Exploring Dongguan Aohai Technology And 2 Other High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets experience a rally with indices like the S&P 500 and Nasdaq Composite reaching record highs, investor sentiment is buoyed by positive developments such as easing trade tensions between the U.S. and China. In this context, exploring high-growth tech stocks in Asia, such as Dongguan Aohai Technology, becomes particularly relevant as investors seek opportunities that align with favorable economic indicators and market momentum.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 28.54% | 35.14% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

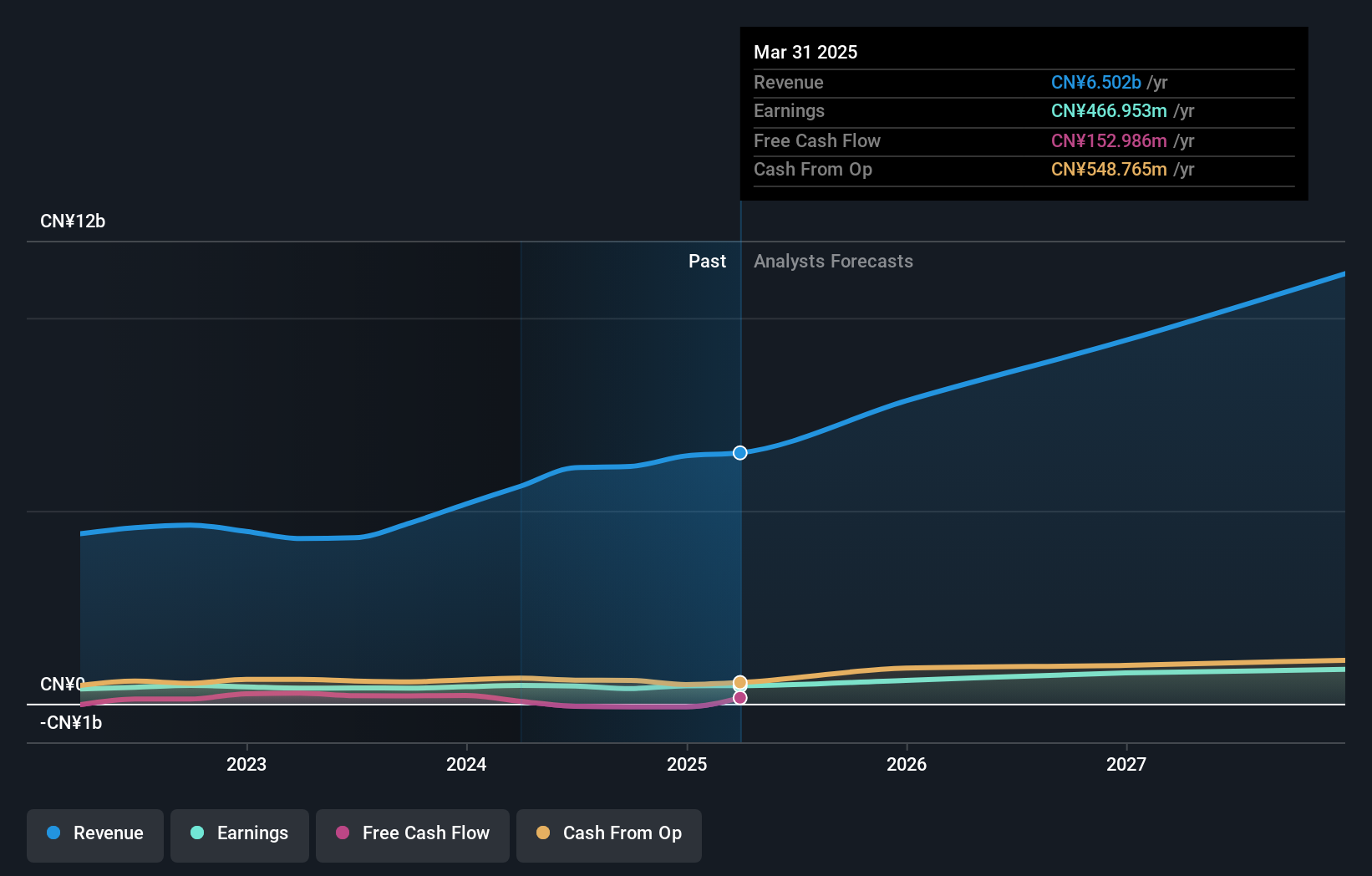

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongguan Aohai Technology Co., Ltd. engages in the research, development, production, and sale of consumer electronics products both domestically and internationally, with a market capitalization of CN¥11.34 billion.

Operations: Aohai Technology focuses on the manufacturing of computer, communications, and electronic equipment, generating revenue of CN¥6.50 billion from these segments.

Dongguan Aohai Technology, a player in the high-growth tech sector in Asia, has demonstrated robust financial performance with a notable 19.2% annual revenue growth and an earnings increase of 23.7% per year. Recently, the company has been active in shareholder value initiatives, announcing a dividend of CNY 9 per ten shares and executing a share buyback program worth CNY 80 million to support its employee stock ownership plan. These moves underscore its commitment to both growth and shareholder returns, positioning it favorably amidst Asia's competitive tech landscape.

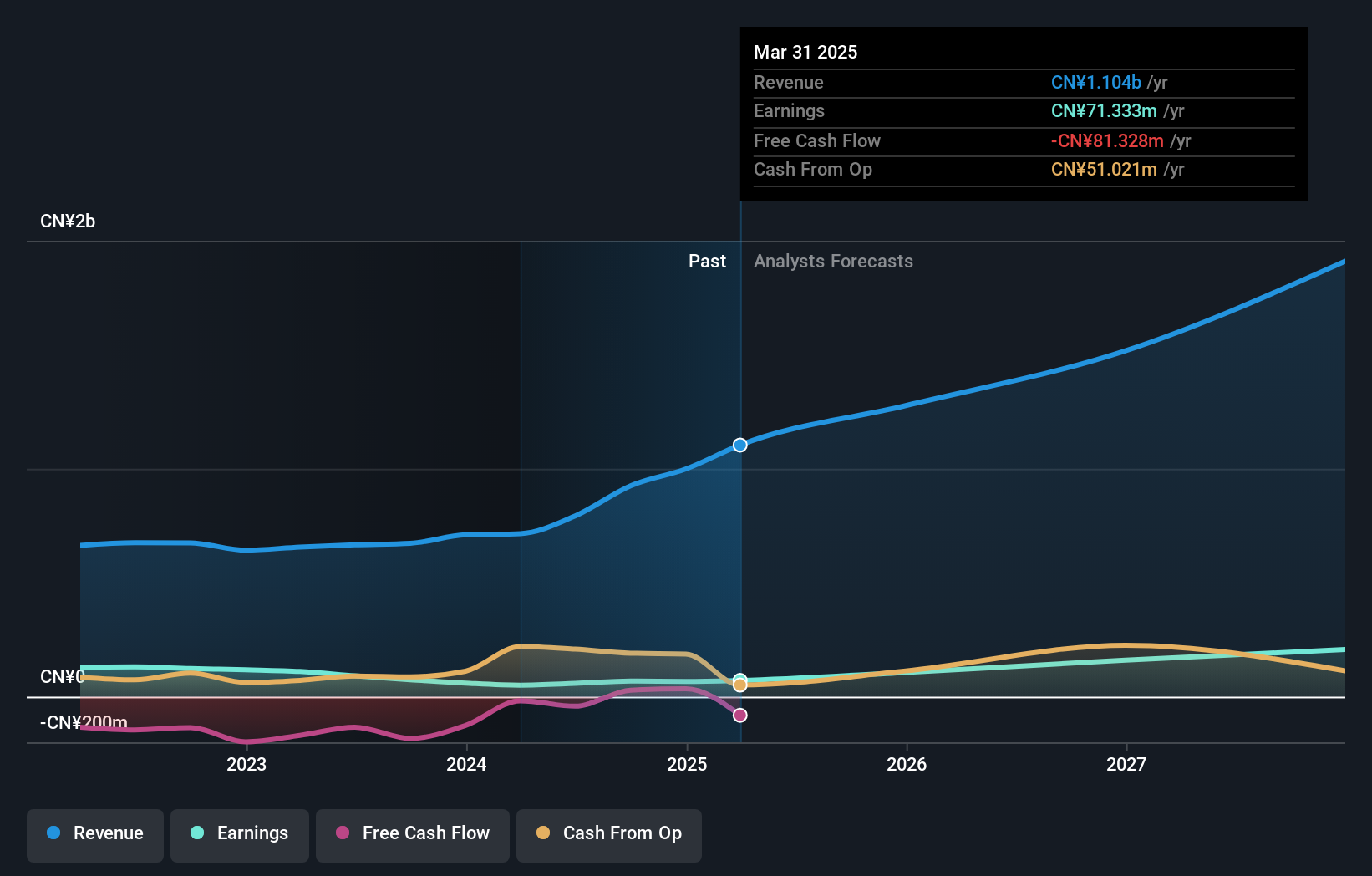

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. specializes in designing and manufacturing passive optical components, serving both domestic and international markets, with a market capitalization of CN¥11.74 billion.

Operations: The company generates revenue primarily from the sale of optoelectronic and other electronic devices, totaling CN¥1.10 billion. The focus on passive optical components positions it in both domestic and international markets.

Advanced Fiber Resources (Zhuhai) has demonstrated a compelling growth trajectory with a 19.4% annual increase in revenue, outpacing the Chinese market's average of 12.4%. This robust expansion is complemented by an even more impressive earnings growth rate of 36.6% annually, significantly above the market norm of 23.4%. The company's commitment to innovation and development is evident from its R&D spending trends, which have strategically supported its leading position in high-tech sectors in Asia. Recent financial disclosures reveal a substantial boost in first-quarter sales to CNY 265.22 million from CNY 160.22 million year-over-year, alongside a rise in net income to CNY 10.84 million, up from CNY 6.49 million, reflecting strong operational efficiency and market demand for its offerings.

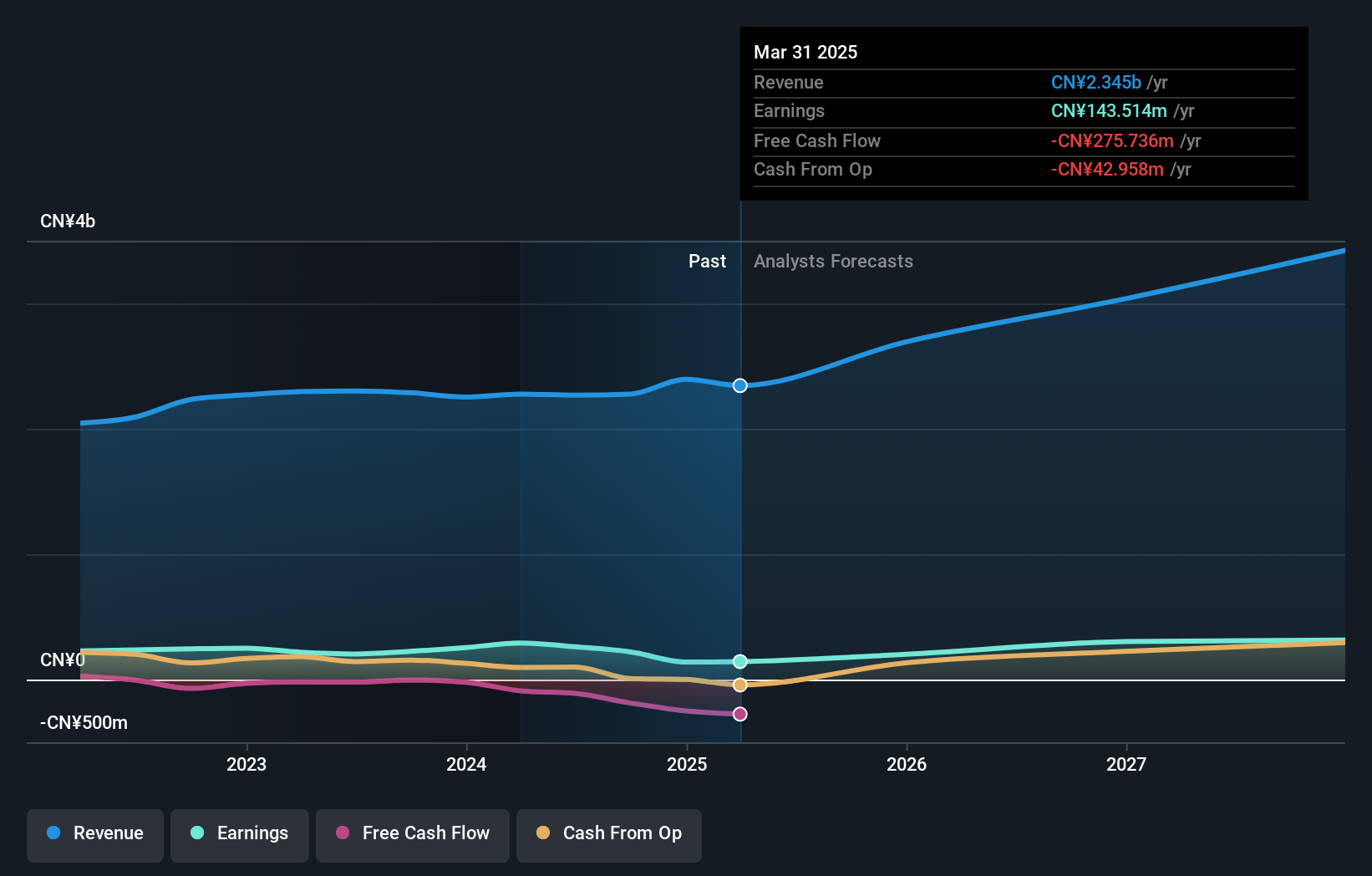

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥11.21 billion.

Operations: The company generates revenue primarily through its software services, amounting to CN¥2.34 billion.

Guangzhou Sie Consulting has shown resilience in a challenging market, with a 13.5% annual revenue growth and an impressive 31% earnings growth per year, outstripping the CN market’s average of 23.4%. Despite a recent dip in net income from CNY 254.4 million to CNY 139.38 million, the firm's strategic R&D investments have been pivotal, amounting to significant figures that bolster its competitive edge in tech innovation. Recent share buybacks underscore confidence in its trajectory, with 142,500 shares repurchased for CNY 2.41 million this quarter alone, signaling robust internal faith in future prospects amidst operational tweaks and capital amendments approved at their latest AGM.

- Dive into the specifics of Guangzhou Sie Consulting here with our thorough health report.

Understand Guangzhou Sie Consulting's track record by examining our Past report.

Make It Happen

- Get an in-depth perspective on all 490 Asian High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300687

Guangzhou Sie Consulting

Operates as a service provider for enterprise digital-intelligent transformation in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026