- China

- /

- Electronic Equipment and Components

- /

- SZSE:301379

Investors Shouldn't Be Too Comfortable With Techshine ElectronicsLtd's (SZSE:301379) Earnings

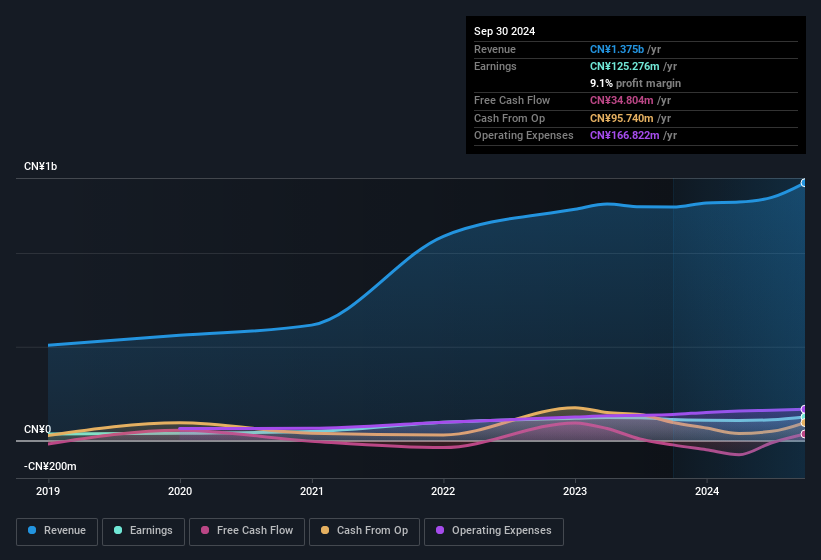

Techshine Electronics Co.,Ltd.'s (SZSE:301379) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

Check out our latest analysis for Techshine ElectronicsLtd

How Do Unusual Items Influence Profit?

To properly understand Techshine ElectronicsLtd's profit results, we need to consider the CN¥27m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. We can see that Techshine ElectronicsLtd's positive unusual items were quite significant relative to its profit in the year to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Techshine ElectronicsLtd.

Our Take On Techshine ElectronicsLtd's Profit Performance

As previously mentioned, Techshine ElectronicsLtd's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. For this reason, we think that Techshine ElectronicsLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Nonetheless, it's still worth noting that its earnings per share have grown at 11% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. While conducting our analysis, we found that Techshine ElectronicsLtd has 2 warning signs and it would be unwise to ignore them.

Today we've zoomed in on a single data point to better understand the nature of Techshine ElectronicsLtd's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Techshine ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301379

Techshine ElectronicsLtd

Engages in the research and development, design, production, and sale of LCD displays, LCM monochrome modules, TFT color screen and complex modules, and TP touch panels in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion