- China

- /

- Electronic Equipment and Components

- /

- SZSE:301326

After Leaping 26% J.Pond Precision Technology Co., Ltd. (SZSE:301326) Shares Are Not Flying Under The Radar

J.Pond Precision Technology Co., Ltd. (SZSE:301326) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 124% in the last year.

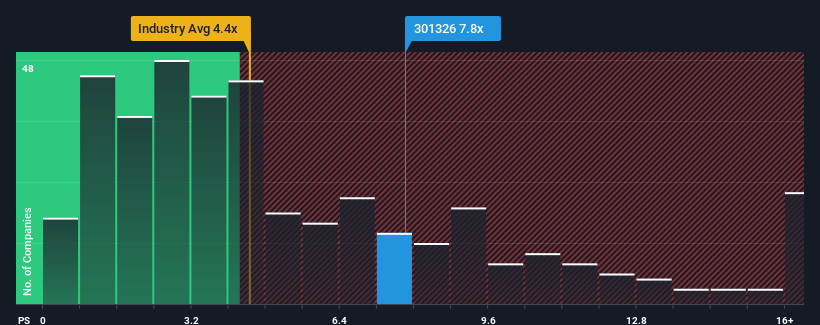

After such a large jump in price, J.Pond Precision Technology may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 7.8x, since almost half of all companies in the Electronic industry in China have P/S ratios under 4.4x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for J.Pond Precision Technology

What Does J.Pond Precision Technology's Recent Performance Look Like?

Recent times haven't been great for J.Pond Precision Technology as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think J.Pond Precision Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like J.Pond Precision Technology's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 25% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 76% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in mind, it's not hard to understand why J.Pond Precision Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in J.Pond Precision Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that J.Pond Precision Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - J.Pond Precision Technology has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301326

J.Pond Precision Technology

Manufactures and sells precision functional and structural parts.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives