- China

- /

- Electronic Equipment and Components

- /

- SZSE:300656

Is Shenzhen MinDe Electronics Technology (SZSE:300656) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Shenzhen MinDe Electronics Technology Ltd. (SZSE:300656) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Shenzhen MinDe Electronics Technology

What Is Shenzhen MinDe Electronics Technology's Net Debt?

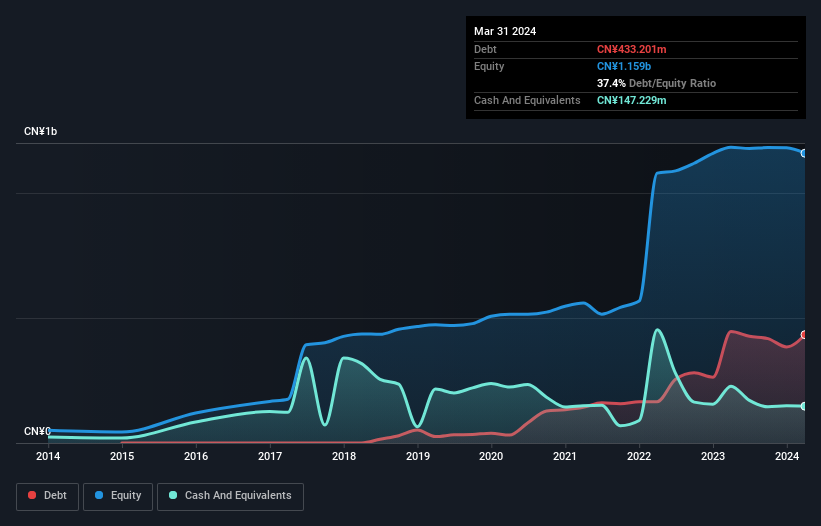

The chart below, which you can click on for greater detail, shows that Shenzhen MinDe Electronics Technology had CN¥433.2m in debt in March 2024; about the same as the year before. However, it also had CN¥147.2m in cash, and so its net debt is CN¥286.0m.

A Look At Shenzhen MinDe Electronics Technology's Liabilities

Zooming in on the latest balance sheet data, we can see that Shenzhen MinDe Electronics Technology had liabilities of CN¥369.8m due within 12 months and liabilities of CN¥218.8m due beyond that. On the other hand, it had cash of CN¥147.2m and CN¥226.6m worth of receivables due within a year. So its liabilities total CN¥214.8m more than the combination of its cash and short-term receivables.

Given Shenzhen MinDe Electronics Technology has a market capitalization of CN¥3.66b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Shenzhen MinDe Electronics Technology has a debt to EBITDA ratio of 3.9 and its EBIT covered its interest expense 6.2 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. We saw Shenzhen MinDe Electronics Technology grow its EBIT by 9.6% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shenzhen MinDe Electronics Technology will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Shenzhen MinDe Electronics Technology saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Shenzhen MinDe Electronics Technology's struggle to convert EBIT to free cash flow had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its EBIT growth rate is relatively strong. We think that Shenzhen MinDe Electronics Technology's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Shenzhen MinDe Electronics Technology has 2 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300656

Shenzhen MinDe Electronics Technology

Shenzhen MinDe Electronics Technology Ltd.

Very low risk and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026