- China

- /

- Communications

- /

- SHSE:688143

Top Growth Companies With Insider Confidence In February 2025

Reviewed by Simply Wall St

As global markets continue to climb toward record highs, fueled by robust growth in U.S. stock indexes and a delayed tariff implementation, investors are closely monitoring inflation data that suggests interest rates may remain elevated for longer. In this environment, companies with strong insider ownership can be particularly appealing as they often signal confidence from those who know the business best, potentially aligning with investor interests during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

We're going to check out a few of the best picks from our screener tool.

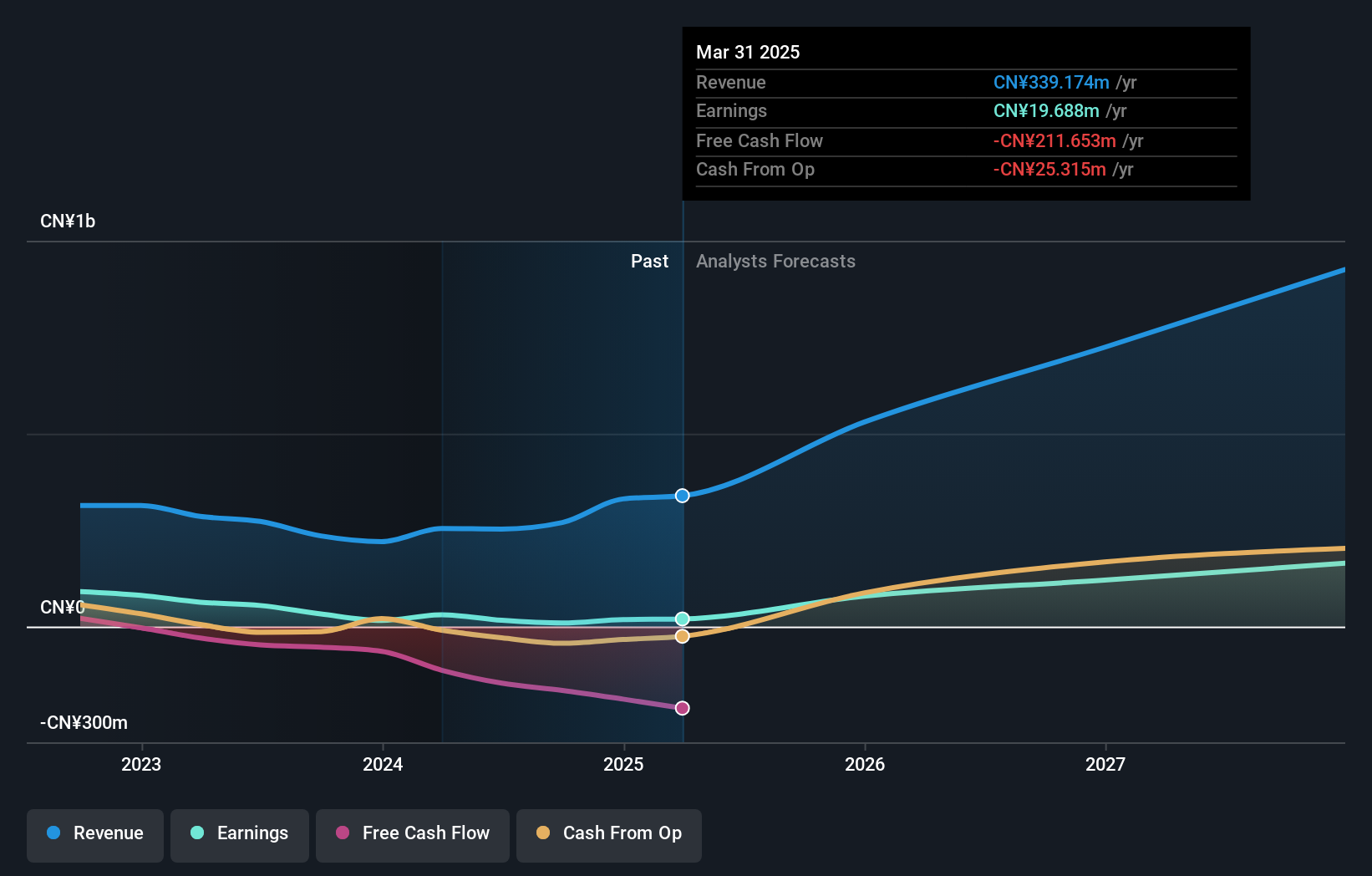

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fiber and cable, optical devices, new materials, high-end equipment, and photoelectric systems in China with a market cap of CN¥3.68 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥269.51 million.

Insider Ownership: 27.5%

Earnings Growth Forecast: 71.4% p.a.

Yangtze Optical Electronic demonstrates strong growth potential, with revenue expected to increase by 39.8% annually, significantly outpacing the Chinese market's average. Earnings are forecast to grow at a substantial 71.44% annually over the next three years, despite recent volatility in share price and lower profit margins compared to last year. The company recently completed a share buyback program worth CNY 20.66 million, enhancing shareholder value without notable insider trading activity in recent months.

- Unlock comprehensive insights into our analysis of Yangtze Optical Electronic stock in this growth report.

- Our comprehensive valuation report raises the possibility that Yangtze Optical Electronic is priced higher than what may be justified by its financials.

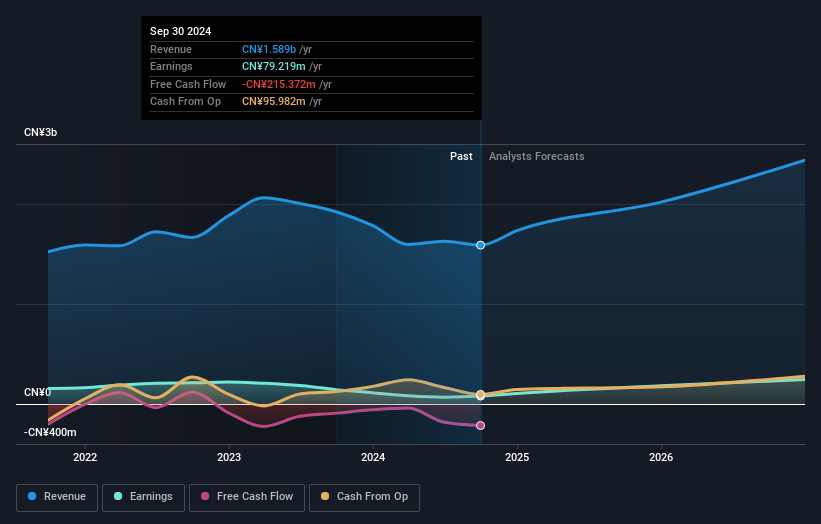

Kaili Catalyst & New MaterialsLtd (SHSE:688269)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kaili Catalyst & New Materials Co., Ltd. focuses on the research, development, production, and sale of metal catalysts both in China and internationally, with a market cap of CN¥3.26 billion.

Operations: The company's revenue is generated from its activities in the research, development, production, and sale of metal catalysts across domestic and international markets.

Insider Ownership: 10.9%

Earnings Growth Forecast: 47.7% p.a.

Kaili Catalyst & New Materials Ltd. is poised for growth, with revenue expected to rise by 18.7% annually, surpassing the Chinese market's average of 13.4%. Earnings are projected to grow significantly at 47.72% per year over the next three years, despite a decline in profit margins from last year's 7.5% to 5%. The company faces challenges with dividend sustainability and lacks recent insider trading activity but remains focused on expanding its financial performance.

- Navigate through the intricacies of Kaili Catalyst & New MaterialsLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Kaili Catalyst & New MaterialsLtd's share price might be on the expensive side.

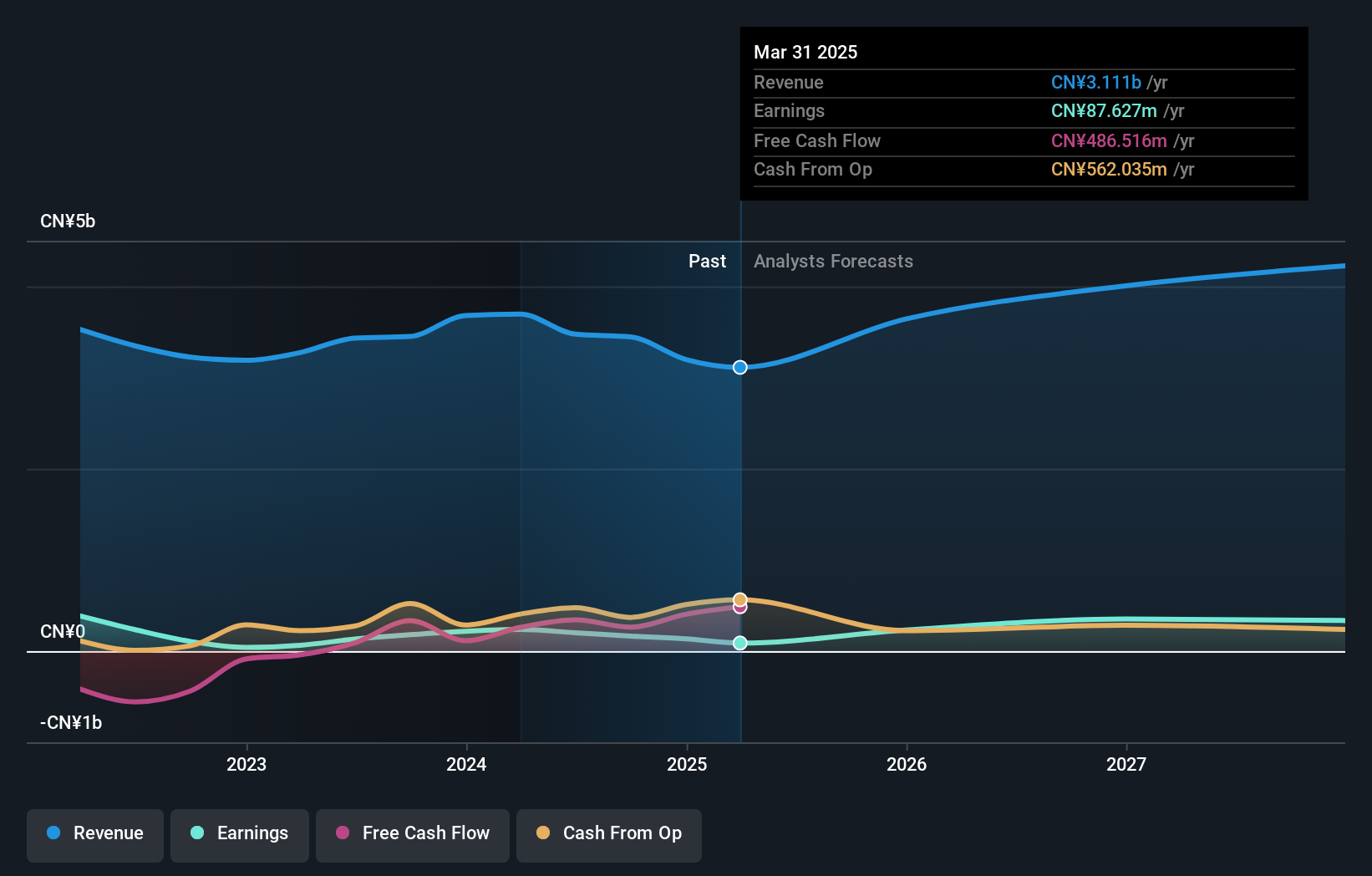

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. (SZSE:300747) operates in the fiber laser industry and has a market cap of approximately CN¥11.17 billion.

Operations: I'm sorry, but the provided text does not include specific revenue segment data for Wuhan Raycus Fiber Laser Technologies Ltd. If you have additional details or figures related to their revenue segments, please share them so I can assist you further.

Insider Ownership: 16.1%

Earnings Growth Forecast: 44.5% p.a.

Wuhan Raycus Fiber Laser Technologies Ltd. is set for strong earnings growth, projected at 44.5% annually, outpacing the Chinese market's average of 25.3%. Despite a slower revenue increase of 15.5%, it still exceeds the market's growth rate of 13.4%. The company's dividend history is unstable, and its return on equity is forecasted to be low at 9.8%. Recent meetings affirmed dividends but lacked substantial insider trading activity in recent months.

- Dive into the specifics of Wuhan Raycus Fiber Laser TechnologiesLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Wuhan Raycus Fiber Laser TechnologiesLtd implies its share price may be too high.

Key Takeaways

- Embark on your investment journey to our 1458 Fast Growing Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688143

Yangtze Optical Electronic

Engages in the research and development, production, and sale of special optical fiber and cables, special optical devices, new materials, high-end equipment, and photoelectric systems in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives