here in our health report.

Evaluate Kinaxis' historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 1234 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600845

High growth potential with excellent balance sheet.

Market Insights

Community Narratives