- China

- /

- Communications

- /

- SZSE:300698

High Growth Tech Stocks In China Featuring Three Prominent Players

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and fluctuating economic indicators, Chinese stocks have shown resilience, with indices like the Shanghai Composite and CSI 300 experiencing significant gains driven by optimism surrounding Beijing's support measures. In this environment, identifying high growth tech stocks involves assessing companies that can leverage supportive government policies and navigate the challenges of contracting manufacturing activity to sustain their momentum in an evolving market landscape.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.62% | 31.72% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

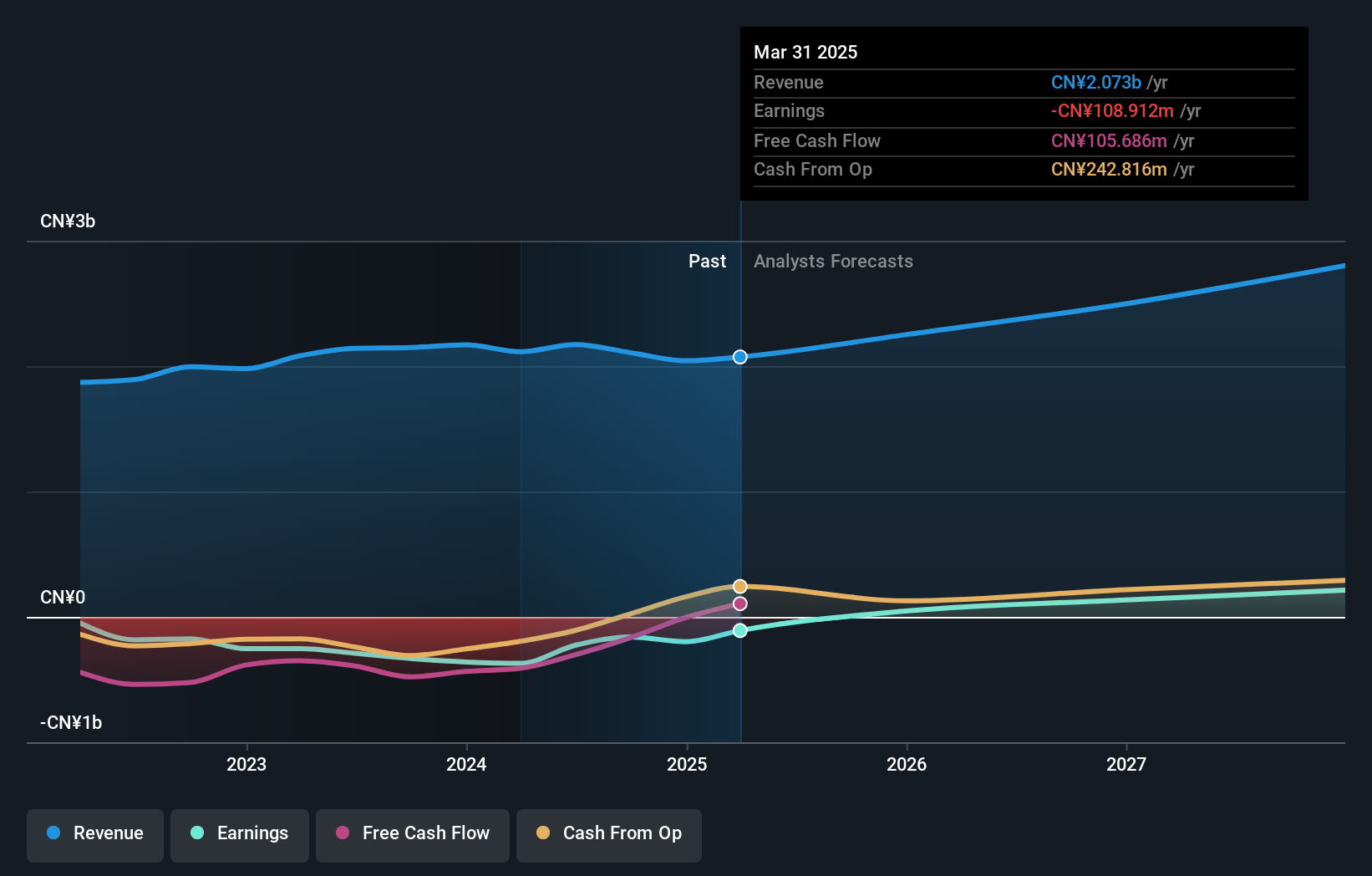

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market capitalization of CN¥5.65 billion.

