- China

- /

- Electronic Equipment and Components

- /

- SHSE:688100

Exploring High Growth Tech And 2 Other Prominent Stocks With Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, the U.S. technology sector has faced notable volatility, driven by competitive pressures in artificial intelligence and mixed corporate earnings reports. As investors navigate these challenges, identifying high-growth tech stocks with strong fundamentals and resilience to market shifts can be crucial for capitalizing on potential opportunities in this dynamic environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets in oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China with a market cap of HK$54.14 billion.

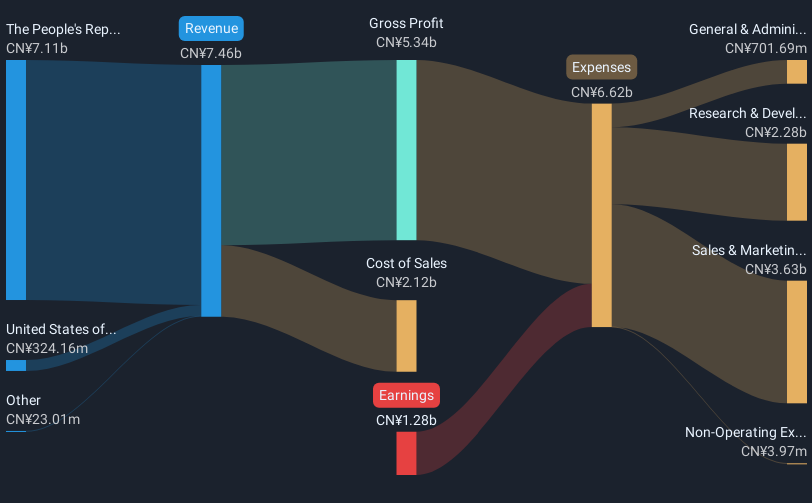

Operations: The company generates revenue primarily from its biotechnology segment, which reported CN¥7.46 billion. It focuses on developing and commercializing treatments across various medical fields in China.

Innovent Biologics has recently made significant strides in the biotech sector, particularly with its innovative treatments for lung cancer. The company's limertinib, approved by China's NMPA for EGFR T790M-mutated NSCLC, demonstrated a promising overall response rate of 68.8% and disease control rate of 92.4%. This approval enhances Innovent's strong presence in targeted therapies, aligning with industry trends towards precision medicine. Additionally, the strategic collaboration with Roche to develop IBI3009 underscores Innovent’s commitment to expanding its oncology portfolio globally. With these advancements and an expected revenue growth of 19.7% per year, Innovent is positioning itself as a key player in addressing critical unmet medical needs.

- Take a closer look at Innovent Biologics' potential here in our health report.

Gain insights into Innovent Biologics' past trends and performance with our Past report.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. specializes in smart utility services and IoT solutions both in China and globally, with a market cap of CN¥17.61 billion.

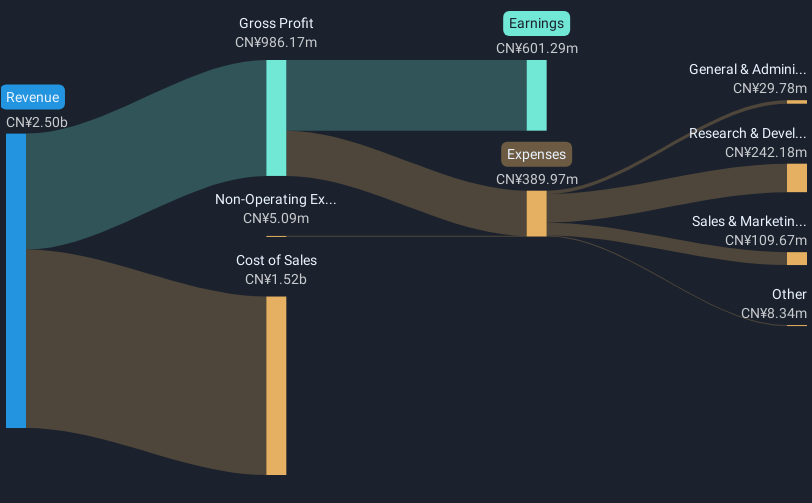

Operations: The company generates revenue primarily from smart utility services and IoT solutions. Its business operations are focused on providing innovative technology solutions both domestically in China and internationally.

Willfar Information Technology has demonstrated robust growth, with a notable 21.3% annual increase in revenue and an earnings surge of 22.3% per year, reflecting a dynamic adaptation to market demands. In January 2025, the company initiated a share repurchase program valued at CNY 150 million, underscoring confidence in its financial health and commitment to shareholder value. This strategic move aligns with Willfar's significant investment in R&D, which has consistently accounted for a substantial portion of their revenue—indicative of their focus on innovation and staying ahead in technology trends. With these developments, Willfar is well-positioned to capitalize on future technology demands while enhancing its market standing.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. specializes in the design and manufacturing of passive optical components, serving both domestic and international markets, with a market cap of CN¥11.75 billion.

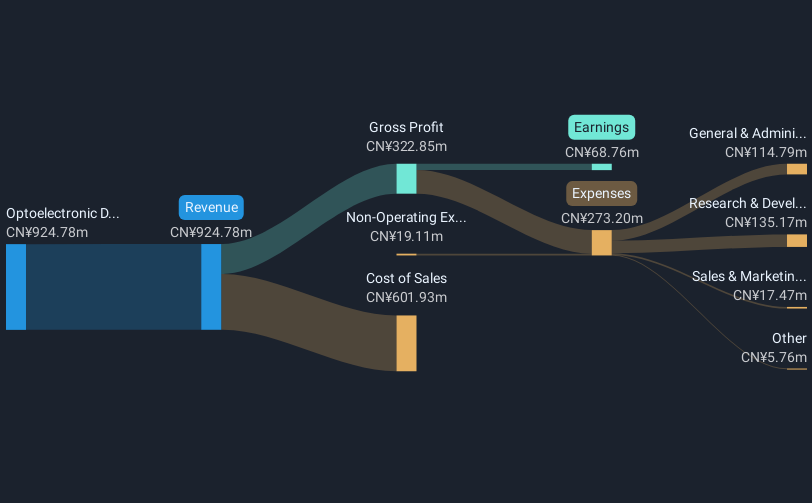

Operations: The company generates revenue primarily from optoelectronic devices and other electronic devices, totaling CN¥924.78 million. The business focuses on the design and manufacturing of passive optical components for a global customer base.

At the recent Photonics West 2025, Advanced Fiber Resources (Zhuhai) showcased its latest innovations, reflecting its commitment to maintaining a competitive edge in the tech industry. Despite facing challenges such as a 7.7% dip in earnings last year and lower profit margins at 7.4%, down from 11.1%, the company is poised for significant recovery with projected annual revenue and earnings growth rates of 23.7% and 42% respectively. This optimistic outlook is bolstered by their strategic R&D investments which have positioned them well to leverage upcoming technology trends and market demands, ensuring sustained growth in a rapidly evolving sector.

- Click to explore a detailed breakdown of our findings in Advanced Fiber Resources (Zhuhai)'s health report.

Understand Advanced Fiber Resources (Zhuhai)'s track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1234 High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Willfar Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688100

Willfar Information Technology

Provides smart utility services and IoT solutions in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion