- China

- /

- Electronic Equipment and Components

- /

- SZSE:301379

Techshine ElectronicsLtd's (SZSE:301379) Dividend Will Be Reduced To CN¥0.40

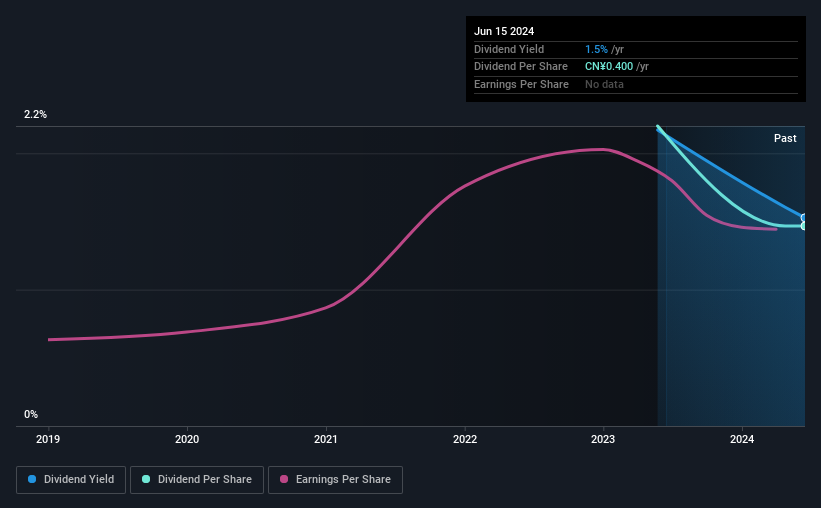

Techshine Electronics Co.,Ltd.'s (SZSE:301379) dividend is being reduced from last year's payment covering the same period to CN¥0.40 on the 18th of June. The dividend yield will be in the average range for the industry at 1.5%.

See our latest analysis for Techshine ElectronicsLtd

Techshine ElectronicsLtd's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Techshine ElectronicsLtd is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Looking forward, earnings per share could rise by 17.9% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 39%, which is in the range that makes us comfortable with the sustainability of the dividend.

Techshine ElectronicsLtd Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Techshine ElectronicsLtd has seen EPS rising for the last five years, at 18% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Techshine ElectronicsLtd (of which 1 can't be ignored!) you should know about. Is Techshine ElectronicsLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Techshine ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301379

Techshine ElectronicsLtd

Engages in the research and development, design, production, and sale of LCD displays, LCM monochrome modules, TFT color screen and complex modules, and TP touch panels in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion