- China

- /

- Electronic Equipment and Components

- /

- SZSE:300853

Investors Appear Satisfied With Hangzhou Shenhao Technology Co.,LTD.'s (SZSE:300853) Prospects As Shares Rocket 38%

Hangzhou Shenhao Technology Co.,LTD. (SZSE:300853) shareholders are no doubt pleased to see that the share price has bounced 38% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

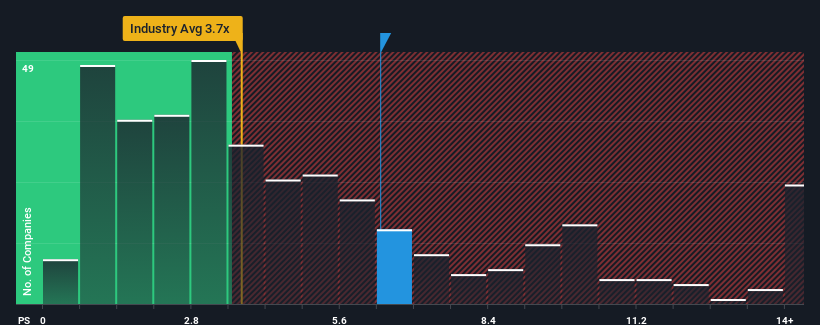

Since its price has surged higher, you could be forgiven for thinking Hangzhou Shenhao TechnologyLTD is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.4x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Hangzhou Shenhao TechnologyLTD

How Has Hangzhou Shenhao TechnologyLTD Performed Recently?

While the industry has experienced revenue growth lately, Hangzhou Shenhao TechnologyLTD's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hangzhou Shenhao TechnologyLTD.How Is Hangzhou Shenhao TechnologyLTD's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hangzhou Shenhao TechnologyLTD's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 31%. The last three years don't look nice either as the company has shrunk revenue by 8.2% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 193% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's understandable that Hangzhou Shenhao TechnologyLTD's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Hangzhou Shenhao TechnologyLTD's P/S Mean For Investors?

Hangzhou Shenhao TechnologyLTD's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hangzhou Shenhao TechnologyLTD's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Hangzhou Shenhao TechnologyLTD (1 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Hangzhou Shenhao TechnologyLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Shenhao TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300853

Hangzhou Shenhao TechnologyLTD

Focuses on the research and development, manufacturing, and sale of intelligent robots, intelligent monitoring and detection equipment, and intelligent control equipment in the field of industrial equipment testing and fault diagnosis in China.

Limited growth with imperfect balance sheet.

Market Insights

Community Narratives