Operations: DBAPPSecurity Co., Ltd. specializes in cybersecurity solutions, primarily generating revenue through the sale of its developed products in China. The company emphasizes research and development to enhance its product offerings, contributing significantly to its operations.

DBAPPSecurity, amid a challenging financial landscape, shows a promising shift towards profitability with expected earnings growth of 73.6% annually. This pivot is underscored by their recent half-year financials, where they narrowed their net loss significantly to CNY 275.61 million from CNY 408.66 million year-over-year and maintained steady revenue growth at 17.3%. Despite current unprofitability and high share price volatility, the company's R&D commitment is robust, aligning with its strategic focus on enhancing cybersecurity solutions in a rapidly evolving tech landscape in China. This dedication to innovation could potentially accelerate DBAPPSecurity's transition to profitability and fortify its market position against competitors in the high-stakes tech arena.

- Delve into the full analysis health report here for a deeper understanding of DBAPPSecurity.

Examine DBAPPSecurity's past performance report to understand how it has performed in the past.

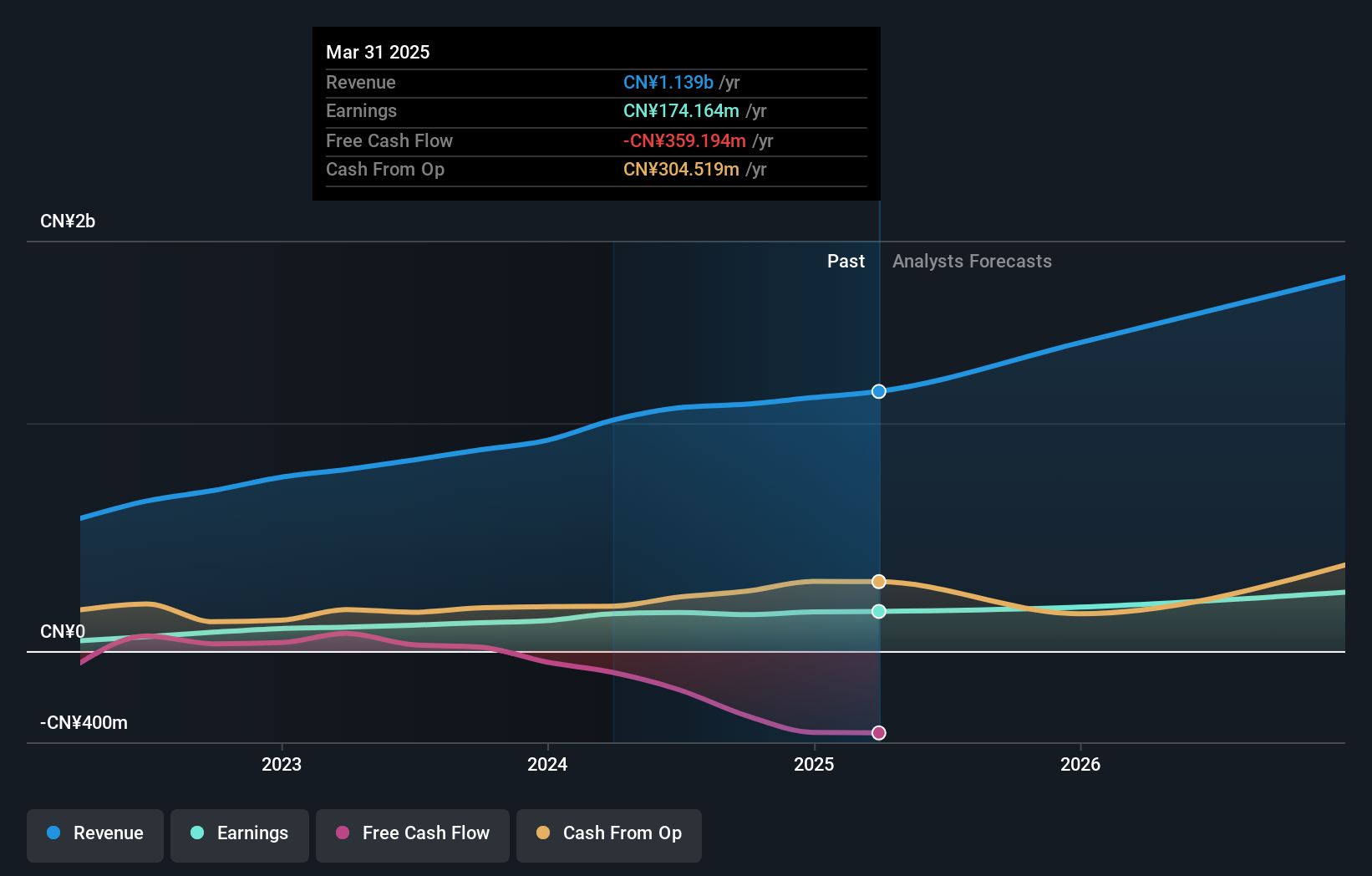

Shenzhen Qingyi Photomask (SHSE:688138)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Qingyi Photomask Limited is involved in the research, design, production, and sales of high precision masks in China with a market capitalization of CN¥6.60 billion.

Operations: Qingyi Photomask specializes in high precision mask production, leveraging its expertise in research and design to drive sales within China. The company's operations are supported by a market capitalization of CN¥6.60 billion, indicating its significant presence in the industry.

Shenzhen Qingyi Photomask has demonstrated a robust performance with its half-year revenue soaring to CNY 560.89 million from CNY 417.41 million, marking a significant year-over-year increase. This growth is complemented by an impressive surge in net income to CNY 88.91 million, up from CNY 53.37 million, reflecting strong operational efficiency and market demand for its photomask technology crucial for semiconductor manufacturing. Despite the broader Chinese tech sector's challenges, Qingyi's commitment to R&D spending is evident as it continues to innovate within the high-precision manufacturing space essential for tech advancements globally. With earnings expected to grow by 20.8% annually, slightly below the national average of 23.7%, Qingyi still outpaces many industry counterparts by maintaining substantial revenue growth at a forecasted rate of 21% per year against the market average of 13.4%.

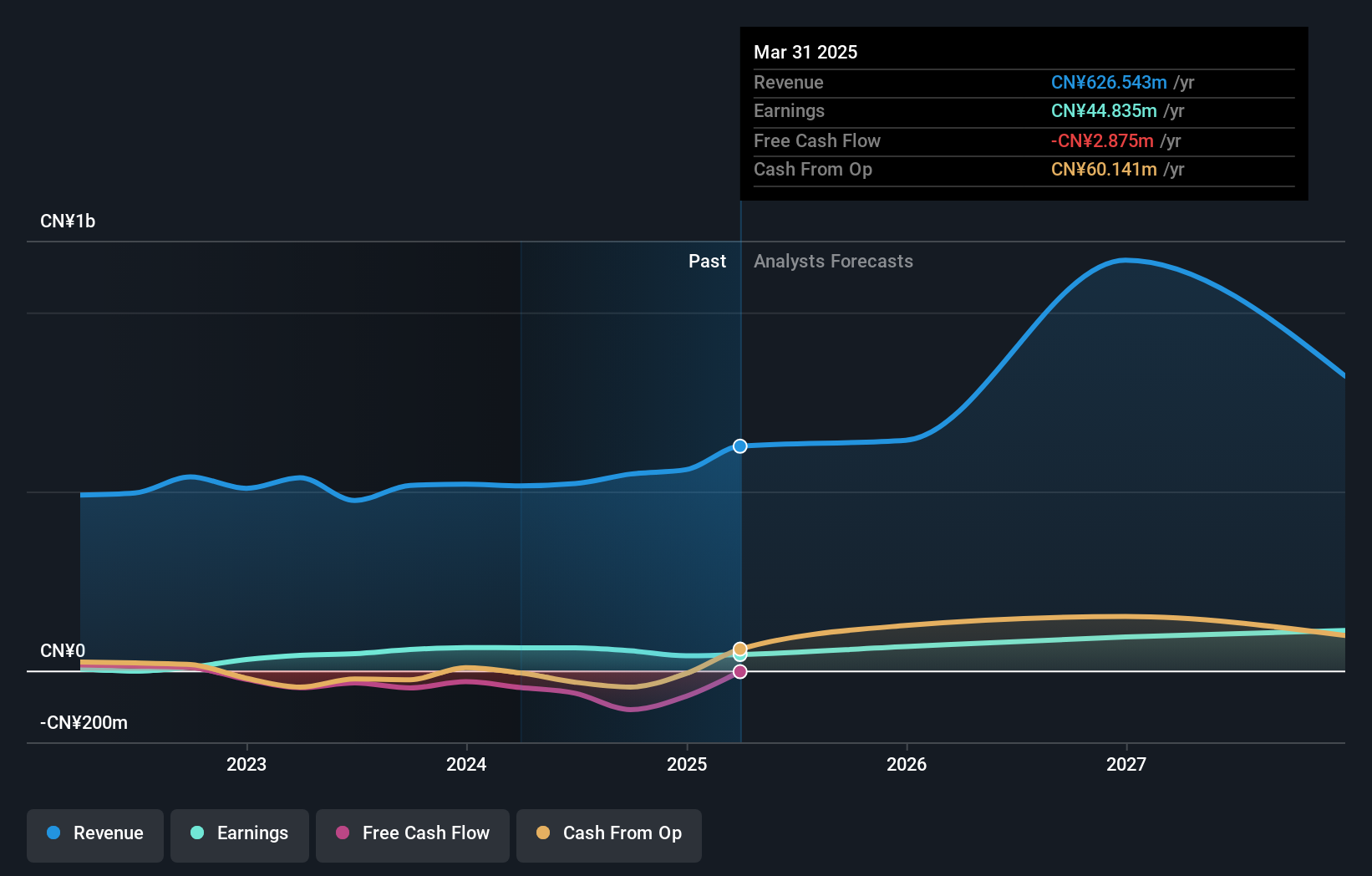

Wanma Technology (SZSE:300698)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wanma Technology Co., Ltd. focuses on the R&D, production, system integration, and sales of communication and medical information equipment with a market cap of CN¥6.63 billion.

Operations: The company generates revenue primarily through its communication and medical information equipment segments. It emphasizes research and development, production, and system integration to support its sales operations.

Wanma Technology, amidst a volatile market, has shown resilience with its earnings slightly dipping to CNY 15.97 million from CNY 16.79 million year-over-year, reflecting a tight operational control in challenging conditions. Despite a marginal decrease in sales and revenue, the company's commitment to innovation is evident with an R&D expense ratio that aligns closely with industry leaders striving for technological advancements. Notably, Wanma's future looks promising as it is poised for substantial growth with expected annual revenue and earnings increases of 35.6% and 47.8%, respectively—outpacing the broader Chinese tech sector's averages significantly. This robust forecast is supported by strategic decisions made during their recent extraordinary shareholders meeting focusing on capital increases and leadership adjustments to bolster their market position further.

Next Steps

- Reveal the 255 hidden gems among our Chinese High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanma Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300698

Wanma Technology

Engages in the research and development, production, system integration, and sales of communication and medical information equipment.

Exceptional growth potential with adequate balance sheet.