- China

- /

- Electronic Equipment and Components

- /

- SZSE:301330

Undiscovered Gems in Asia with Promising Potential August 2025

Reviewed by Simply Wall St

As global markets react to potential rate cuts and shifting economic conditions, the Asian market has shown resilience, with Chinese indices reaching new highs amid stabilizing trade ties. In this dynamic environment, identifying promising small-cap stocks requires a keen understanding of market trends and economic indicators that suggest growth potential despite broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.58% | 38.70% | ★★★★★★ |

| Sinopower Semiconductor | NA | 0.64% | -7.63% | ★★★★★★ |

| Center International GroupLtd | 18.20% | 0.69% | -31.63% | ★★★★★★ |

| Zhejiang JW Precision MachineryLtd | 14.74% | 4.97% | -20.59% | ★★★★★★ |

| Torigoe | 8.59% | 4.69% | 9.28% | ★★★★★☆ |

| Yashima Denki | 2.36% | 1.42% | 23.63% | ★★★★★☆ |

| Messe eSangLtd | 0.23% | 29.23% | 53.17% | ★★★★★☆ |

| Shenzhen Coship Electronics | 39.15% | 24.47% | 53.77% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

STX EngineLtd (KOSE:A077970)

Simply Wall St Value Rating: ★★★★☆☆

Overview: STX Engine Co., Ltd. is a South Korean company that specializes in the manufacturing and sale of diesel engines and electronic communication devices, with a market cap of ₩1.62 trillion.

Operations: STX Engine generates revenue through three main segments: Civil Business (₩297.19 billion), Special Business (₩328.41 billion), and Electronic Communication (₩138.93 billion).

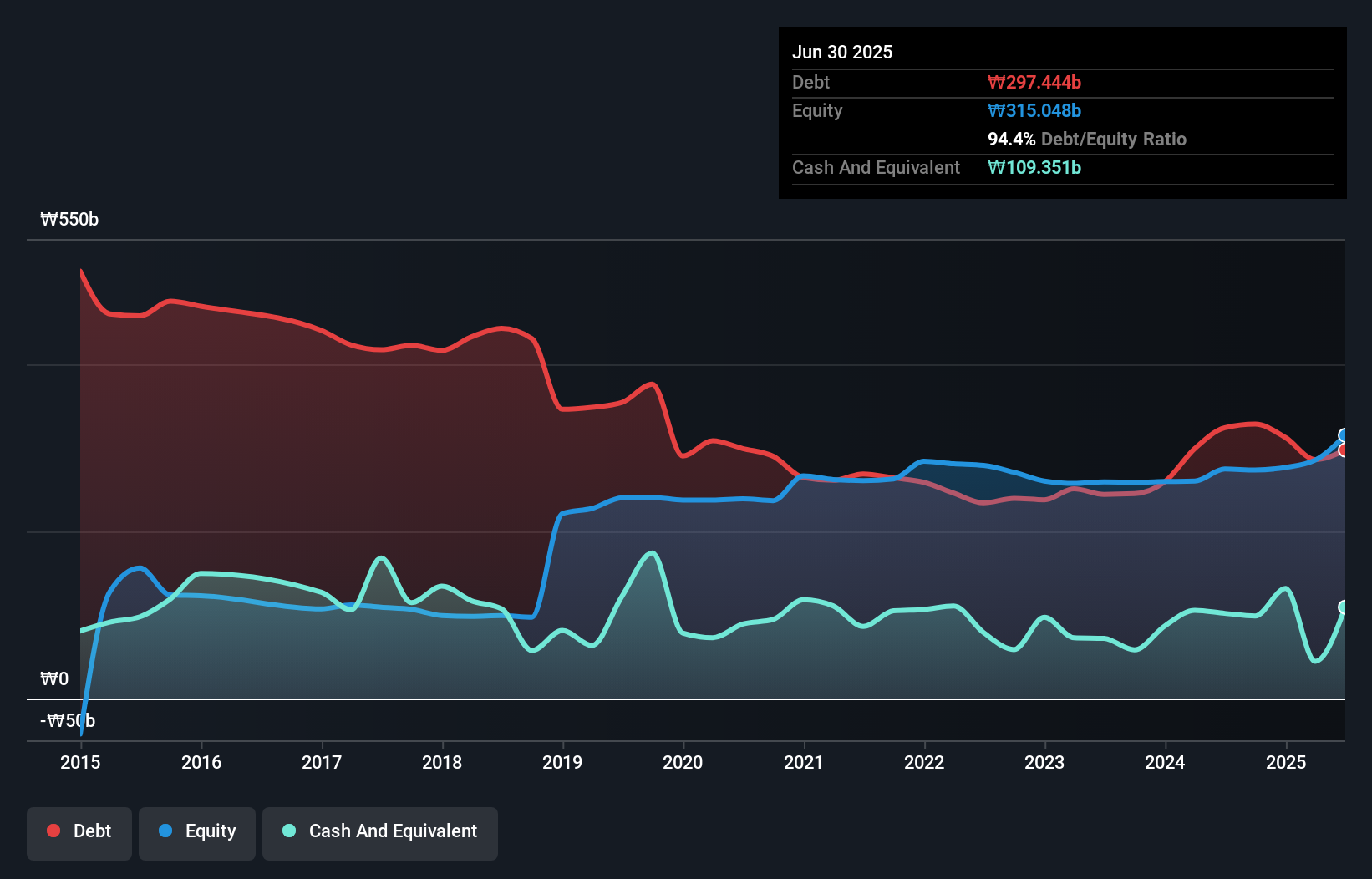

STX Engine Ltd., a relatively small player in the machinery industry, has shown impressive earnings growth of 59.7% over the past year, outpacing the industry's average of 6.6%. Despite this strong performance, its net debt to equity ratio stands at a high 59.7%, although it has improved from 125.2% five years ago. The company's interest payments are well covered by EBIT at a ratio of 5x, indicating solid operational efficiency despite a volatile share price recently and substantial shareholder dilution over the past year. Trading at approximately 70% below its estimated fair value suggests potential for significant upside if financial conditions stabilize further.

- Click to explore a detailed breakdown of our findings in STX EngineLtd's health report.

Explore historical data to track STX EngineLtd's performance over time in our Past section.

Zkteco (SZSE:301330)

Simply Wall St Value Rating: ★★★★★★

Overview: ZKTeco Co., Ltd. offers biometric solutions and AI Cognitive Spatial Intelligence technologies, with a market cap of CN¥8.34 billion.

Operations: The company generates revenue primarily through its biometric solutions and AI Cognitive Spatial Intelligence technologies. It has a market cap of CN¥8.34 billion, indicating its significant presence in the industry.

