- China

- /

- Electronic Equipment and Components

- /

- SZSE:300902

Guoanda Co., Ltd.'s (SZSE:300902) Earnings Haven't Escaped The Attention Of Investors

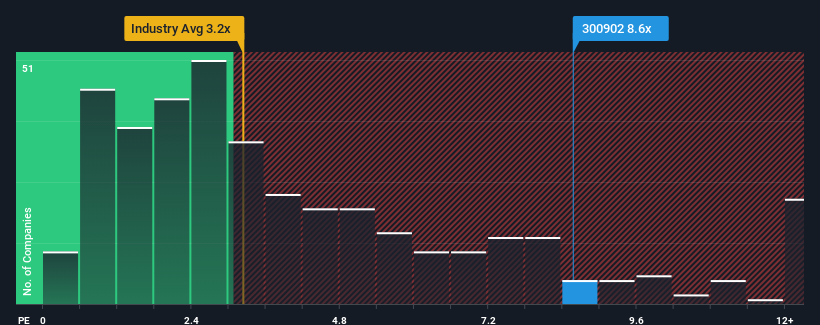

Guoanda Co., Ltd.'s (SZSE:300902) price-to-sales (or "P/S") ratio of 8.6x may look like a poor investment opportunity when you consider close to half the companies in the Electronic industry in China have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Guoanda

What Does Guoanda's P/S Mean For Shareholders?

Guoanda certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Guoanda will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Guoanda?

In order to justify its P/S ratio, Guoanda would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 68% gain to the company's top line. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 44% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

In light of this, it's understandable that Guoanda's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Guoanda shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Guoanda is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300902

Guoanda

Engages in the research, development, production, and sale of automatic fire extinguishing devices and systems in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives