- China

- /

- Communications

- /

- SZSE:300698

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by competitive pressures in the tech sector and fluctuating economic indicators, investors are keenly observing movements within key indices such as the Nasdaq Composite, which recently experienced volatility due to developments in artificial intelligence. In this dynamic environment, identifying high growth tech stocks involves evaluating companies that not only demonstrate strong innovation and adaptability but also possess robust financial health to withstand market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Cubic Sensor and InstrumentLtd (SHSE:688665)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cubic Sensor and Instrument Co., Ltd. specializes in manufacturing gas sensors and sensor solutions in China, with a market cap of CN¥3.38 billion.

Operations: Cubic Sensor and Instrument Co., Ltd. generates revenue primarily through the production of gas sensors and sensor solutions. The company operates within the Chinese market, focusing on advanced sensor technology to cater to various industrial applications.

Cubic Sensor and Instrument Co.,Ltd. faces challenges with a volatile share price and a significant earnings decline of 36.6% over the past year, contrasting sharply with its industry's average growth of 2.3%. However, the company's future looks promising with an expected revenue growth rate of 20.6% per year, outpacing the CN market forecast of 13.5%. Additionally, earnings are projected to surge by an impressive 42% annually. Despite lower profit margins this year at 11.9%, down from last year’s 22.3%, the firm’s commitment to innovation is evident in its R&D investments aimed at harnessing emerging technologies to regain competitive edge and enhance operational efficiencies in the long term.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. is engaged in the production and sale of smart sensors and optoelectronic instrument products, with a market cap of CN¥3.47 billion.

Operations: The company focuses on producing and selling smart sensors and optoelectronic instruments. It operates with a market capitalization of CN¥3.47 billion, reflecting its position in the industry.

Beijing Beetech is navigating the competitive tech landscape with notable agility, supported by a robust annual revenue growth of 19.3%, outstripping the Chinese market's average of 13.5%. The company's commitment to innovation is underscored by its R&D spending which has been strategically increased to harness cutting-edge technologies, ensuring it remains at the forefront of industry advancements. With earnings projected to surge by an impressive 55.3% annually, Beijing Beetech's strategic focus on high-impact areas such as AI and software development positions it well for sustained growth in a rapidly evolving sector. Moreover, recent corporate activities including a significant shareholders meeting to discuss strategic shifts further highlight its proactive stance in adapting to market dynamics and enhancing shareholder value.

- Click here and access our complete health analysis report to understand the dynamics of Beijing Beetech.

Explore historical data to track Beijing Beetech's performance over time in our Past section.

Wanma Technology (SZSE:300698)

