- South Korea

- /

- Entertainment

- /

- KOSDAQ:A293490

High Growth Tech Stocks in Asia for November 2025

Reviewed by Simply Wall St

As global markets face volatility with U.S. consumer sentiment nearing record lows and tech stocks experiencing a sell-off, the Asian market presents an intriguing landscape for high-growth technology investments, particularly as easing U.S.-China trade tensions have recently bolstered risk appetite. In this environment, identifying promising tech stocks in Asia requires a focus on companies that demonstrate resilience amidst economic uncertainties and possess innovative capabilities to capitalize on evolving technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 21.66% | 24.66% | ★★★★★★ |

| ASROCK Incorporation | 29.29% | 31.73% | ★★★★★★ |

| PharmaEssentia | 34.39% | 51.51% | ★★★★★★ |

| Taiwan Union Technology | 22.06% | 34.17% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Gold Circuit Electronics | 27.50% | 35.18% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kakao Games Corp. is a global provider of mobile and PC online game services with a market cap of ₩1.50 trillion.

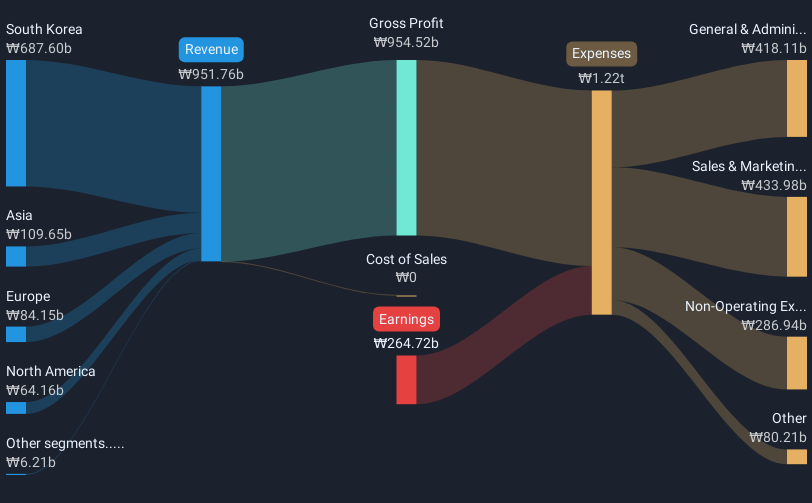

Operations: The company operates a platform offering mobile and PC online games to a global audience.

Kakao Games, with a projected annual revenue growth of 24%, significantly outpaces the Korean market average of 10.3%. This robust expansion is supported by innovations like Chrono Odyssey, an MMORPG that leverages Unreal Engine 5 for groundbreaking visuals and gameplay. Despite current unprofitability, earnings are expected to surge by an impressive 110.63% annually. The recent private placement of over 6.9 million shares at KRW 15,680 each underscores strong financial backing and investor confidence, positioning Kakao Games well for future profitability and growth in the high-stakes gaming sector.

- Click here and access our complete health analysis report to understand the dynamics of Kakao Games.

Gain insights into Kakao Games' historical performance by reviewing our past performance report.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★☆☆

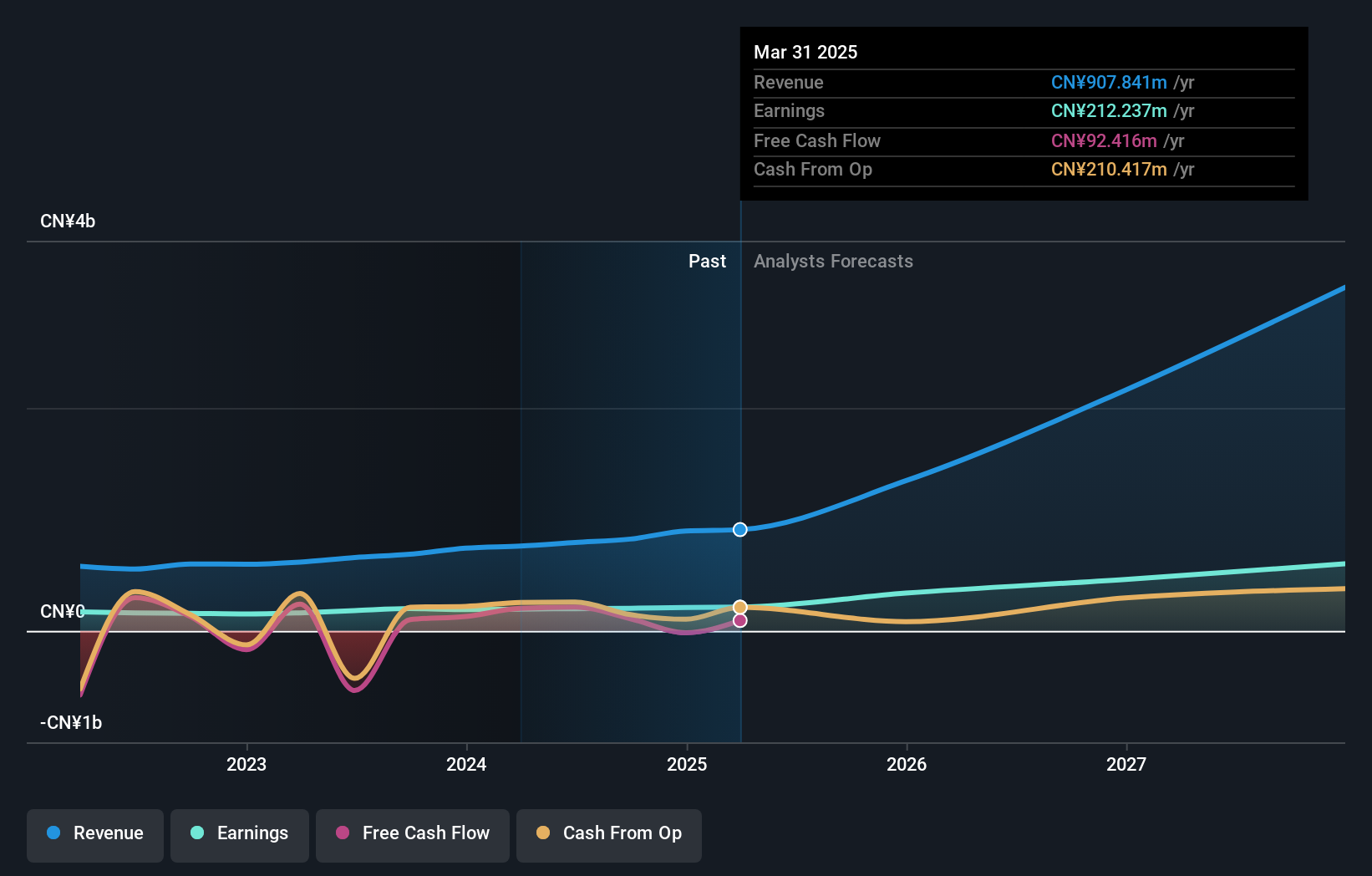

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥8.76 billion.

Operations: The company, along with its subsidiaries, focuses on delivering smart transportation platform solutions across various road networks in China. Its primary revenue stream comes from Software and Information Technology, generating CN¥973.70 million.

Jiangsu Tongxingbao Intelligent Transportation Technology, an emerging force in Asia's tech landscape, recently confirmed a cash dividend distribution which underscores its commitment to shareholder returns amidst robust financial performance. With a striking 48.1% annual revenue growth outpacing the Chinese market average of 9.1%, and earnings projected to rise by 39.4% annually, the company is solidifying its foothold in intelligent transportation solutions. Notably, R&D investments have surged to strategically enhance product offerings and capture evolving market demands, positioning it well for sustained innovation and market expansion.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

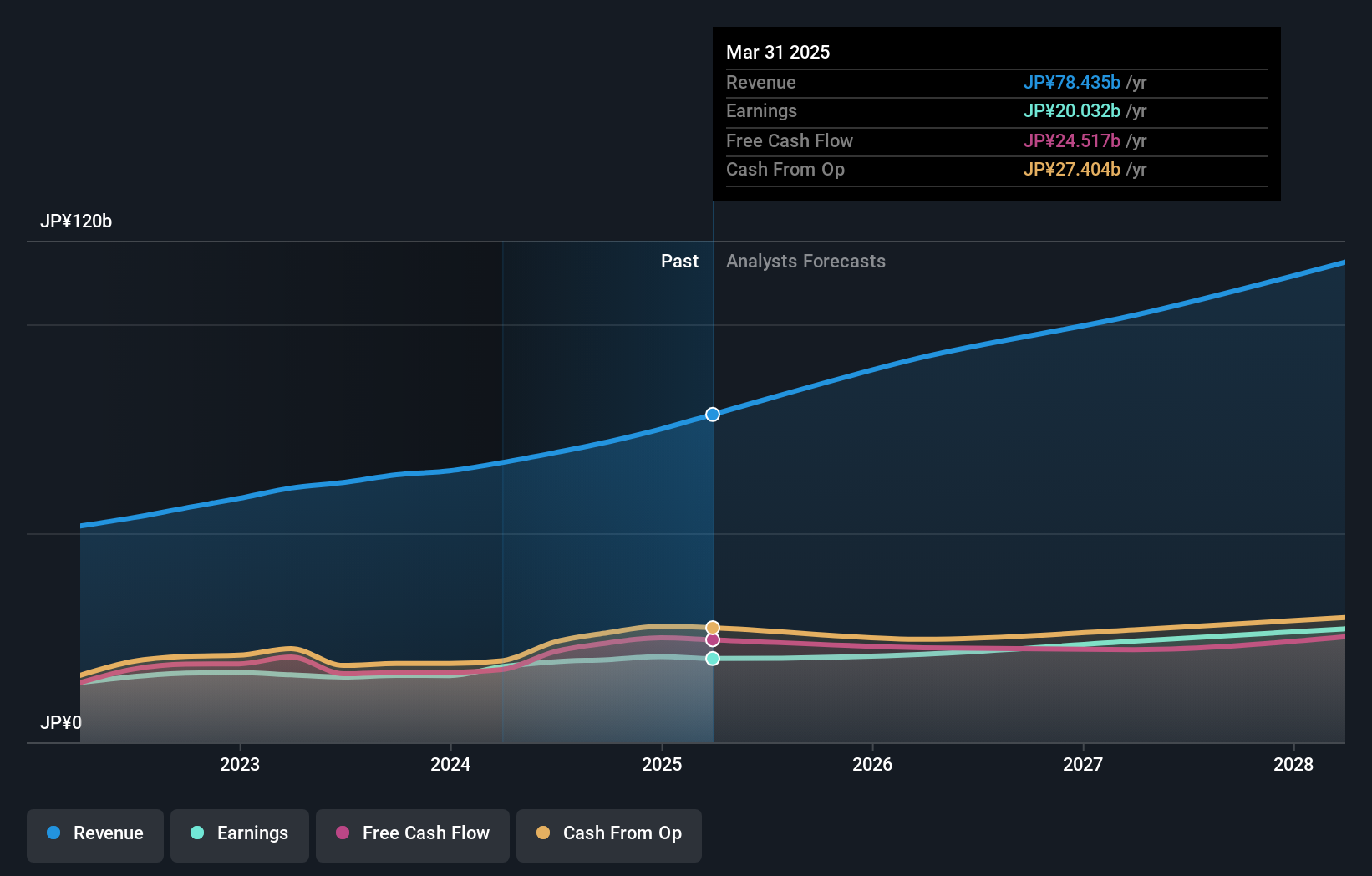

Overview: Kakaku.com, Inc. operates in Japan offering purchase support and restaurant review services, with a market capitalization of ¥504.09 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan. The company's business model capitalizes on providing consumer information and reviews to facilitate purchasing decisions.

Kakaku.com, Inc. stands out in Asia's tech sector with a robust annual revenue growth of 11.7%, surpassing Japan's market average of 4.5%. Despite earnings growth trailing the Interactive Media and Services industry at only 0.2% compared to an industry rate of 19.8%, the company forecasts earnings to climb by approximately 12.9% annually, which is higher than the national forecast of 8%. Additionally, Kakaku.com maintains a strong commitment to innovation with significant R&D investments aimed at enhancing product offerings and securing competitive advantage in a rapidly evolving marketplace.

- Take a closer look at Kakaku.com's potential here in our health report.

Assess Kakaku.com's past performance with our detailed historical performance reports.

Taking Advantage

- Gain an insight into the universe of 176 Asian High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakao Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A293490

Kakao Games

Operates a mobile and PC online game service platform for gamers worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives