High Growth Tech And 2 Other Innovative Companies With Strong Potential

Reviewed by Simply Wall St

As global markets continue to ride a wave of optimism, fueled by hopes for softer tariffs and enthusiasm around artificial intelligence, major indices like the S&P 500 have reached new heights, reflecting strong investor sentiment. In this environment of growth stocks outpacing value shares, identifying companies with innovative technologies and robust potential can be key to navigating the evolving landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. operates in the technology sector, providing software and services primarily for the hospitality, retail, and entertainment industries, with a market cap of CN¥17.90 billion.

Operations: Shiji Information Technology generates revenue primarily through its software and service offerings tailored for the hospitality, retail, and entertainment sectors. The company's operations are supported by a diverse portfolio of technology solutions aimed at enhancing business efficiency within these industries.

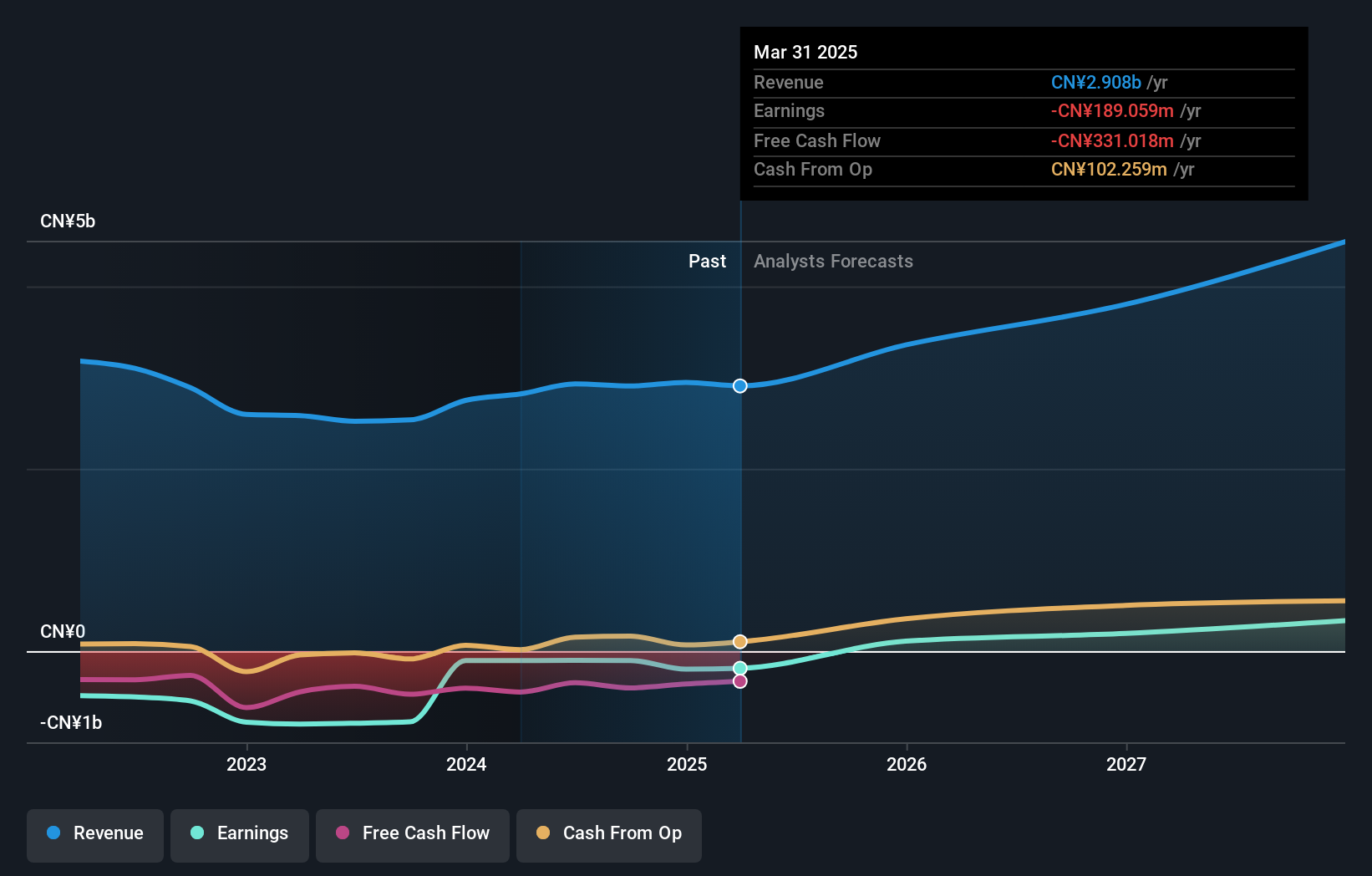

Beijing Shiji Information Technology has demonstrated robust financial performance with a notable increase in sales, rising from CNY 1.86 billion to CNY 2.02 billion year-over-year as of September 2024. This growth is complemented by an earnings increase, where net income improved from CNY 14.42 million to CNY 15.88 million, reflecting a solid annualized earnings growth rate of approximately 95.5%. Despite current unprofitability, the company is expected to pivot into profitability within three years, showcasing potential above-average market growth compared to the broader CN market's forecast of 13.3% revenue growth per year. This trajectory is supported by significant investment in R&D which underscores its commitment to innovation and maintaining competitiveness in the fast-evolving tech landscape.

Foshan Yowant TechnologyLtd (SZSE:002291)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foshan Yowant Technology Co., Ltd operates in the digital marketing sector in China with a market capitalization of CN¥5.85 billion.

Operations: Yowant Technology focuses on digital marketing services in China, leveraging its expertise to generate revenue through specialized marketing solutions. The company navigates the competitive landscape by optimizing operational efficiencies and managing costs effectively to sustain its profit margins.

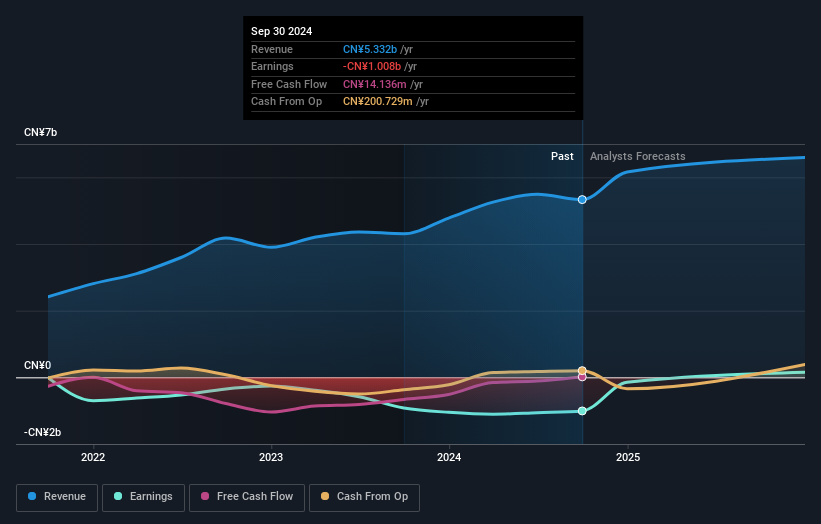

Foshan Yowant TechnologyLtd, amidst a challenging fiscal period, reported a narrowing net loss from CNY 449.61 million to CNY 408.29 million for the nine months ending September 2024, reflecting an improving financial trajectory. The company's aggressive R&D investment is pivotal, as it underpins its strategy to pivot into profitability within the next three years—a prospect that outpaces average market growth projections. This focus on innovation could significantly enhance its competitive edge in the tech industry, despite current unprofitability and market volatility.

- Click here and access our complete health analysis report to understand the dynamics of Foshan Yowant TechnologyLtd.

Understand Foshan Yowant TechnologyLtd's track record by examining our Past report.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation technology and has a market capitalization of approximately CN¥22.06 billion.

Operations: Huace Navigation Technology generates revenue primarily through its navigation technology solutions. The company's net profit margin is a notable aspect, reflecting its financial performance in the industry.

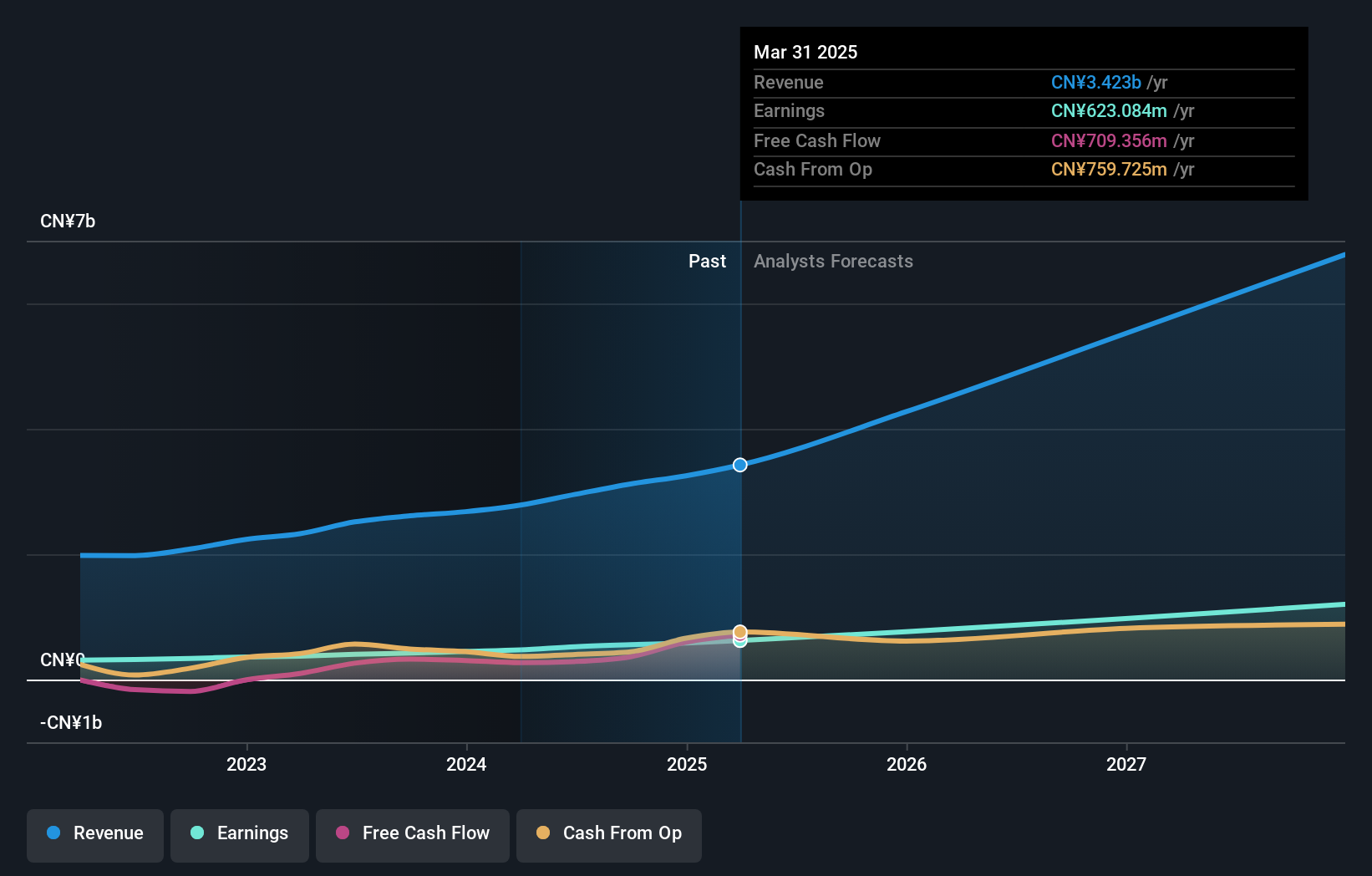

Shanghai Huace Navigation Technology, recently added to key Shenzhen Stock Exchange indexes, is making significant strides in the tech industry through strategic partnerships and innovative GNSS solutions. With an annual revenue growth rate of 26.2% and earnings expansion at 24.4%, the company is outpacing many peers. Its collaboration with Swift Navigation leverages cutting-edge technology for precise positioning services, crucial for autonomous vehicles and robotics, positioning it well within a rapidly evolving sector. This focus on high-performance GNSS receivers combined with scalable real-time corrections underscores its commitment to advancing critical navigation technologies that are becoming indispensable in modern transportation and surveying industries.

Taking Advantage

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1228 more companies for you to explore.Click here to unveil our expertly curated list of 1231 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002291

Guangdong Yowant Technology Group

Guangdong Yowant Technology Group Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives