- China

- /

- Electronic Equipment and Components

- /

- SZSE:300991

Shenzhen Chuangyitong Technology Co.,Ltd. (SZSE:300991) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Shenzhen Chuangyitong Technology Co.,Ltd. (SZSE:300991) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 9.2% over that longer period.

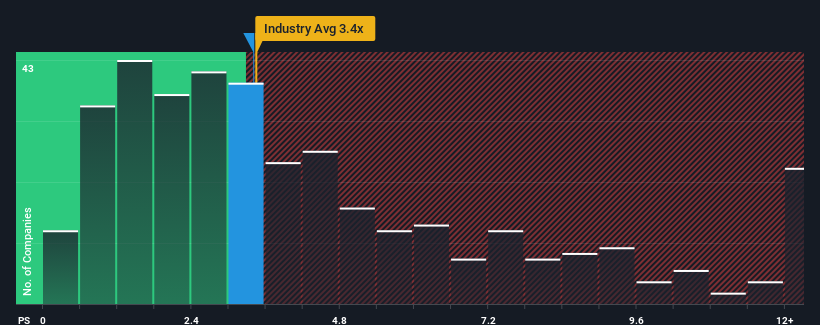

Although its price has dipped substantially, it's still not a stretch to say that Shenzhen Chuangyitong TechnologyLtd's price-to-sales (or "P/S") ratio of 3.4x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Shenzhen Chuangyitong TechnologyLtd

What Does Shenzhen Chuangyitong TechnologyLtd's P/S Mean For Shareholders?

Shenzhen Chuangyitong TechnologyLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Chuangyitong TechnologyLtd will help you shine a light on its historical performance.How Is Shenzhen Chuangyitong TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Chuangyitong TechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. The latest three year period has also seen a 17% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

With this information, we find it interesting that Shenzhen Chuangyitong TechnologyLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Shenzhen Chuangyitong TechnologyLtd's P/S

Following Shenzhen Chuangyitong TechnologyLtd's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shenzhen Chuangyitong TechnologyLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shenzhen Chuangyitong TechnologyLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300991

Shenzhen Chuangyitong TechnologyLtd

Shenzhen Chuangyitong Technology Co.,Ltd.

Proven track record with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion