- China

- /

- Electronic Equipment and Components

- /

- SZSE:300902

Investors Appear Satisfied With Guoanda Co., Ltd.'s (SZSE:300902) Prospects As Shares Rocket 30%

Guoanda Co., Ltd. (SZSE:300902) shares have continued their recent momentum with a 30% gain in the last month alone. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

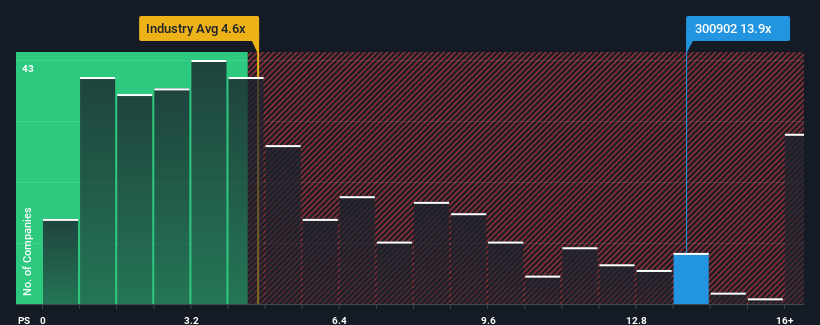

Since its price has surged higher, Guoanda may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 13.9x, since almost half of all companies in the Electronic industry in China have P/S ratios under 4.6x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Guoanda

What Does Guoanda's P/S Mean For Shareholders?

Recent revenue growth for Guoanda has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Guoanda's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Guoanda?

In order to justify its P/S ratio, Guoanda would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 36% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 91% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

In light of this, it's understandable that Guoanda's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Guoanda's P/S Mean For Investors?

Shares in Guoanda have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Guoanda shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with Guoanda (including 2 which make us uncomfortable).

If these risks are making you reconsider your opinion on Guoanda, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300902

Guoanda

Engages in the research, development, production, and sale of automatic fire extinguishing devices and systems in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives