- Japan

- /

- Trade Distributors

- /

- TSE:9934

Discovering Undiscovered Gems in Asia This November 2025

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with U.S. small-cap indexes declining and Asia's economic dynamics shifting, investors are keenly observing opportunities in the region. In this context, identifying promising stocks involves seeking companies that can capitalize on local market trends and demonstrate resilience amid broader economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Advanced International Multitech | 30.42% | 1.80% | -3.87% | ★★★★★★ |

| Quality Reliability Technology | 8.30% | 1.20% | -45.53% | ★★★★★★ |

| Shenke Slide Bearing | 10.82% | 13.63% | 33.31% | ★★★★★★ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| Shandong Sacred Sun Power SourcesLtd | 19.20% | 12.37% | 36.24% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| Hangzhou Zhengqiang | 19.76% | 7.83% | 16.32% | ★★★★★☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SMARTGEN (Zhengzhou) Technology (SZSE:301361)

Simply Wall St Value Rating: ★★★★★★

Overview: SMARTGEN (Zhengzhou) Technology Co., Ltd. specializes in the development and manufacturing of control systems for generators, with a market cap of CN¥4.73 billion.

Operations: SMARTGEN (Zhengzhou) Technology generates revenue primarily from the sale of control systems for generators. The company focuses on optimizing its cost structure to enhance profitability, with a notable trend in its net profit margin.

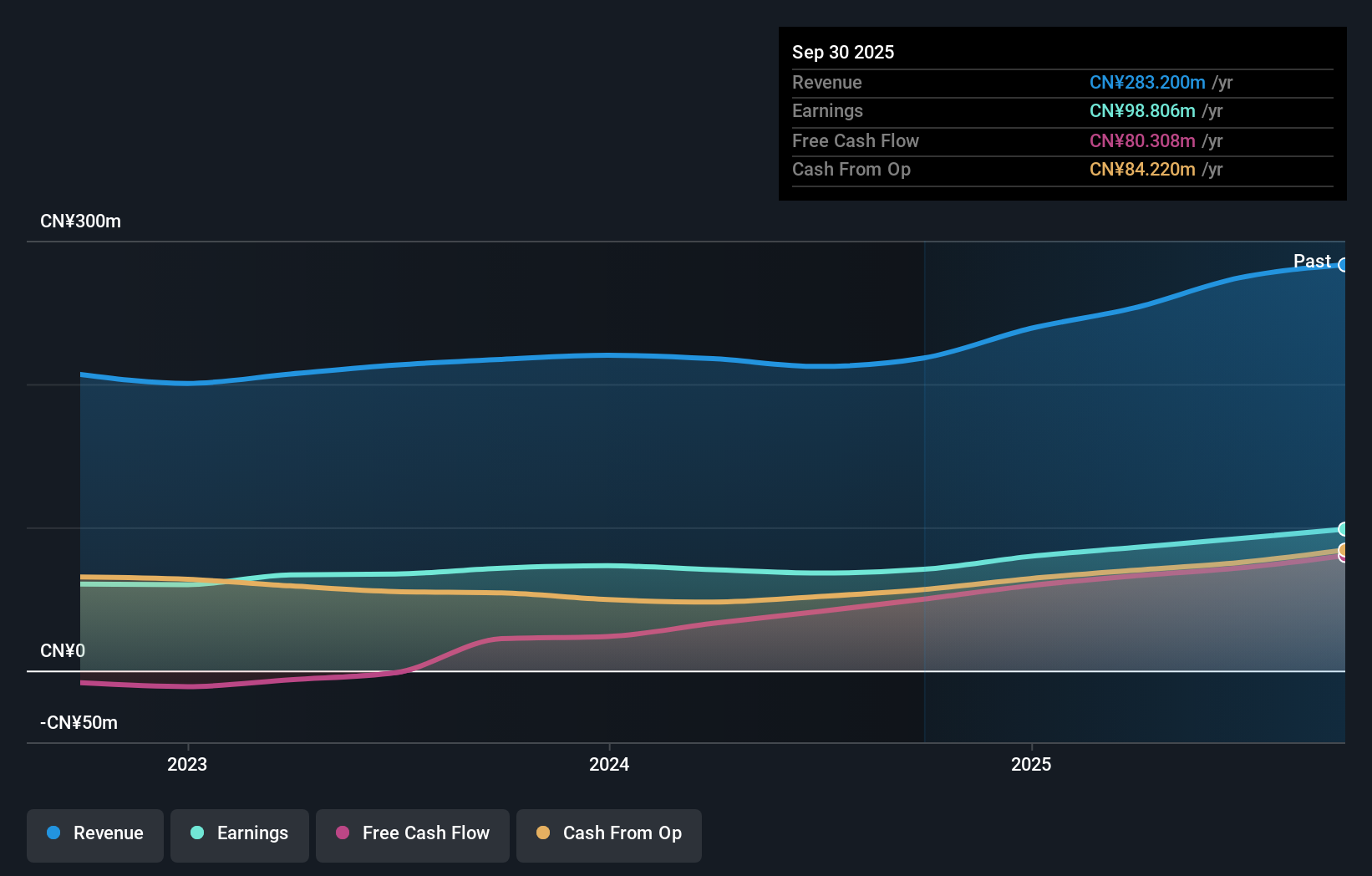

SMARTGEN (Zhengzhou) Technology, a nimble player in the electronics sector, has demonstrated commendable growth with earnings surging 39.8% over the past year, outpacing the industry's 8.7%. The company is debt-free for five years and boasts high-quality earnings, reflected in its favorable price-to-earnings ratio of 47.9x compared to the industry average of 55.2x. Recent financials reveal a robust performance with sales hitting CNY 203 million for nine months ending September 2025, up from CNY 158.56 million last year, while net income rose to CNY 70.65 million from CNY 51.56 million previously.

- Click to explore a detailed breakdown of our findings in SMARTGEN (Zhengzhou) Technology's health report.

Understand SMARTGEN (Zhengzhou) Technology's track record by examining our Past report.

NSD (TSE:9759)

Simply Wall St Value Rating: ★★★★★☆

Overview: NSD Co., Ltd. is a Japanese company specializing in IT solutions, with a market capitalization of ¥265.70 billion.

Operations: NSD generates revenue primarily through its System Development Business, with Financial IT contributing ¥33.52 billion and Industrial IT adding ¥27.23 billion. The Solution Business also plays a significant role, bringing in ¥15.76 billion.

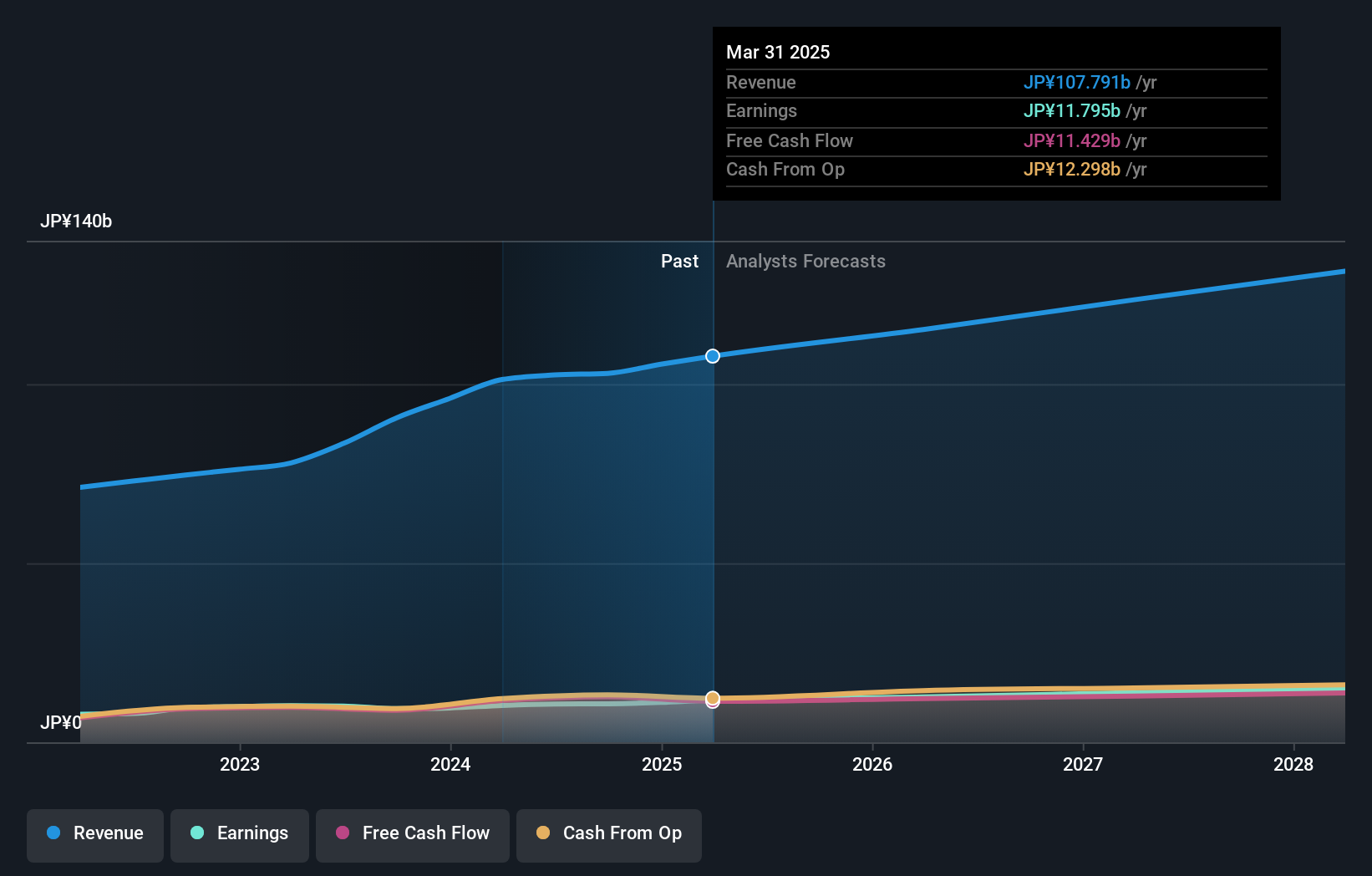

NSD Co., Ltd. stands out with its robust financial health, having more cash than total debt, which signals a strong balance sheet. Over the past five years, earnings have grown at 13.3% annually, showcasing consistent performance despite not surpassing the IT industry’s 16.1% growth last year. The company announced a share repurchase program worth ¥2 billion to enhance shareholder returns and maintain investor confidence. Recent sales figures show an increase to JPY 46,507 million year-to-date from JPY 42,881 million previously. With high-quality earnings and positive free cash flow, NSD seems well-positioned for future growth prospects in the tech sector.

- Get an in-depth perspective on NSD's performance by reading our health report here.

Gain insights into NSD's past trends and performance with our Past report.

Inaba Denki SangyoLtd (TSE:9934)

Simply Wall St Value Rating: ★★★★★★

Overview: Inaba Denki Sangyo Co., Ltd. operates by selling electrical equipment, materials, industrial automation, and proprietary products both in Japan and internationally, with a market capitalization of ¥252.75 billion.

Operations: Inaba Denki Sangyo generates revenue through the sale of electrical equipment, materials, industrial automation, and proprietary products. The company's financial performance is highlighted by its net profit margin trend, which reflects its profitability efficiency over time.

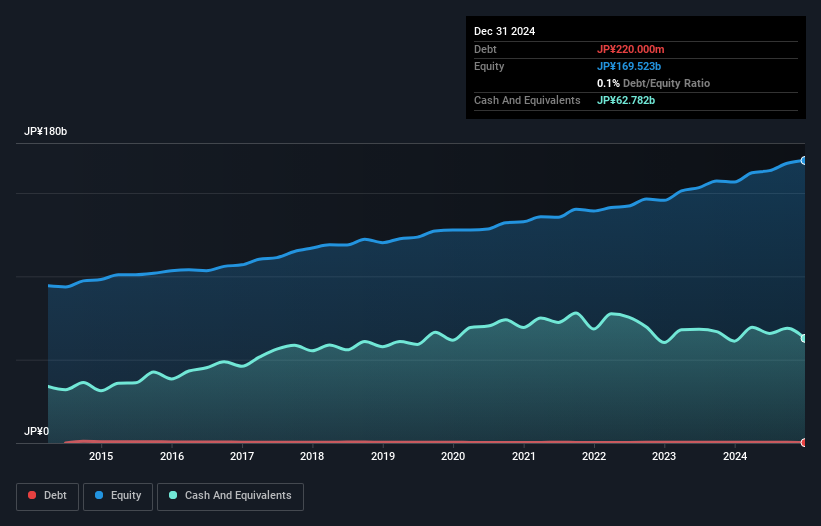

Inaba Denki Sangyo, a nimble player in the trade distributors sector, has shown impressive earnings growth of 26.5% over the past year, outpacing the industry average of 7.7%. The company seems to have high-quality earnings and is trading at a significant discount of 42.5% below its estimated fair value. Over five years, its debt-to-equity ratio improved from 0.3 to 0.1, indicating prudent financial management. Recently announced plans for a share repurchase program worth ¥4.4 billion and an upcoming stock split suggest strategic moves to enhance shareholder value and address capital costs effectively.

Where To Now?

- Click here to access our complete index of 2406 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9934

Inaba Denki SangyoLtd

Sells electrical equipment and materials, industrial automation, and proprietary products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives