As we step into January 2025, global markets have shown mixed signals with U.S. stocks closing out a strong year despite recent profit-taking and economic indicators like the Chicago PMI highlighting ongoing challenges in manufacturing. Amid this backdrop, identifying high growth tech stocks involves looking for companies that demonstrate resilience and innovation potential, especially as broader market sentiment remains cautious yet optimistic about future growth opportunities in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Shenzhen LihexingLtd (SZSE:301013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Lihexing Co., Ltd. focuses on the R&D, production, and sale of automation and intelligent equipment for the information and communication technology industry in China, with a market cap of CN¥2.48 billion.

Operations: The company generates revenue primarily from its automation and intelligent equipment tailored for the information and communication technology sector in China. Emphasizing innovation, it allocates resources towards research and development to enhance its product offerings.

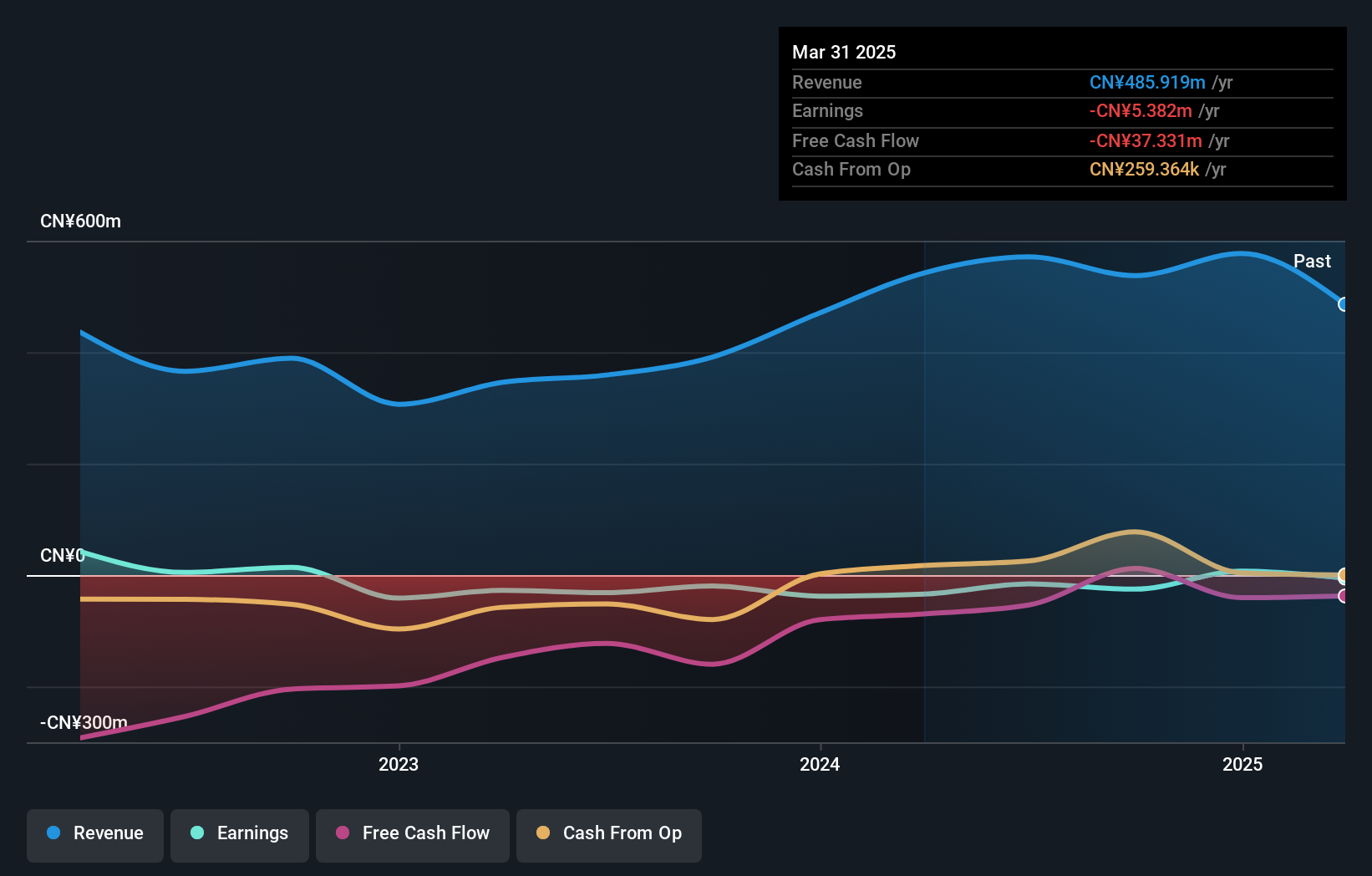

Shenzhen LihexingLtd, amidst a challenging tech landscape, has demonstrated robust financial agility with its revenue soaring by 33.6% annually, outpacing the CN market's average of 13.5%. This growth trajectory is complemented by an impressive forecast of earnings growth at 67.56% per year, signaling potential profitability within three years. Recent financials underscore this momentum; the firm's nine-month revenue jumped to CNY 359.27 million from CNY 291.74 million in the previous year, alongside a notable increase in net income to CNY 15.32 million from CNY 2.88 million. With positive free cash flow and R&D investments aligning with strategic market expansions, Shenzhen LihexingLtd is shaping up as a resilient contender in the high-tech arena despite current unprofitability.

- Get an in-depth perspective on Shenzhen LihexingLtd's performance by reading our health report here.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. operates in the electronic components and parts industry with a market cap of CN¥2.69 billion.

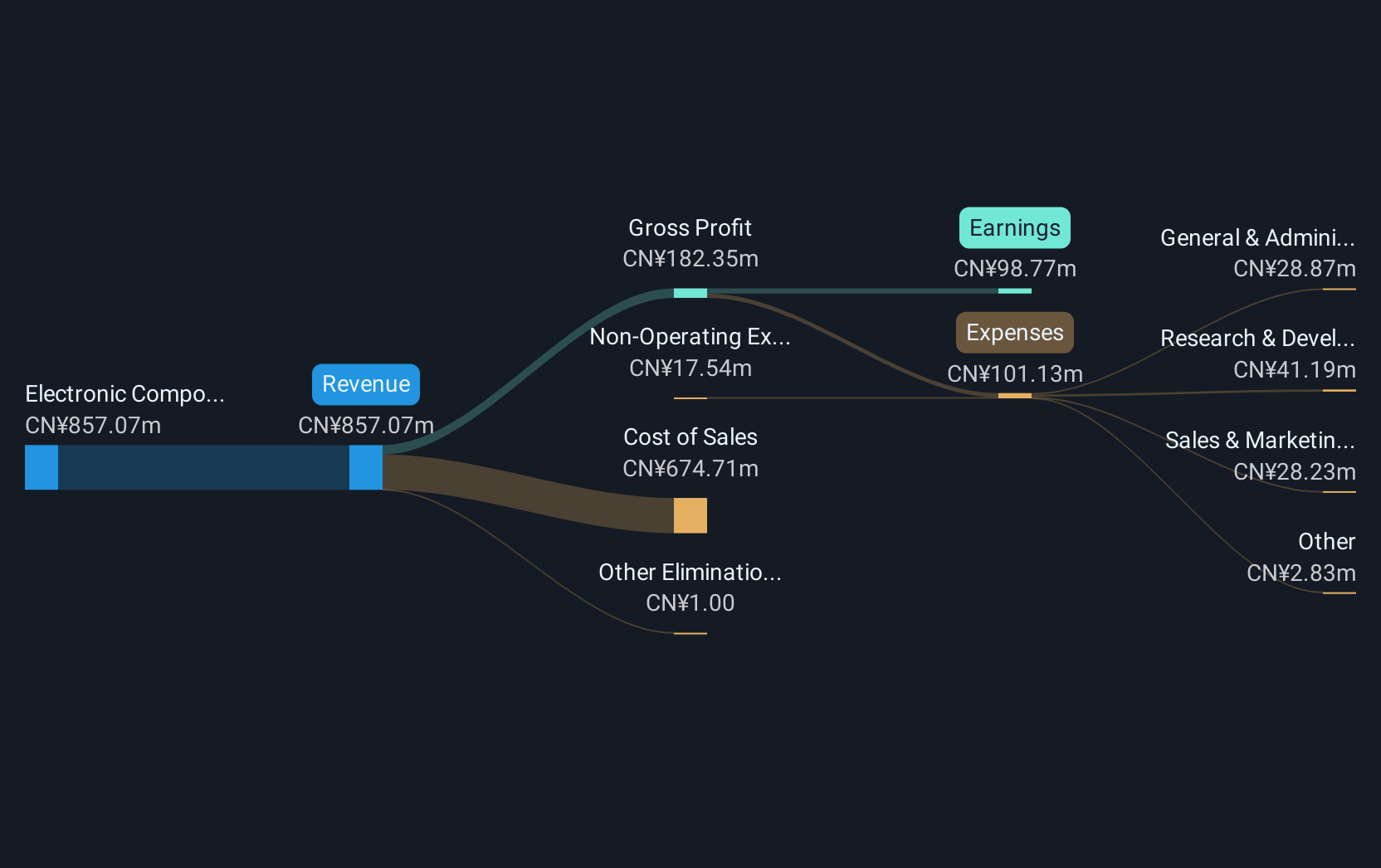

Operations: Smartwin generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥758.76 million.

Jiangsu Smartwin Electronics TechnologyLtd has carved a niche in the high-tech sector with significant advancements and strategic decisions that underscore its growth potential. In the last year, the company's revenue surged by 28.8% annually, outstripping the Chinese market average of 13.5%. This upward trajectory is further evidenced by an annual earnings increase of 33.6%, positioning it well above industry norms. Notably, R&D investments remain robust, totaling CNY 45 million in the recent fiscal period, which represents approximately 7.5% of their total revenue; this investment aligns with their commitment to innovation and market expansion despite recent operational adjustments like cancelling a major share issuance plan in December 2024. These figures reflect not only Jiangsu Smartwin's resilience but also its proactive stance in navigating market dynamics and enhancing shareholder value through focused leadership changes and strategic planning sessions aimed at bolstering governance and future growth prospects.

- Click to explore a detailed breakdown of our findings in Jiangsu Smartwin Electronics TechnologyLtd's health report.

Understand Jiangsu Smartwin Electronics TechnologyLtd's track record by examining our Past report.

Jiayuan Science and TechnologyLtd (SZSE:301117)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiayuan Science and Technology Co., Ltd. specializes in offering network information security products and comprehensive information solutions, with a market capitalization of CN¥2.50 billion.

Operations: The company generates revenue primarily through its network information security products and comprehensive information solutions. With a market capitalization of approximately CN¥2.50 billion, it focuses on addressing cybersecurity needs for various clients.

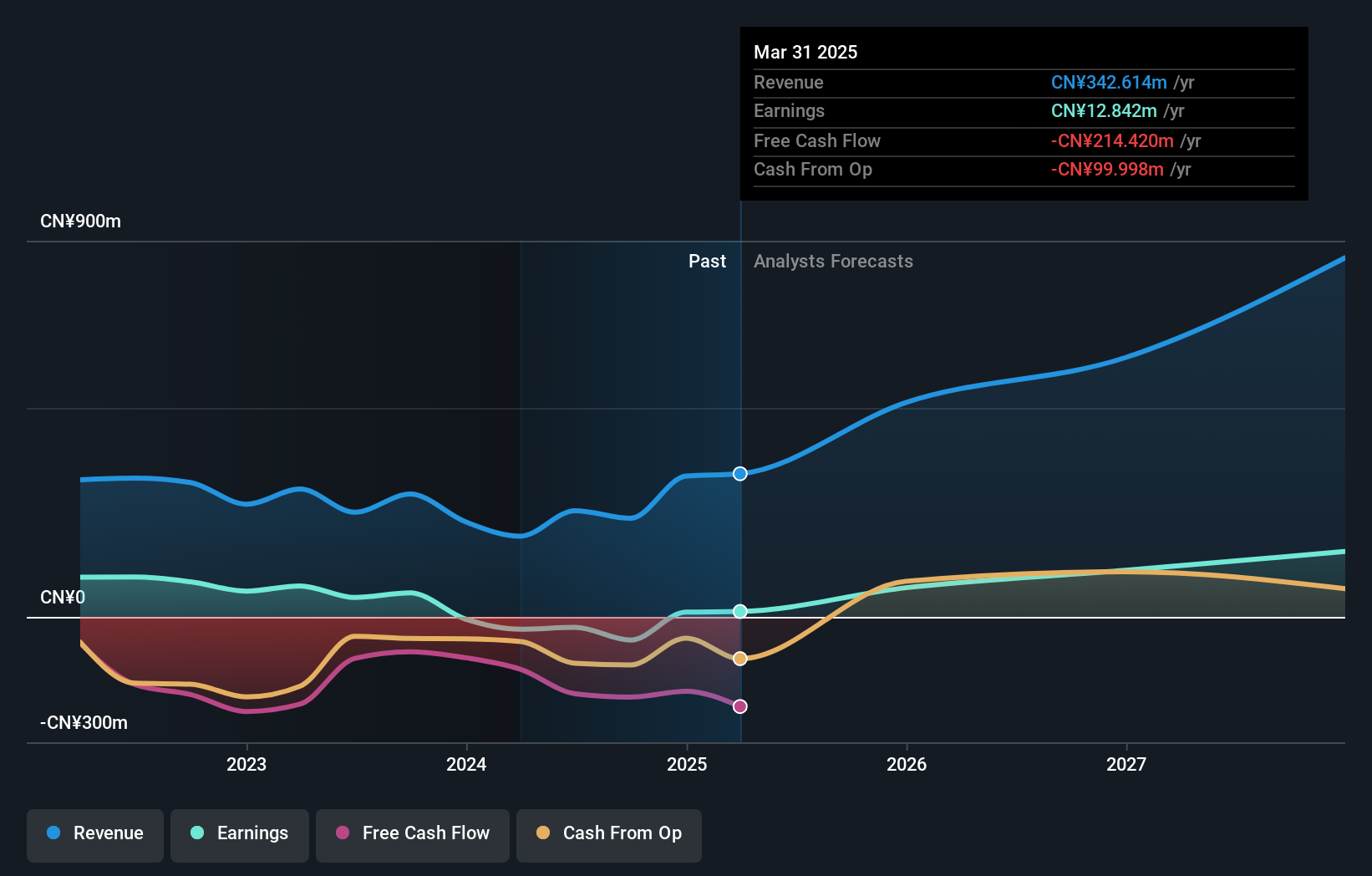

Jiayuan Science and TechnologyLtd has demonstrated a robust growth trajectory with an annual revenue increase of 36.5%, significantly outpacing the Chinese market's average growth rate of 13.5%. The company is navigating its path toward profitability, with earnings expected to surge by 83.6% annually. Despite recent challenges, including a net loss reported in the latest earnings results, Jiayuan continues to prioritize innovation, investing heavily in R&D which accounted for a substantial portion of their expenses. These strategic decisions are pivotal as the company adapts its operations and governance structures to enhance future performance and stability in a competitive tech landscape.

Taking Advantage

- Click through to start exploring the rest of the 1263 High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301117

Jiayuan Science and TechnologyLtd

Provides network information security products and comprehensive information solutions.

Excellent balance sheet with low risk.

Market Insights

Community Narratives