High Growth Tech Stocks Including Dongguan Tarry ElectronicsLtd And Two More With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, investors are closely watching the technology-oriented Nasdaq Composite, which recently experienced a notable decline. In this environment, identifying high growth tech stocks like Dongguan Tarry Electronics Ltd involves evaluating companies that can effectively leverage innovation and adapt to shifting market dynamics while maintaining robust financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 24.52% | 34.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Growth Rating: ★★★★☆☆

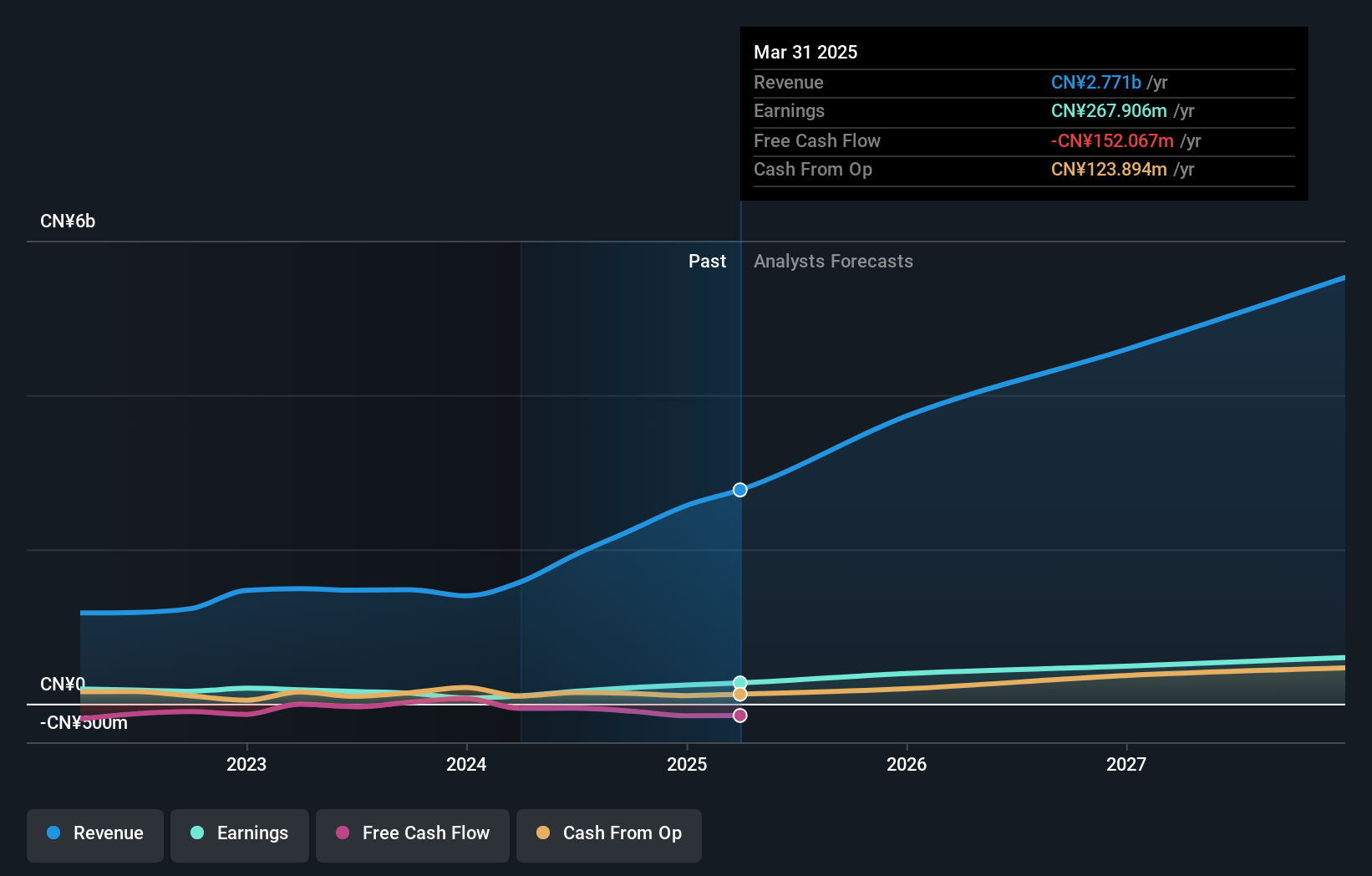

Overview: Dongguan Tarry Electronics Co., Ltd. specializes in the manufacturing and sale of precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China with a market capitalization of CN¥6.51 billion.

Operations: Tarry Electronics generates revenue primarily from its manufacturing industry segment, amounting to CN¥2.24 billion. The company's product portfolio includes precision die cutting products, foam protective film tapes, and EMI shielding products.

Dongguan Tarry ElectronicsLtd has demonstrated robust performance, with a 53% earnings growth over the past year, surpassing the electronic industry's average of 2.3%. This growth trajectory is supported by significant R&D investment, aligning with an aggressive strategy to innovate and capture market share. Despite a forecasted earnings growth of 23.5% per annum falling slightly below China's market average of 25.1%, the company's revenue is expected to outpace the CN market with a projected annual increase of 20%. Moreover, recent strategic buybacks underscore management’s confidence in sustaining growth, having repurchased shares worth CNY 31.59 million—a clear signal to stakeholders of its commitment to enhancing shareholder value amidst competitive pressures and evolving tech landscapes.

YD Electronic TechnologyLtd (SZSE:301123)

Simply Wall St Growth Rating: ★★★★★☆

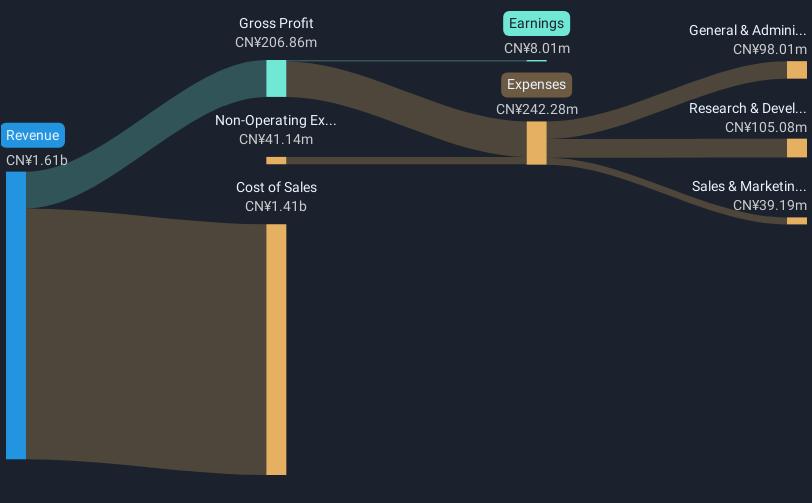

Overview: YD Electronic Technology Co., Ltd. is involved in the research, development, production, and sale of FPC boards, connector components, LED backlight modules, and other precision electronic components in China with a market cap of CN¥4.96 billion.

Operations: The company focuses on producing and selling FPC boards, connector components, and LED backlight modules. It operates primarily in the precision electronic components sector within China.

YD Electronic TechnologyLtd is carving out a significant presence in the high-growth tech sector, underscored by its strategic focus on R&D which has seen a substantial allocation of resources. Last year, the company invested 15% of its revenue into R&D activities, aiming to spearhead developments in next-generation electronic solutions. This investment is part of why YD's revenue surged by 25.5% annually, outpacing the industry average significantly. Moreover, with an aggressive buyback strategy that saw CNY 50 million spent last year to repurchase shares, YD is not just reinvesting in innovation but also actively working to enhance shareholder value amidst volatile market conditions.

- Get an in-depth perspective on YD Electronic TechnologyLtd's performance by reading our health report here.

Understand YD Electronic TechnologyLtd's track record by examining our Past report.

Insyde Software (TPEX:6231)

Simply Wall St Growth Rating: ★★★★★☆

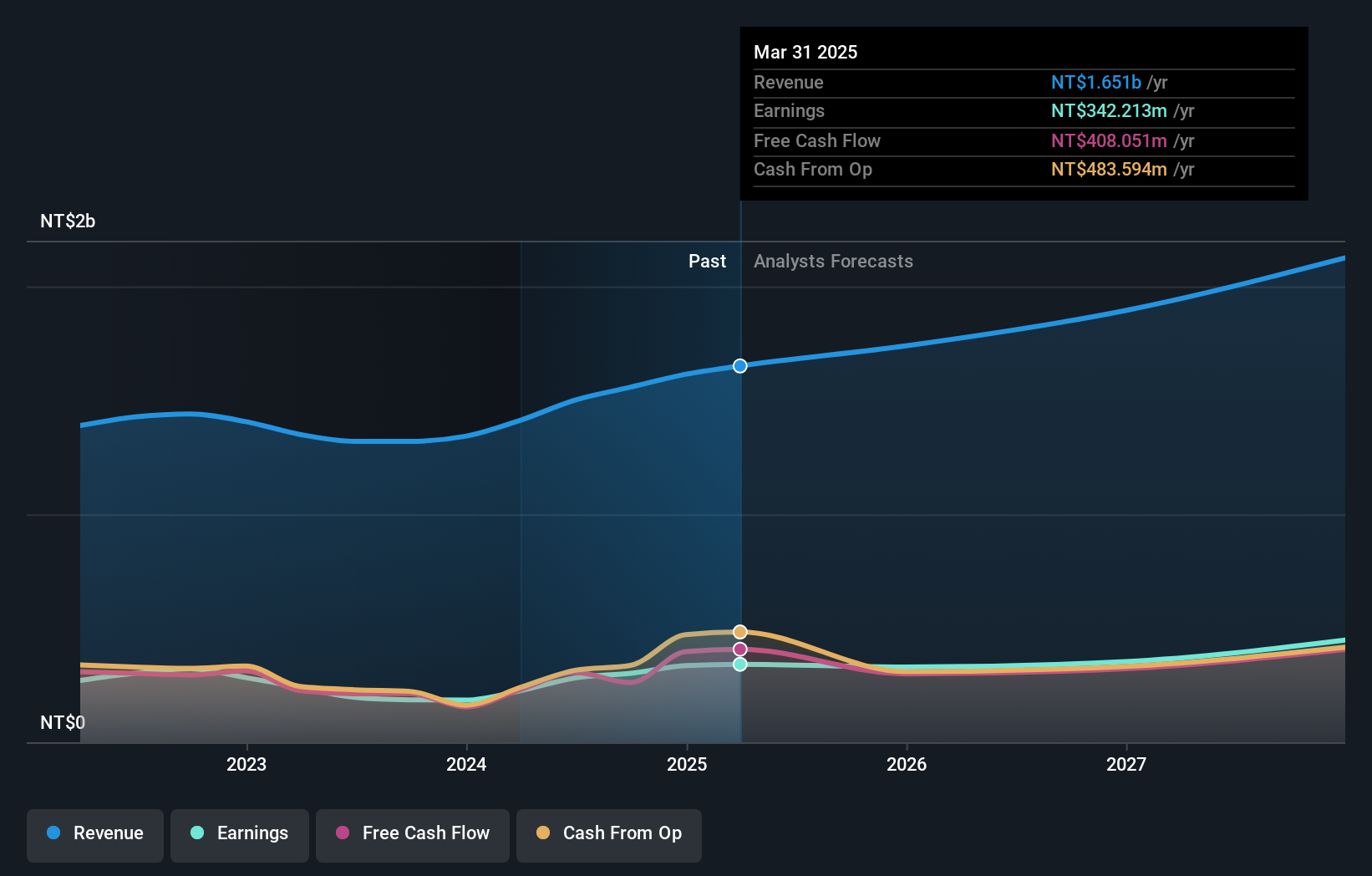

Overview: Insyde Software Corp. offers system firmware and software engineering services to the mobile, desktop, server, and embedded systems industries globally, with a market capitalization of NT$18.19 billion.

Operations: Insyde Software Corp. generates revenue primarily from its software and programming segment, amounting to NT$1.56 billion. The company focuses on providing specialized firmware and software solutions across various technology sectors globally.

Insyde Software has demonstrated robust financial performance with third-quarter sales rising to TWD 413.37 million from TWD 356.96 million the previous year, and net income increasing significantly to TWD 88.49 million from TWD 68.54 million. This growth trajectory is underpinned by a strategic emphasis on R&D, evidenced by a recent leadership change aimed at enhancing their technological edge, with Tim Lewis stepping in as Chief Technology Officer. Their commitment to innovation is expected to sustain an earnings growth of 59.9% annually, outstripping the broader Taiwanese market's average of 17.5%, positioning them well within the competitive tech landscape despite market volatility and leadership transitions.

- Click here and access our complete health analysis report to understand the dynamics of Insyde Software.

Examine Insyde Software's past performance report to understand how it has performed in the past.

Taking Advantage

- Investigate our full lineup of 1228 High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6231

Insyde Software

Provides system firmware and software engineering services for companies in the mobile, desktop, server, and embedded systems industries worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives