- China

- /

- Communications

- /

- SHSE:688143

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

Amid a week of geopolitical tensions and consumer spending concerns, U.S. stocks experienced a downturn despite early gains, with major indices like the S&P 500 initially reaching record highs before closing lower. In this environment, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability to shifting economic conditions, which can be crucial for navigating market volatility and capitalizing on emerging opportunities in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1192 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

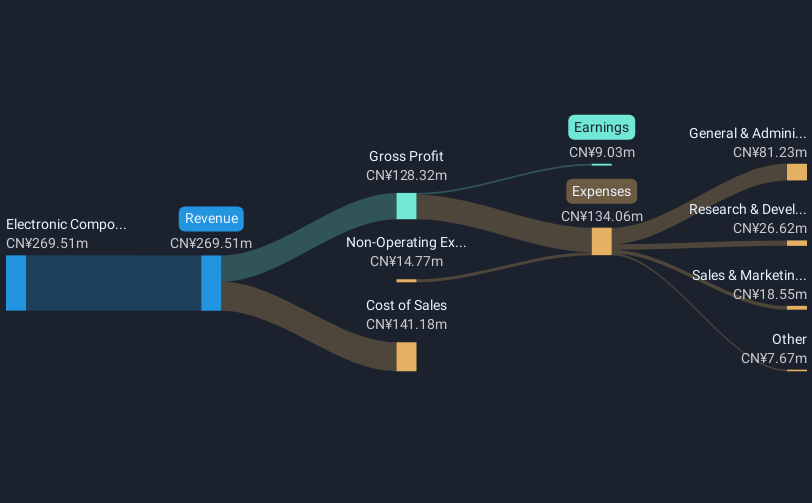

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fiber and cable, optical devices, new materials, high-end equipment, and photoelectric systems in China with a market cap of CN¥4.23 billion.

Operations: Yangtze Optical Electronic Co., Ltd. generates revenue primarily from its electronic components and parts segment, amounting to CN¥269.51 million. The company is involved in the R&D, production, and sale of specialized optical products and systems within China.

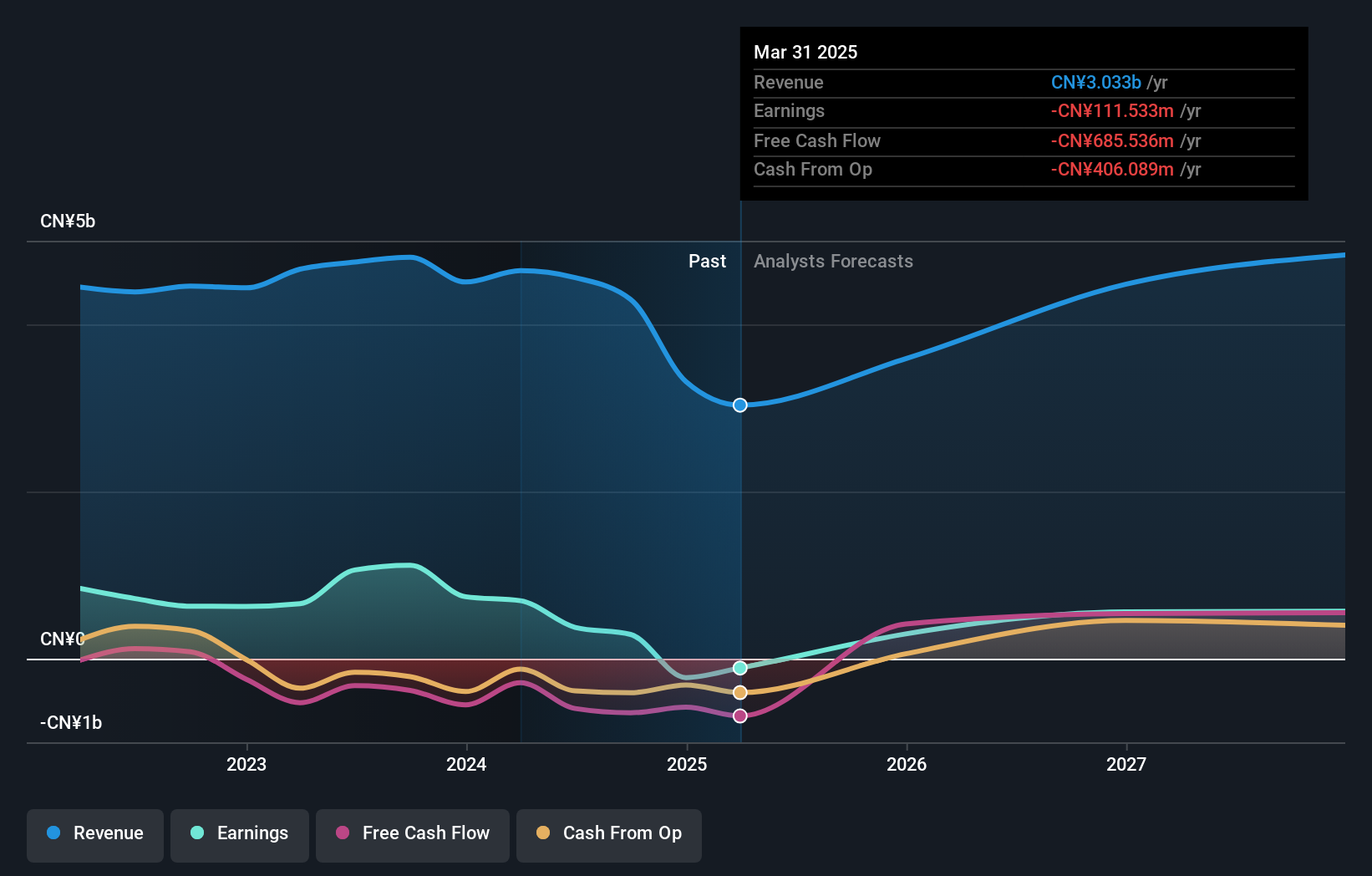

Yangtze Optical Electronic demonstrates robust growth dynamics, with an annual revenue increase of 39.8%, outpacing the Chinese market's average of 13.4%. This performance is complemented by an even more impressive projected earnings growth rate of 71.4% per year, significantly above the market norm of 25.3%. However, it's crucial to note a contraction in profit margins from 13.8% to 3.4% over the past year, reflecting potential cost challenges or investment phases that could impact short-term profitability. The company has also actively engaged in share repurchases, buying back shares worth CNY 20.66 million recently, signaling confidence in its financial health and commitment to shareholder value despite current margin pressures.

- Get an in-depth perspective on Yangtze Optical Electronic's performance by reading our health report here.

Gain insights into Yangtze Optical Electronic's past trends and performance with our Past report.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥22.59 billion.

Operations: Venustech Group generates revenue primarily through its network security products and solutions, which are complemented by its trusted security management platforms and specialized services. The company's focus on cybersecurity positions it well in the global market.

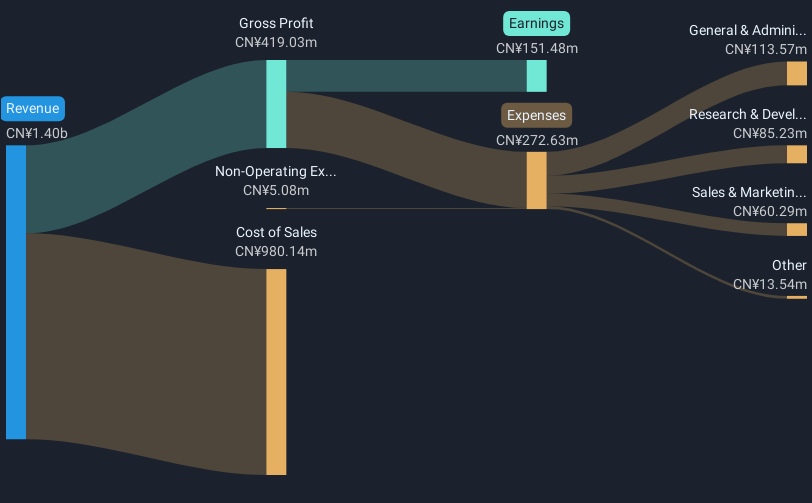

Venustech Group, amid a challenging backdrop with a net profit margin reduction to 6.7% from last year's 23.3%, still shows promise with projected annual earnings growth at an impressive 33.6%, outstripping the Chinese market forecast of 25.3%. This growth is bolstered by revenue projections increasing by 14.1% annually, surpassing the market average of 13.4%. Despite recent setbacks in earnings contraction over the past year and negative free cash flow, Venustech's aggressive R&D investment strategy positions it for potential rebound and innovation-driven growth in the competitive tech landscape, aligning with industry shifts towards more integrated and advanced software solutions.

Jones Tech (SZSE:300684)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jones Tech PLC offers materials solutions for intelligent electronic equipment across Asia, Europe, and America with a market cap of CN¥8.70 billion.

Operations: Jones Tech PLC specializes in providing materials solutions for intelligent electronic equipment across multiple regions, including Asia, Europe, and America.

Jones Tech's recent strategic moves, including significant changes to its bylaws and board structure, underscore a proactive approach in governance aimed at enhancing operational efficiency and stakeholder engagement. This is complemented by an impressive forecast of 37.5% annual earnings growth over the next three years, significantly outpacing the Chinese market's expectation of 25.3%. Furthermore, with revenue projected to expand by 26.3% annually—double the market forecast of 13.4%—Jones Tech is well-positioned to leverage its robust R&D investments, which have been pivotal in maintaining its competitive edge in a rapidly evolving tech landscape. These developments not only reflect Jones Tech’s adaptability but also highlight its potential for sustained growth amid dynamic industry shifts.

- Navigate through the intricacies of Jones Tech with our comprehensive health report here.

Understand Jones Tech's track record by examining our Past report.

Turning Ideas Into Actions

- Explore the 1192 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688143

Yangtze Optical Electronic

Engages in the research and development, production, and sale of special optical fiber and cables, special optical devices, new materials, high-end equipment, and photoelectric systems in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives