- China

- /

- Electronic Equipment and Components

- /

- SZSE:300903

Improved Revenues Required Before Guangdong Kingshine Electronic Technology Co.,Ltd. (SZSE:300903) Stock's 43% Jump Looks Justified

Guangdong Kingshine Electronic Technology Co.,Ltd. (SZSE:300903) shares have had a really impressive month, gaining 43% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.1% over the last year.

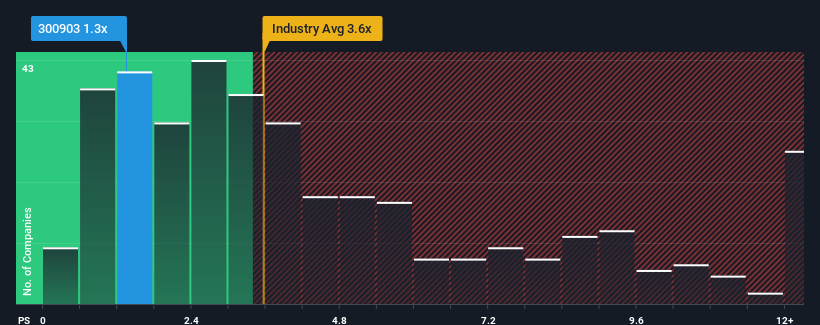

In spite of the firm bounce in price, Guangdong Kingshine Electronic TechnologyLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 3.6x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Guangdong Kingshine Electronic TechnologyLtd

What Does Guangdong Kingshine Electronic TechnologyLtd's P/S Mean For Shareholders?

Guangdong Kingshine Electronic TechnologyLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangdong Kingshine Electronic TechnologyLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Guangdong Kingshine Electronic TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 68% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 25% shows it's noticeably less attractive.

In light of this, it's understandable that Guangdong Kingshine Electronic TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Even after such a strong price move, Guangdong Kingshine Electronic TechnologyLtd's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Guangdong Kingshine Electronic TechnologyLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Guangdong Kingshine Electronic TechnologyLtd that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300903

Guangdong Kingshine Electronic TechnologyLtd

Guangdong Kingshine Electronic Technology Co.,Ltd.

Low risk and slightly overvalued.

Market Insights

Community Narratives