- China

- /

- Electronic Equipment and Components

- /

- SZSE:300976

Dongguan Tarry ElectronicsLtd's (SZSE:300976) Dividend Is Being Reduced To CN¥0.23

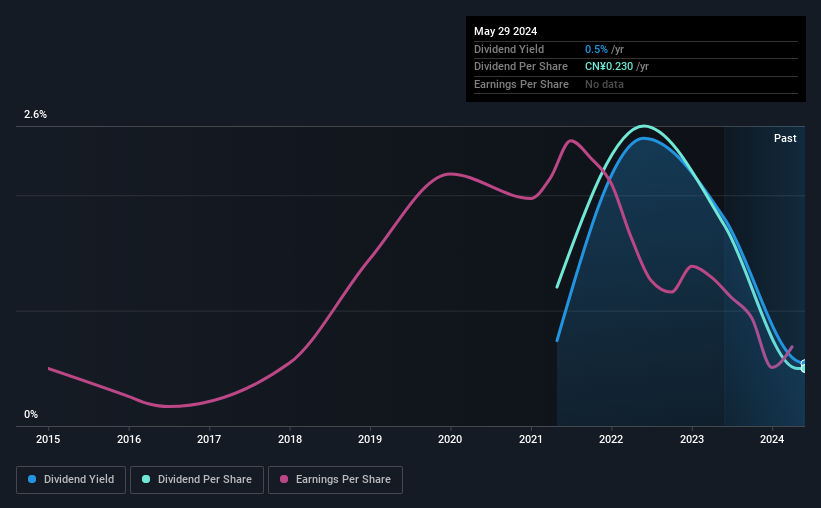

Dongguan Tarry Electronics Co.,Ltd (SZSE:300976) has announced that on 3rd of June, it will be paying a dividend ofCN¥0.23, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 0.5%, which only provides a modest boost to overall returns.

Check out our latest analysis for Dongguan Tarry ElectronicsLtd

Dongguan Tarry ElectronicsLtd's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Dongguan Tarry ElectronicsLtd is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share is forecast to rise by 192.3% over the next year. If the dividend continues on this path, the payout ratio could be 6.7% by next year, which we think can be pretty sustainable going forward.

Dongguan Tarry ElectronicsLtd's Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The annual payment during the last 3 years was CN¥0.556 in 2021, and the most recent fiscal year payment was CN¥0.23. Dividend payments have fallen sharply, down 59% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Earnings per share has been sinking by 13% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While Dongguan Tarry ElectronicsLtd is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Dongguan Tarry ElectronicsLtd that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300976

Dongguan Tarry ElectronicsLtd

Manufactures and sells precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success