- China

- /

- Electronic Equipment and Components

- /

- SZSE:300939

Shenzhen AV-Display Co., Ltd.'s (SZSE:300939) Shares May Have Run Too Fast Too Soon

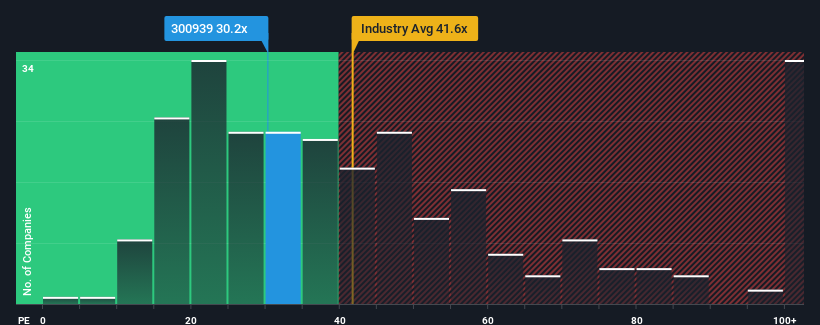

It's not a stretch to say that Shenzhen AV-Display Co., Ltd.'s (SZSE:300939) price-to-earnings (or "P/E") ratio of 30.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For instance, Shenzhen AV-Display's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Shenzhen AV-Display

Is There Some Growth For Shenzhen AV-Display?

The only time you'd be comfortable seeing a P/E like Shenzhen AV-Display's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Shenzhen AV-Display is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Shenzhen AV-Display's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shenzhen AV-Display currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Shenzhen AV-Display that you should be aware of.

You might be able to find a better investment than Shenzhen AV-Display. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300939

Shenzhen AV-Display

Engages in the research, develop, production, and sale of liquid crystal display (LCD) and touch products in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026