Simply Wall St Growth Rating: ★★★★★★

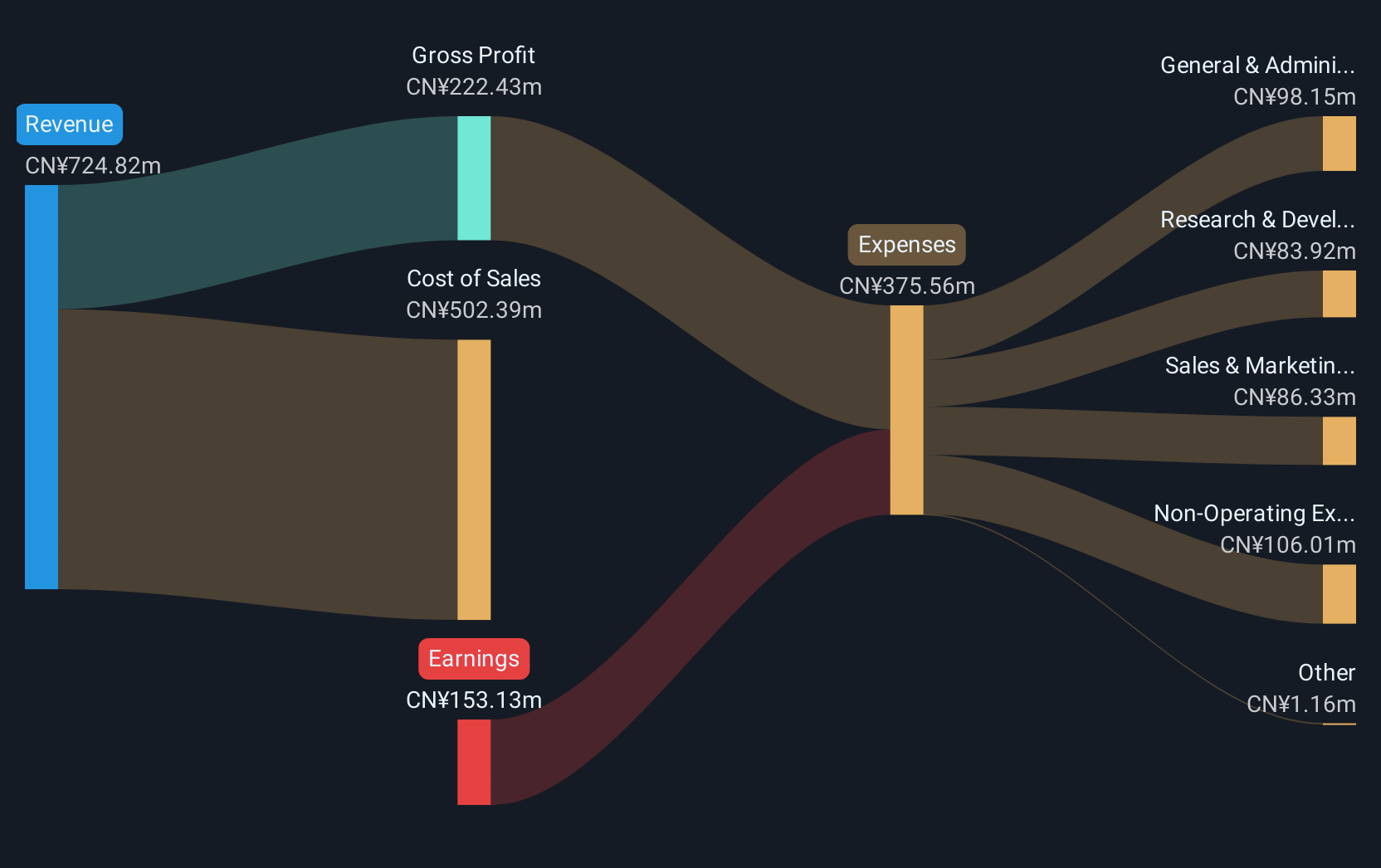

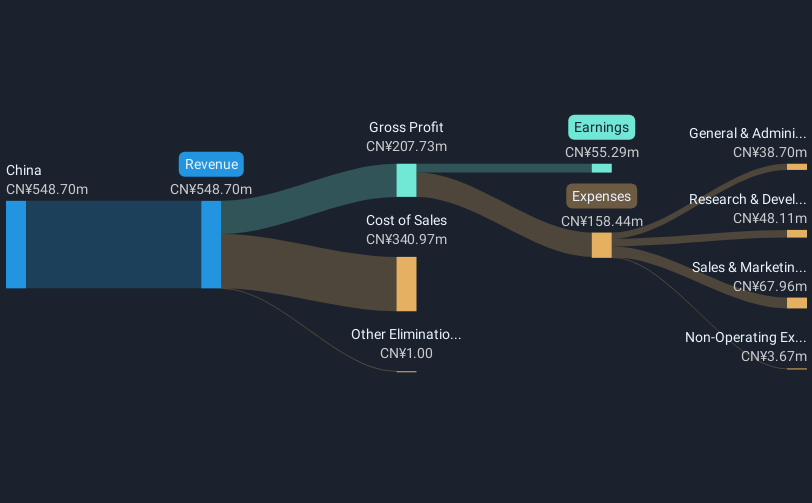

Overview: Wanma Technology Co., Ltd. specializes in the research and development, production, system integration, and sales of communication and medical information equipment with a market capitalization of CN¥4.98 billion.

Operations: The company generates revenue primarily from the communication and medical information equipment sectors, focusing on R&D, production, system integration, and sales. It operates with a market capitalization of CN¥4.98 billion.

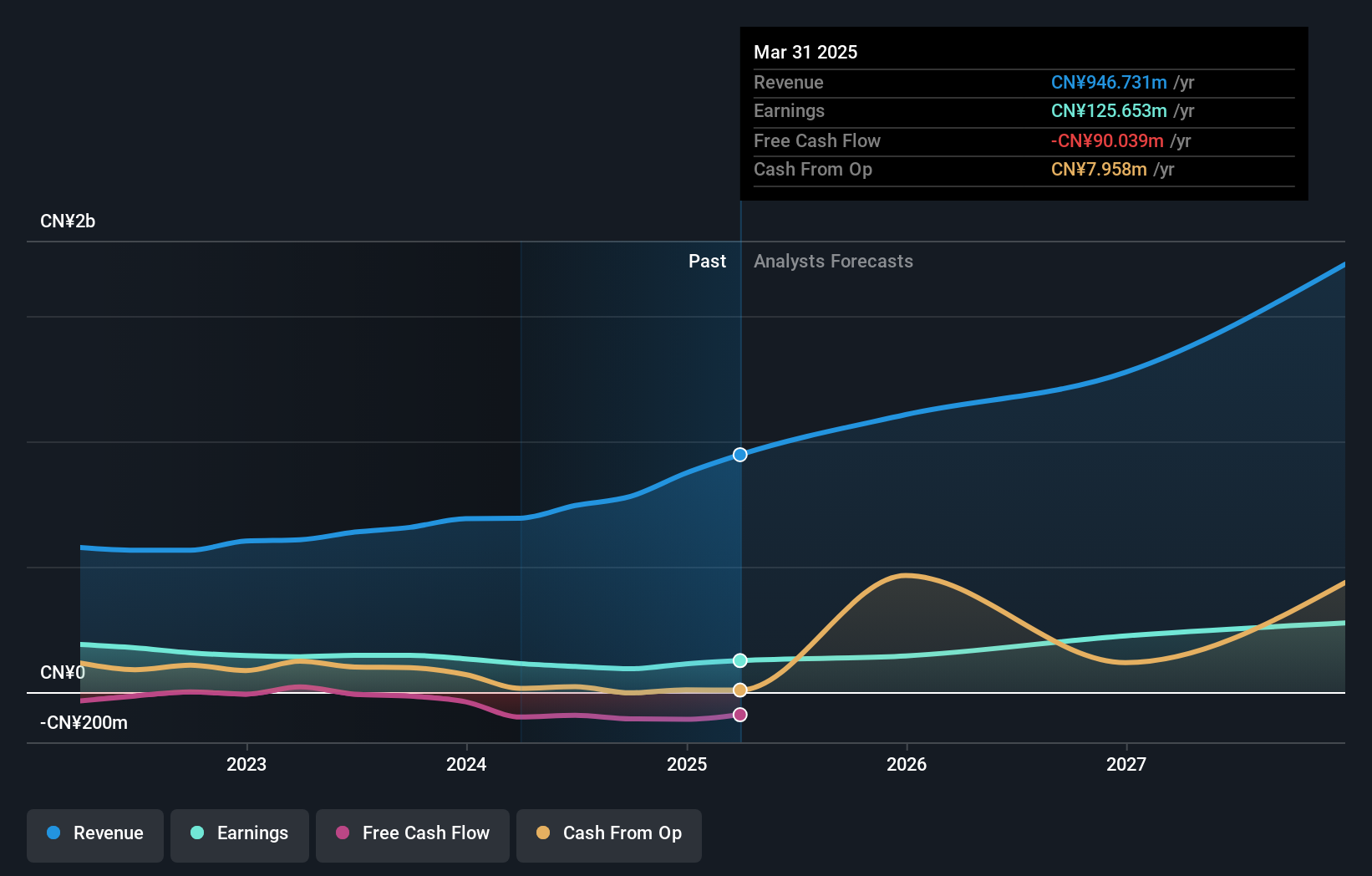

Wanma Technology is distinguishing itself in the tech sector with a remarkable annual revenue growth of 35.8%, significantly outpacing the Chinese market average of 13.5%. This growth trajectory is complemented by an impressive forecast for earnings to expand by 43% annually, positioning it well above the industry norm. The company's strategic emphasis on R&D investment is pivotal, fostering innovation that keeps it competitive amidst evolving market demands. Recently, Wanma enhanced its market position through a strategic acquisition valued at approximately CNY 200 million, signaling robust confidence in its future prospects and commitment to expanding its technological capabilities.

- Delve into the full analysis health report here for a deeper understanding of Wanma Technology.

Gain insights into Wanma Technology's past trends and performance with our Past report.

Summing It All Up

- Gain an insight into the universe of 1234 High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanma Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300698

Wanma Technology

Engages in the research and development, production, system integration, and sales of communication and medical information equipment.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives