- China

- /

- Electronic Equipment and Components

- /

- SZSE:300790

The total return for DongGuan YuTong Optical TechnologyLtd (SZSE:300790) investors has risen faster than earnings growth over the last year

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the DongGuan YuTong Optical Technology Co.,Ltd. (SZSE:300790) share price has soared 102% in the last 1 year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 27% gain in the last three months. On the other hand, longer term shareholders have had a tougher run, with the stock falling 4.8% in three years.

In light of the stock dropping 5.0% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for DongGuan YuTong Optical TechnologyLtd

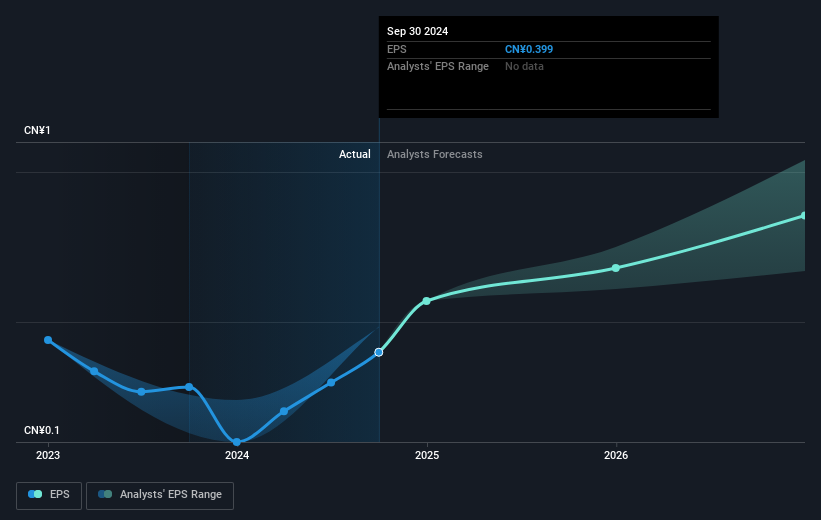

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

DongGuan YuTong Optical TechnologyLtd was able to grow EPS by 41% in the last twelve months. The share price gain of 102% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 59.25 also points to this optimism.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that DongGuan YuTong Optical TechnologyLtd has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's good to see that DongGuan YuTong Optical TechnologyLtd has rewarded shareholders with a total shareholder return of 103% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for DongGuan YuTong Optical TechnologyLtd that you should be aware of.

We will like DongGuan YuTong Optical TechnologyLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300790

DongGuan YuTong Optical TechnologyLtd

DongGuan YuTong Optical Technology Co.,Ltd.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives