- China

- /

- Electronic Equipment and Components

- /

- SZSE:301328

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a mixed landscape with U.S. stocks concluding another strong year despite recent profit-taking and economic indicators like the Chicago PMI reflecting ongoing challenges. Amid these dynamics, high growth tech stocks continue to capture investor interest, offering potential opportunities for those seeking innovation-driven growth in an environment marked by fluctuating indices and evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and internationally, with a market cap of CN¥7.16 billion.

Operations: Wuxi Boton Technology Co., Ltd. focuses on industrial bulk material handling and mobile Internet services, catering to both domestic and international markets. The company's revenue streams are primarily derived from these two sectors, reflecting its diversified business operations.

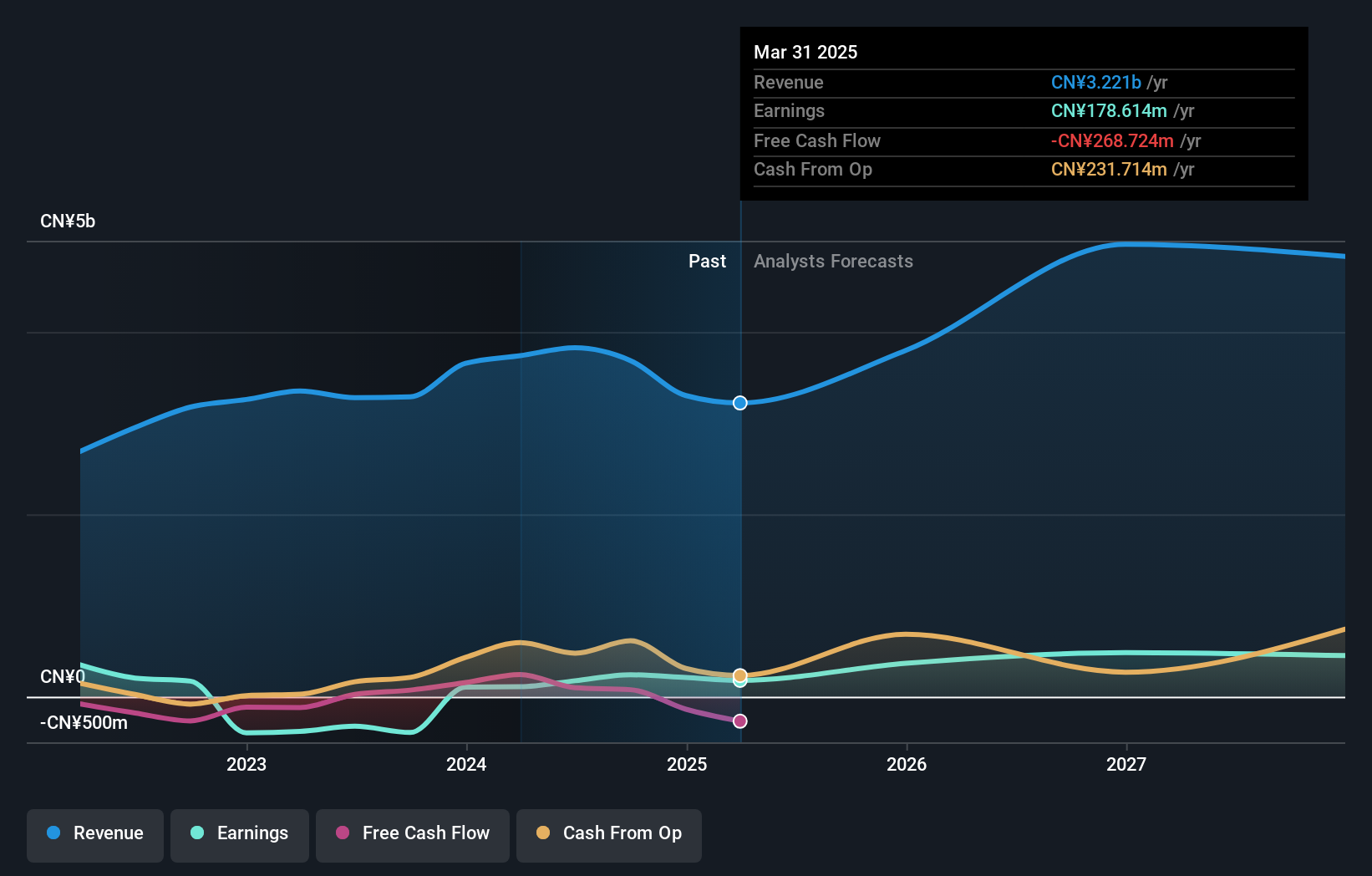

Wuxi Boton Technology has demonstrated a robust financial performance, with its latest earnings report showing a significant uptick in net income to CNY 237.7 million from CNY 103.42 million year-over-year, alongside a stable revenue growth of 16.7% annually. This growth trajectory is complemented by an anticipated annual earnings increase of 25.1%, outpacing the broader Chinese market's forecast of 25%. The firm's commitment to innovation is evident in its strategic R&D investments, crucial for maintaining competitive edge in the high-stakes tech landscape. Despite facing challenges like a one-off loss of CN¥199M last year, Wuxi Boton's forward-looking strategies and above-market growth projections position it as a noteworthy contender in the technology sector.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market capitalization of CN¥6.44 billion.

Operations: The company focuses on providing software solutions and services within the medical and health sector in China. It generates revenue through various streams, including software development, system integration, and technical support services. The net profit margin has shown fluctuations over recent periods.

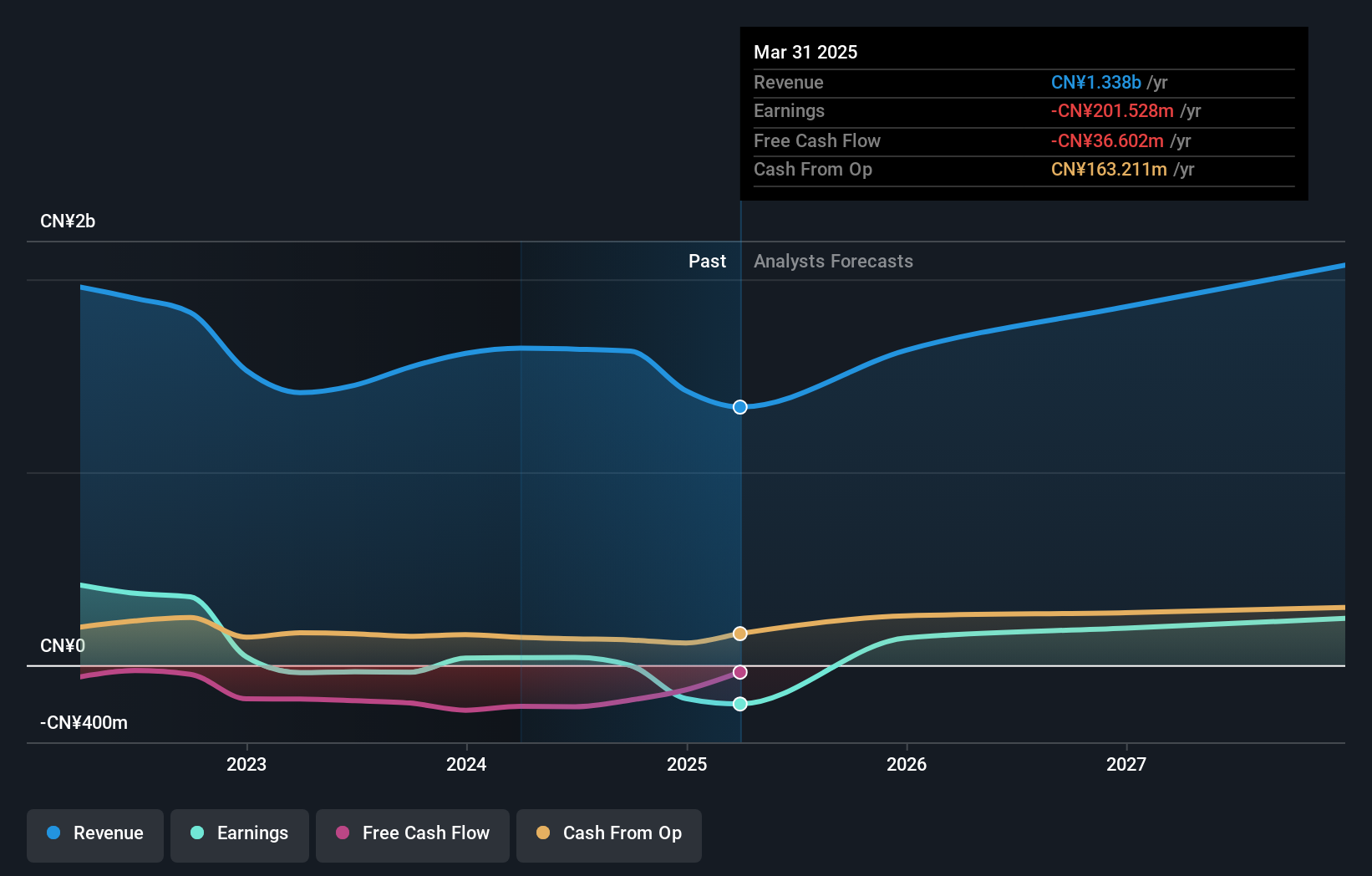

B-SOFTLtd's recent earnings report highlights a challenging yet evolving landscape, with net income sliding to CNY 52.75 million from CNY 91.38 million year-over-year, despite a slight increase in revenue to CNY 1,168.62 million. This reflects an annualized revenue growth of 16.5%, slightly above the broader Chinese market's growth rate of 13.5%. The firm is navigating through these financial headwinds with a focus on innovation and development; its commitment is underscored by substantial R&D investments aimed at capturing future market opportunities and enhancing product offerings in the competitive tech sector.

- Take a closer look at B-SOFTLtd's potential here in our health report.

Understand B-SOFTLtd's track record by examining our Past report.

WCON Electronics (Guangdong) (SZSE:301328)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WCON Electronics (Guangdong) Co., Ltd. focuses on the research and development, manufacturing, and marketing of connectors and cable assemblies in China, with a market capitalization of CN¥4.24 billion.

Operations: The company generates revenue primarily from the sale of connectors, amounting to CN¥500.40 million. The business is centered on manufacturing and marketing these products within China.

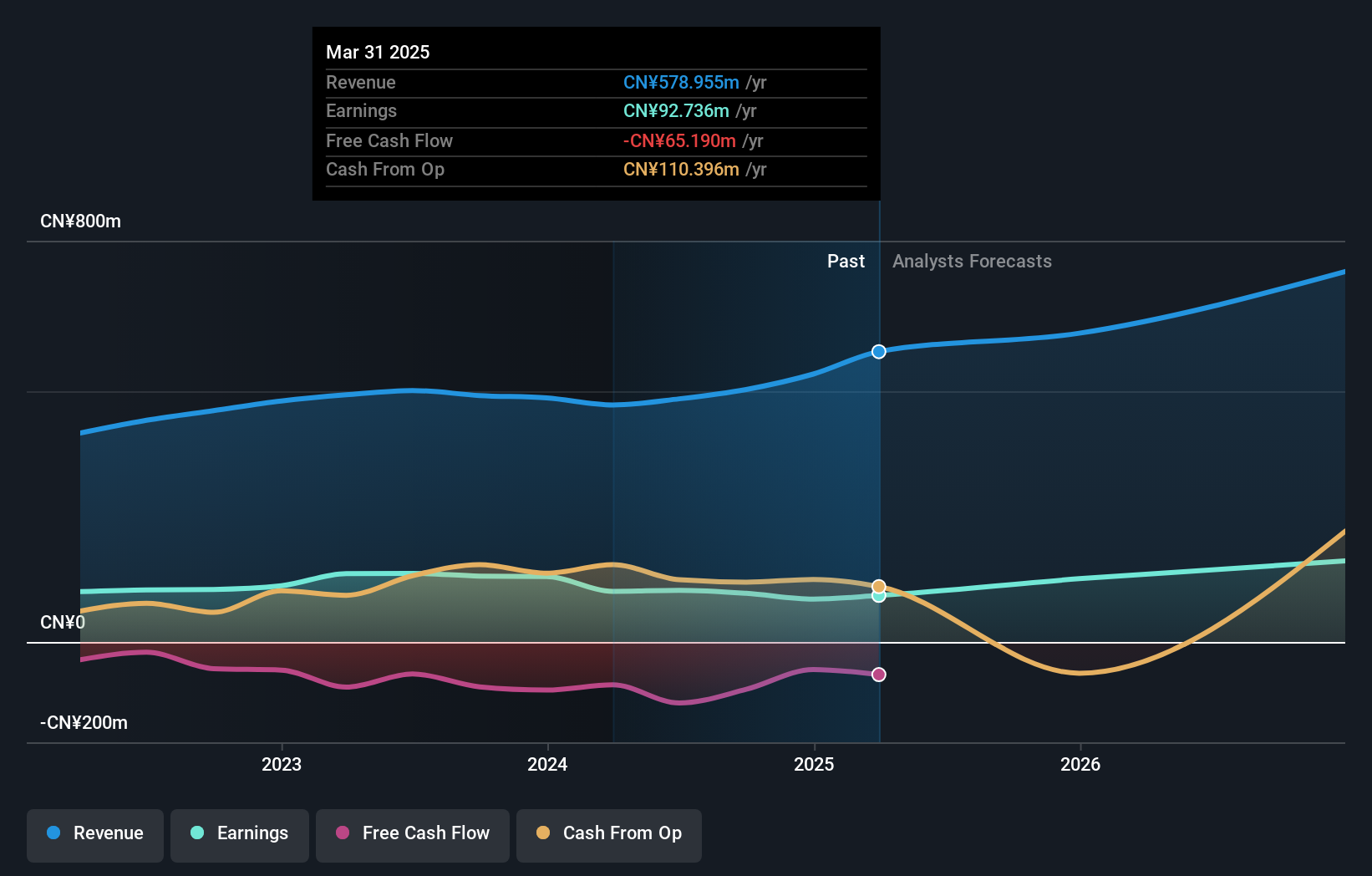

WCON Electronics (Guangdong) showcases robust potential in the tech sector, evidenced by its revenue growth of 20.8% annually, outpacing the broader Chinese market's 13.5%. Despite a dip in net income from CNY 101.29 million to CNY 68.03 million over nine months, the company is poised for significant earnings growth at an annual rate of 26.5%. This financial trajectory is bolstered by strategic initiatives like the recent approval of a new audit firm and amendments to enhance transaction decision-making systems, reflecting a proactive approach in governance and operational efficiency. These steps are integral as WCON navigates through competitive markets while investing in innovation to secure its future in high-tech industries.

- Dive into the specifics of WCON Electronics (Guangdong) here with our thorough health report.

Learn about WCON Electronics (Guangdong)'s historical performance.

Key Takeaways

- Unlock our comprehensive list of 1267 High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WCON Electronics (Guangdong) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301328

WCON Electronics (Guangdong)

Engages in the research and development, manufacturing, and marketing of connectors and cable assemblies in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026