- China

- /

- Electronic Equipment and Components

- /

- SZSE:300615

Further Upside For XDC Industries (Shenzhen) Limited (SZSE:300615) Shares Could Introduce Price Risks After 37% Bounce

XDC Industries (Shenzhen) Limited (SZSE:300615) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.9% in the last twelve months.

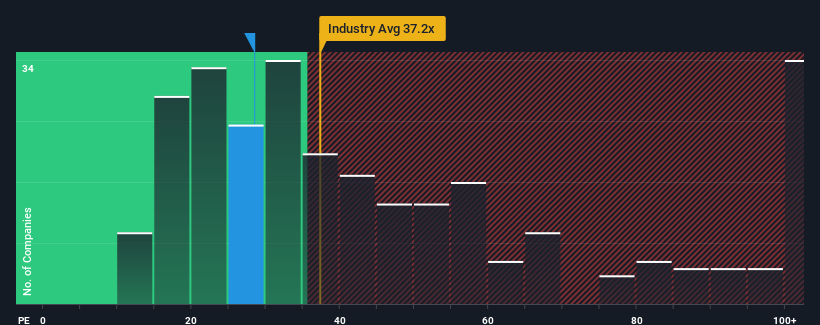

Although its price has surged higher, you could still be forgiven for feeling indifferent about XDC Industries (Shenzhen)'s P/E ratio of 28.5x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for XDC Industries (Shenzhen) as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for XDC Industries (Shenzhen)

Does Growth Match The P/E?

In order to justify its P/E ratio, XDC Industries (Shenzhen) would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 116% last year. The strong recent performance means it was also able to grow EPS by 662% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that XDC Industries (Shenzhen) is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From XDC Industries (Shenzhen)'s P/E?

XDC Industries (Shenzhen)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that XDC Industries (Shenzhen) currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for XDC Industries (Shenzhen) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300615

XDC Industries (Shenzhen)

Engages in the research and development, production, and sale of RF devices in the mobile communications industry in China and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success