- China

- /

- Electronic Equipment and Components

- /

- SZSE:301280

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience a boost from favorable trade deals and economic indicators suggest mixed growth across various regions, the Asian tech sector stands out with its dynamic potential amidst these developments. In this environment, identifying high-growth stocks involves looking for companies that can leverage technological advancements and navigate international trade dynamics effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Naruida Technology | 47.72% | 54.38% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company involved in the research, development, production, and sale of human vaccines with a market cap of approximately CN¥9.77 billion.

Operations: Changchun BCHT Biotechnology focuses on the development and commercialization of human vaccines, serving both domestic and international markets. The company operates within the biopharmaceutical sector, leveraging its expertise in vaccine production to drive revenue.

Changchun BCHT Biotechnology, grappling with a challenging year marked by a 67% drop in earnings, still forecasts robust future growth. Its revenue is expected to climb at an annual rate of 13.2%, outpacing the Chinese market's average of 12.5%. Despite recent setbacks, including its removal from the Shanghai Stock Exchange Health Care Sector Index on June 20, 2025, the company's earnings are projected to surge by an impressive 26.8% annually. This anticipated growth is supported by significant investments in R&D aimed at pioneering new biotechnologies, positioning Changchun BCHT for potential recovery and expansion in Asia's competitive biotech landscape.

- Click to explore a detailed breakdown of our findings in Changchun BCHT Biotechnology's health report.

Gain insights into Changchun BCHT Biotechnology's past trends and performance with our Past report.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★★☆

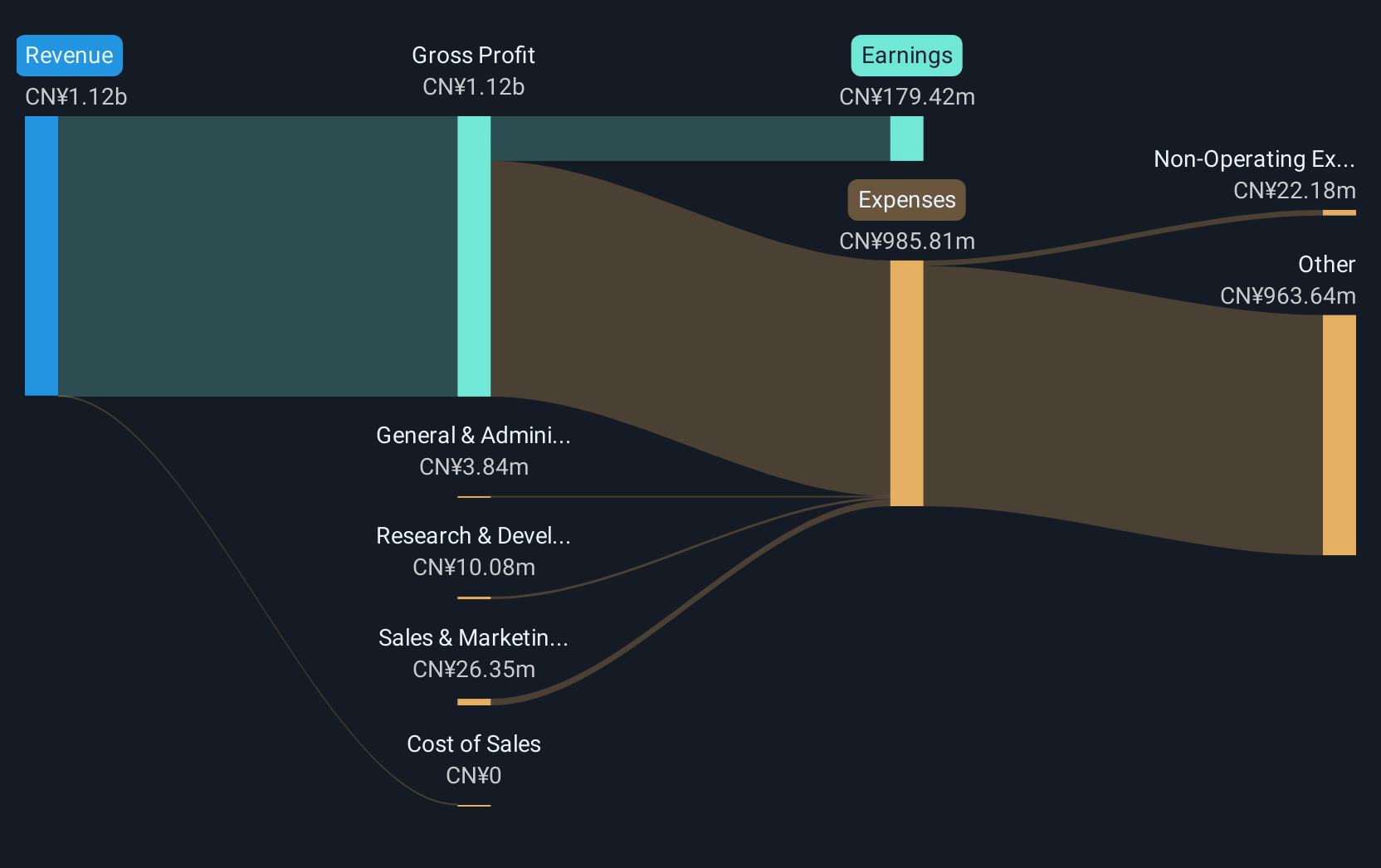

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market capitalization of CN¥5.86 billion.

Operations: Zhejiang ZUCH Technology Co., Ltd. focuses on the production and sale of electric connectors within China. The company operates in a niche market, contributing to its market capitalization of approximately CN¥5.86 billion.

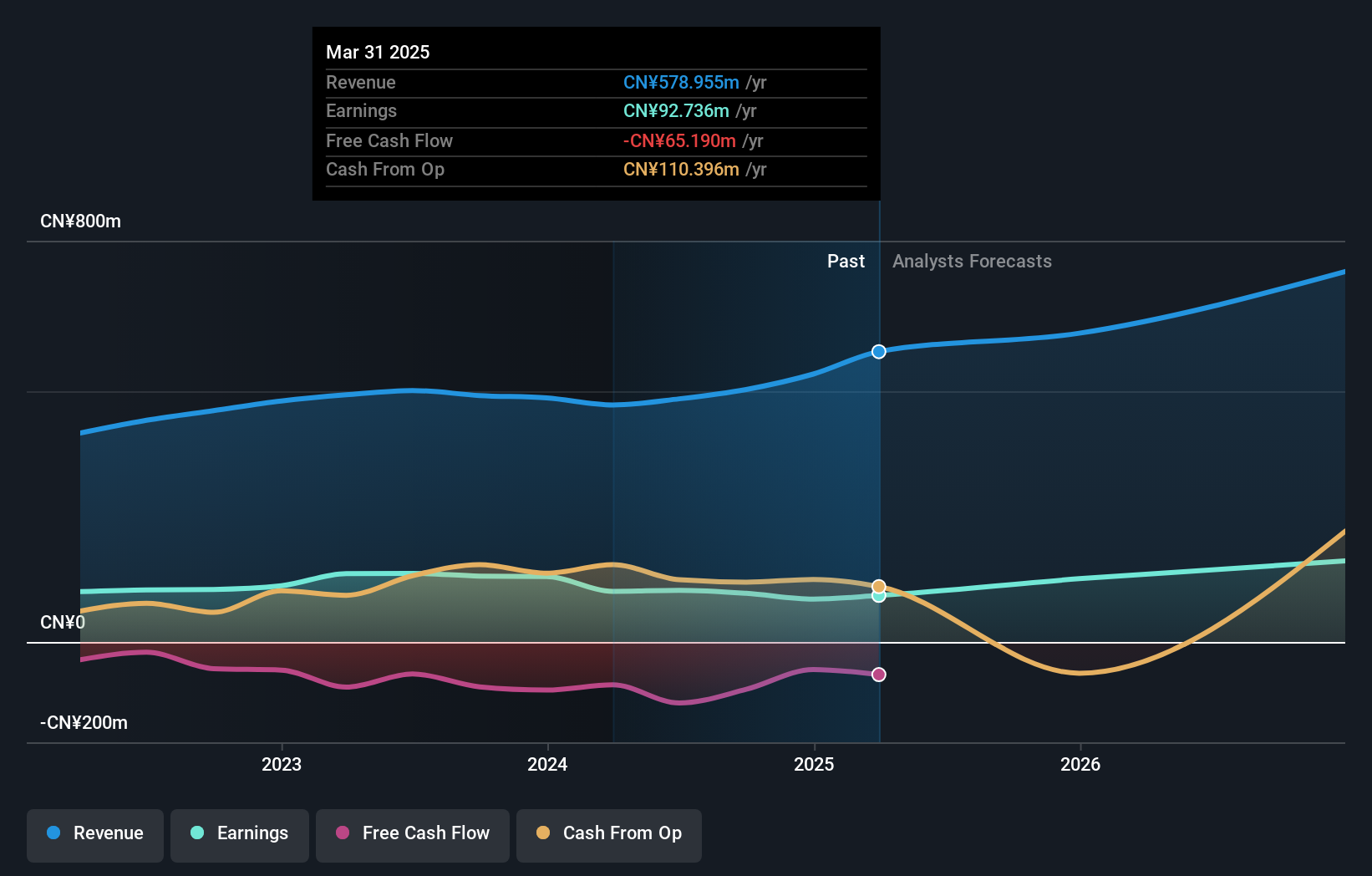

Zhejiang ZUCH Technology, amidst a vibrant Asian tech landscape, is demonstrating robust growth metrics that outshine many regional counterparts. With an impressive annual revenue increase of 28%, the company surpasses the Chinese market average growth of 12.5%. This financial vigor is matched by an earnings surge forecasted at 28.4% annually, positioning ZUCH well above the industry curve. The firm's commitment to innovation is evident in its R&D spending, crucial for maintaining its competitive edge in developing cutting-edge technologies. As it continues to expand its technological footprint, ZUCH not only secures a strong position within high-growth sectors but also promises significant potential for future advancements.

- Click here to discover the nuances of Zhejiang ZUCH Technology with our detailed analytical health report.

Evaluate Zhejiang ZUCH Technology's historical performance by accessing our past performance report.

WCON Electronics (Guangdong) (SZSE:301328)

Simply Wall St Growth Rating: ★★★★☆☆

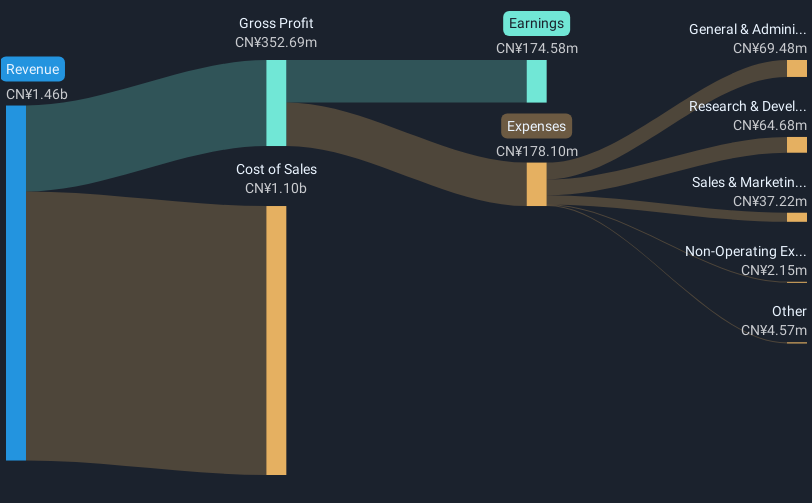

Overview: WCON Electronics (Guangdong) Co., Ltd. focuses on the research, development, manufacturing, and marketing of connectors and cable assemblies in China with a market capitalization of CN¥4.98 billion.

Operations: The company generates revenue primarily from its connector segment, amounting to CN¥573.76 million.

WCON Electronics (Guangdong) is navigating the competitive tech landscape with strategic agility, evidenced by its robust annual earnings growth forecast at 30.8% and revenue growth at 14.4%, both metrics outpacing the broader Chinese market averages of 23.6% and 12.5%, respectively. Despite a challenging year with negative earnings growth of -8.2%, the company's commitment to innovation is underscored by significant R&D investments, positioning it for recovery and future competitiveness in Asia’s high-tech sector. Recent corporate actions, including dividend affirmations and bylaw amendments, reflect an adaptive governance framework poised to support sustained growth amidst evolving market dynamics.

Where To Now?

- Gain an insight into the universe of 164 Asian High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang ZUCH Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301280

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives