- China

- /

- Electronic Equipment and Components

- /

- SZSE:301282

Camelot Electronics Technology Co.,Ltd.'s (SZSE:301282) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Most readers would already be aware that Camelot Electronics TechnologyLtd's (SZSE:301282) stock increased significantly by 10% over the past week. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. In this article, we decided to focus on Camelot Electronics TechnologyLtd's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Camelot Electronics TechnologyLtd

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Camelot Electronics TechnologyLtd is:

3.2% = CN¥53m ÷ CN¥1.7b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.03 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Camelot Electronics TechnologyLtd's Earnings Growth And 3.2% ROE

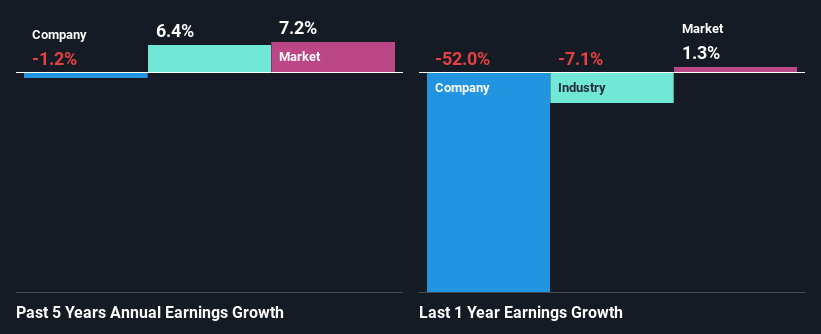

It is hard to argue that Camelot Electronics TechnologyLtd's ROE is much good in and of itself. Even when compared to the industry average of 6.3%, the ROE figure is pretty disappointing. Therefore, Camelot Electronics TechnologyLtd's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

Next, on comparing with the industry net income growth, we found that the industry grew its earnings by 6.4% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Camelot Electronics TechnologyLtd fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Camelot Electronics TechnologyLtd Using Its Retained Earnings Effectively?

Despite having a normal three-year median payout ratio of 45% (implying that the company keeps 55% of its income) over the last three years, Camelot Electronics TechnologyLtd has seen a negligible amount of growth in earnings as we saw above. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Additionally, Camelot Electronics TechnologyLtd started paying a dividend only recently. So it looks like the management must have perceived that shareholders favor dividends over earnings growth.

Summary

On the whole, we feel that the performance shown by Camelot Electronics TechnologyLtd can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Camelot Electronics TechnologyLtd and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301282

Camelot Electronics TechnologyLtd

Engages in the research, production, and sale of printed circuit boards for intelligent electric vehicles in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026