- China

- /

- Electronic Equipment and Components

- /

- SZSE:300991

The Strong Earnings Posted By Shenzhen Chuangyitong TechnologyLtd (SZSE:300991) Are A Good Indication Of The Strength Of The Business

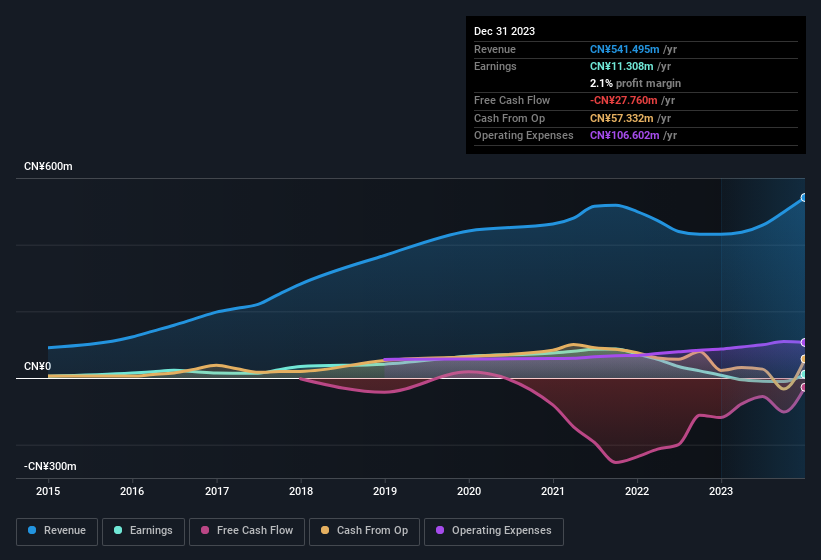

When companies post strong earnings, the stock generally performs well, just like Shenzhen Chuangyitong Technology Co.,Ltd.'s (SZSE:300991) stock has recently. We have done some analysis, and we found several positive factors beyond the profit numbers.

See our latest analysis for Shenzhen Chuangyitong TechnologyLtd

The Impact Of Unusual Items On Profit

To properly understand Shenzhen Chuangyitong TechnologyLtd's profit results, we need to consider the CN¥12m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Shenzhen Chuangyitong TechnologyLtd doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shenzhen Chuangyitong TechnologyLtd.

Our Take On Shenzhen Chuangyitong TechnologyLtd's Profit Performance

Because unusual items detracted from Shenzhen Chuangyitong TechnologyLtd's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Shenzhen Chuangyitong TechnologyLtd's earnings potential is at least as good as it seems, and maybe even better! And on top of that, its earnings per share increased by 33% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To help with this, we've discovered 4 warning signs (3 are a bit concerning!) that you ought to be aware of before buying any shares in Shenzhen Chuangyitong TechnologyLtd.

Today we've zoomed in on a single data point to better understand the nature of Shenzhen Chuangyitong TechnologyLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300991

Shenzhen Chuangyitong TechnologyLtd

Shenzhen Chuangyitong Technology Co.,Ltd.

Proven track record with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026