- China

- /

- Electronic Equipment and Components

- /

- SZSE:301280

Zhejiang ZUCH Technology Co., Ltd's (SZSE:301280) Shares Leap 32% Yet They're Still Not Telling The Full Story

The Zhejiang ZUCH Technology Co., Ltd (SZSE:301280) share price has done very well over the last month, posting an excellent gain of 32%. Looking back a bit further, it's encouraging to see the stock is up 68% in the last year.

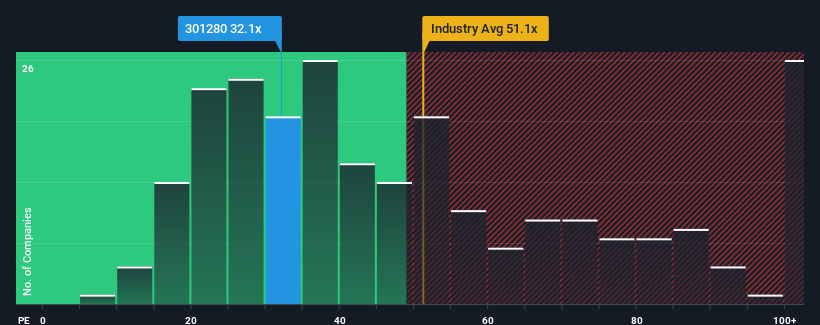

Although its price has surged higher, Zhejiang ZUCH Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 32.1x, since almost half of all companies in China have P/E ratios greater than 38x and even P/E's higher than 74x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for Zhejiang ZUCH Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zhejiang ZUCH Technology

Is There Any Growth For Zhejiang ZUCH Technology?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang ZUCH Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 3.4% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 40% during the coming year according to the only analyst following the company. With the market predicted to deliver 37% growth , the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Zhejiang ZUCH Technology's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Zhejiang ZUCH Technology's P/E?

The latest share price surge wasn't enough to lift Zhejiang ZUCH Technology's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang ZUCH Technology currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Zhejiang ZUCH Technology (1 can't be ignored) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang ZUCH Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301280

Zhejiang ZUCH Technology

Engages in research and development, production, and sale of electronic connectors in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026