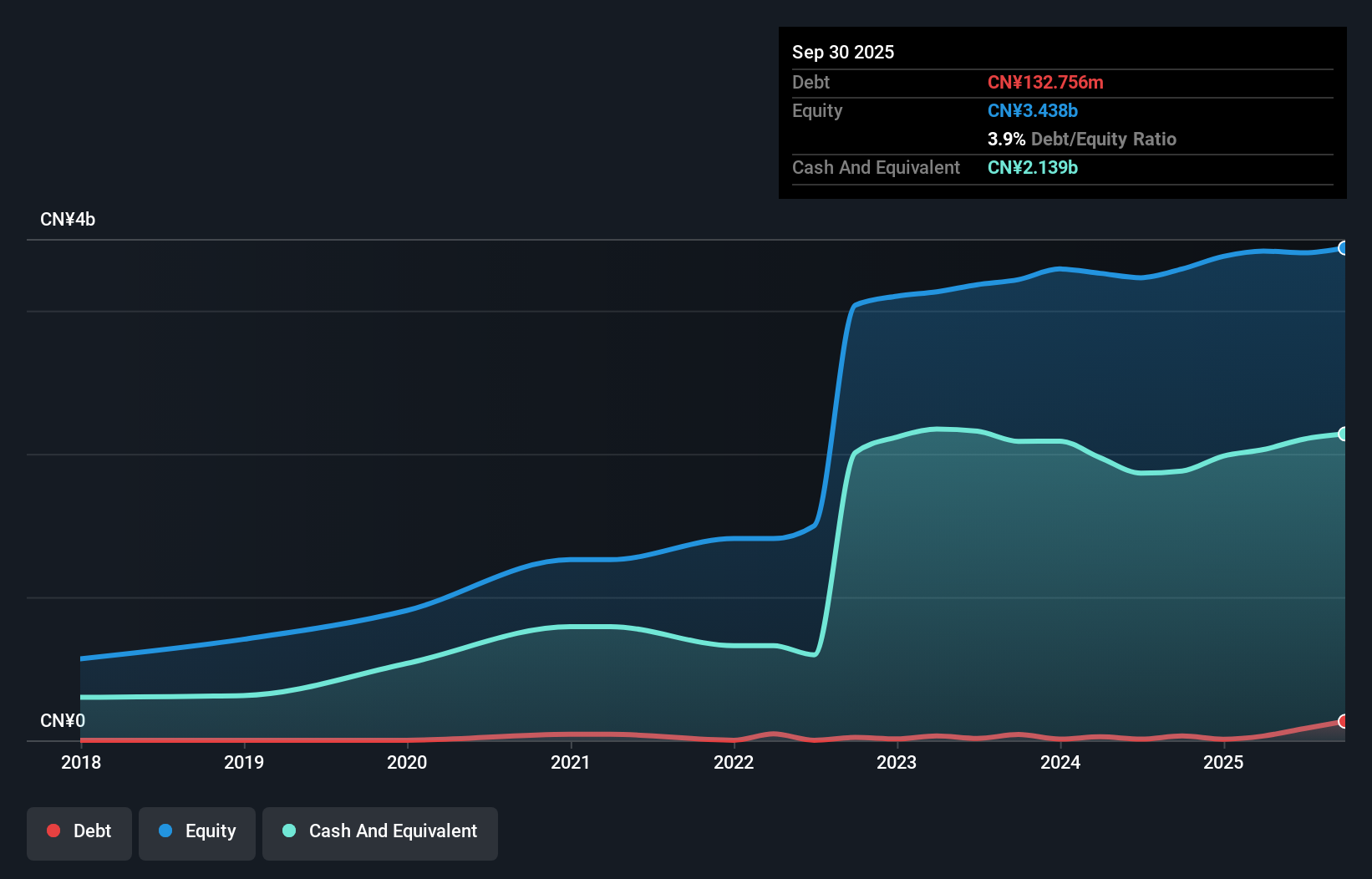

Zkteco, a player in the electronic industry, shows promising financial health with its debt to equity ratio dropping from 1.1% to 0.9% over five years and a price-to-earnings ratio of 44.8x, below the industry average of 61.6x. The firm boasts high-quality earnings and recorded an impressive earnings growth of 8.3% last year, outpacing the industry's 3.2%. Recent strategic moves include a significant stake in Noor Technology Company alongside AICTEC, aiming to bolster security technology manufacturing in Saudi Arabia under Vision 2030 goals, potentially enhancing their market footprint in the Middle East region.

- Unlock comprehensive insights into our analysis of Zkteco stock in this health report.

Examine Zkteco's past performance report to understand how it has performed in the past.

Thunder Tiger (TWSE:8033)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thunder Tiger Corp. is a company that, along with its subsidiaries, produces and markets remote-controlled vehicles and medical devices across Taiwan, the Americas, and globally, with a market capitalization of NT$26.40 billion.

Operations: Thunder Tiger generates revenue primarily from the production and sale of remote-controlled vehicles and medical devices. The company operates in Taiwan, the Americas, and internationally with a market capitalization of NT$26.40 billion.

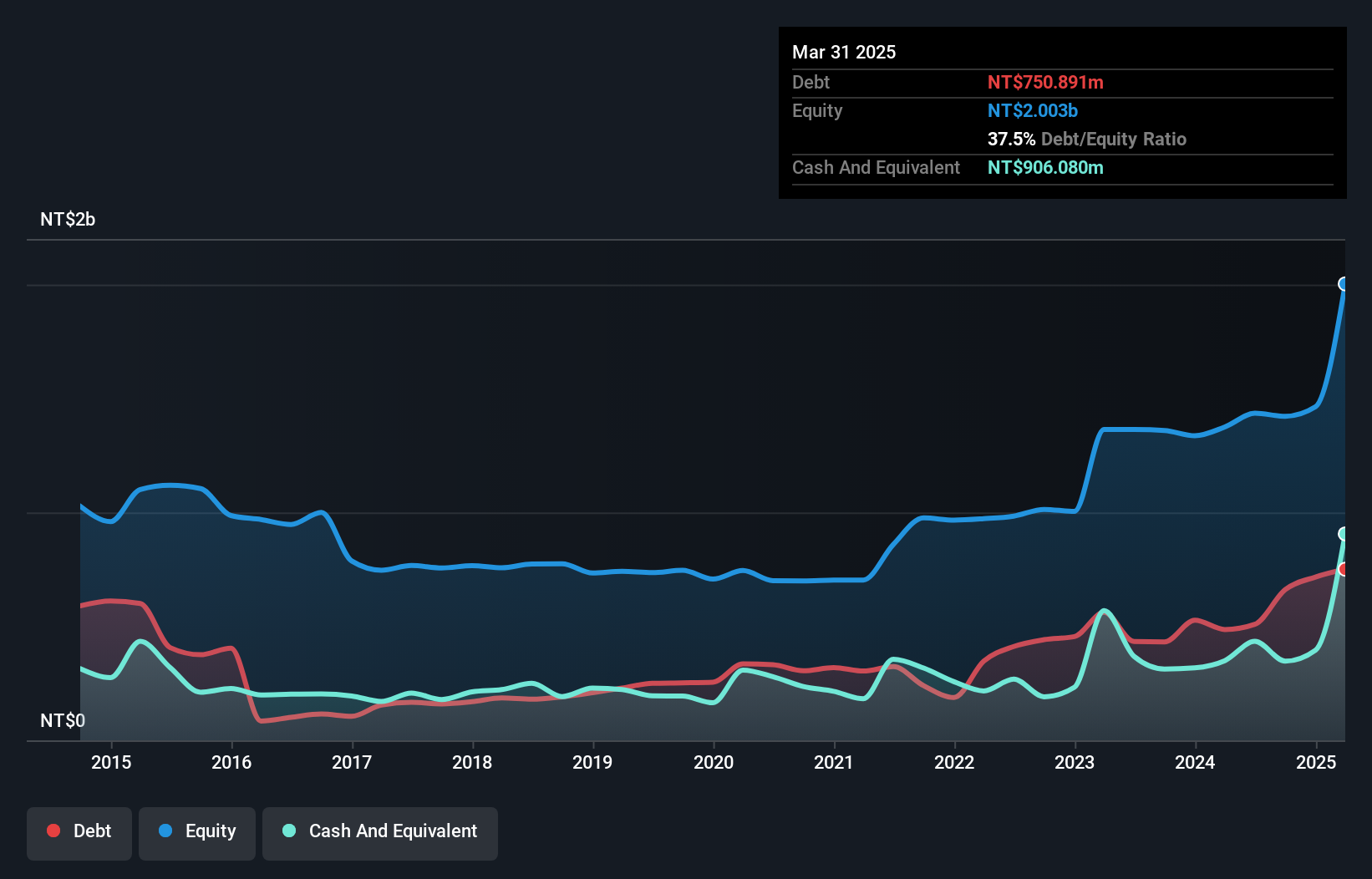

Thunder Tiger, a small player in the Asian market, reported impressive earnings growth of 81% over the past year, outpacing its industry peers. Despite this growth and high-quality earnings, interest payments on debt remain poorly covered with an EBIT coverage of only 0.9x. The company has successfully lowered its debt-to-equity ratio from 47.3% to 31.2% over five years, indicating improved financial health. Recent sales figures for Q2 reached TWD 419 million compared to TWD 351 million last year, while net income increased to TWD 68 million from TWD 48 million in the same period.

Seize The Opportunity

- Navigate through the entire inventory of 2398 Asian Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zkteco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301330

Zkteco

Provides biometric solutions and AI cognitive spatial intelligence technologies.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion