- China

- /

- Electronic Equipment and Components

- /

- SZSE:300572

High Growth Tech Stocks in Asia for May 2025

Reviewed by Simply Wall St

As global markets face volatility with U.S. stocks declining amid Treasury market fluctuations and renewed tariff threats, the Asian tech sector continues to draw attention due to its potential for high growth despite broader market challenges. In this environment, a good stock may be characterized by strong fundamentals and resilience to external pressures such as trade tensions and economic uncertainties, which can be crucial for navigating the current landscape successfully.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.64% | 30.42% | ★★★★★★ |

| Flaircomm Microelectronics | 30.38% | 34.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| ALTEOGEN | 54.36% | 68.99% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Maoyan Entertainment (SEHK:1896)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maoyan Entertainment is an investment holding company that operates a platform in the entertainment industry in the People’s Republic of China, with a market cap of HK$8.28 billion.

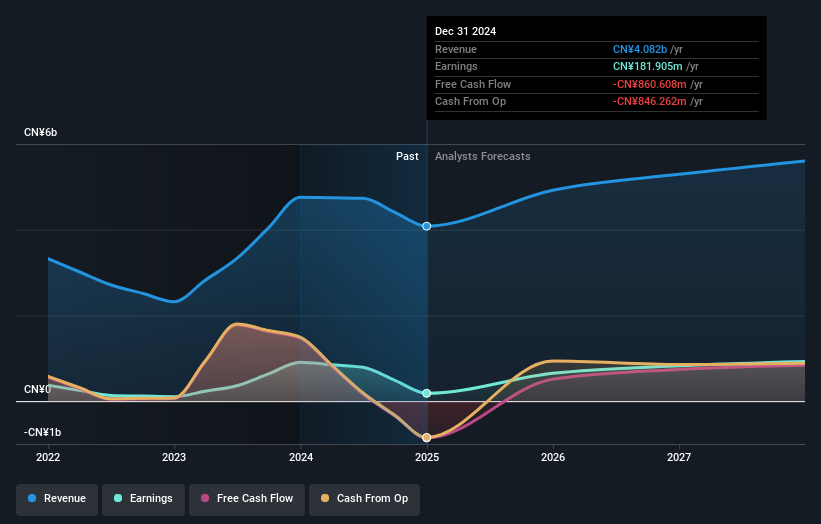

Operations: The company generates revenue primarily through business services, amounting to CN¥4.08 billion.

In the dynamic landscape of Asia's tech sector, Maoyan Entertainment navigates through a challenging fiscal year with significant shifts in its financial metrics. Despite a downturn in annual revenue to CNY 4.08 billion, down by approximately 14% from the previous year, and a stark reduction in net income to CNY 181.91 million from CNY 910.41 million, the company has proposed a final dividend of HKD 0.32 per share, signaling confidence in its financial management and shareholder value commitment. This scenario underscores not only the volatility faced by high-growth sectors but also highlights Maoyan's strategic responses to evolving market dynamics and investor expectations amidst competitive pressures.

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascentage Pharma Group International is a clinical-stage biotechnology company focused on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of approximately HK$17.32 billion.

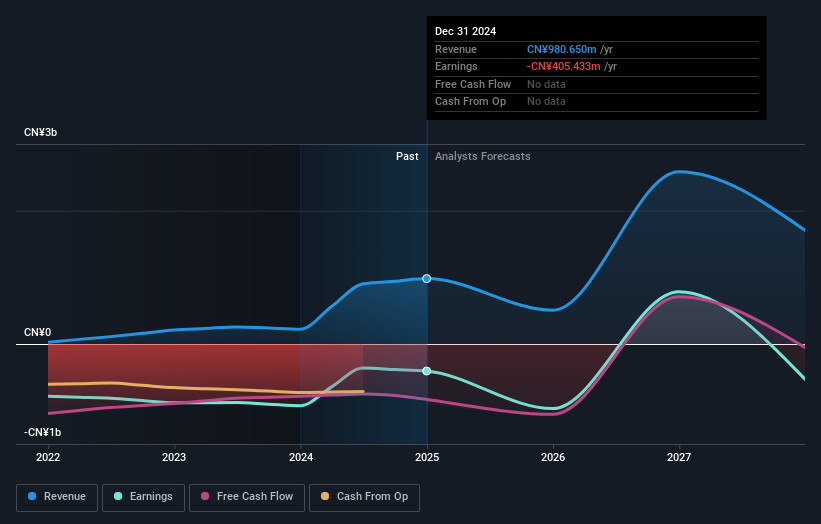

Operations: The company generates revenue primarily from the development and sale of novel small-scale therapies, amounting to CN¥980.65 million. Ascentage Pharma Group International focuses on addressing cancers, chronic hepatitis B virus (HBV), and age-related diseases within Mainland China.

Ascentage Pharma Group International, a front-runner in the oncology sector, has demonstrated promising advancements with its innovative drug candidates lisaftoclax and olverembatinib. Recent clinical data unveiled at major medical conferences underscored their efficacy in blood cancers and solid tumors, marking significant strides in treatment options. The company's commitment to R&D is evident from its annualized revenue growth of 22.2% and earnings forecast to surge by 64.9% annually. Moreover, inclusion in the 2025 Chinese Society of Clinical Oncology Guidelines not only validates their potential but also enhances Ascentage Pharma's positioning within Asia's competitive biotech landscape.

Shenzhen Anche Technologies (SZSE:300572)

Simply Wall St Growth Rating: ★★★★★☆

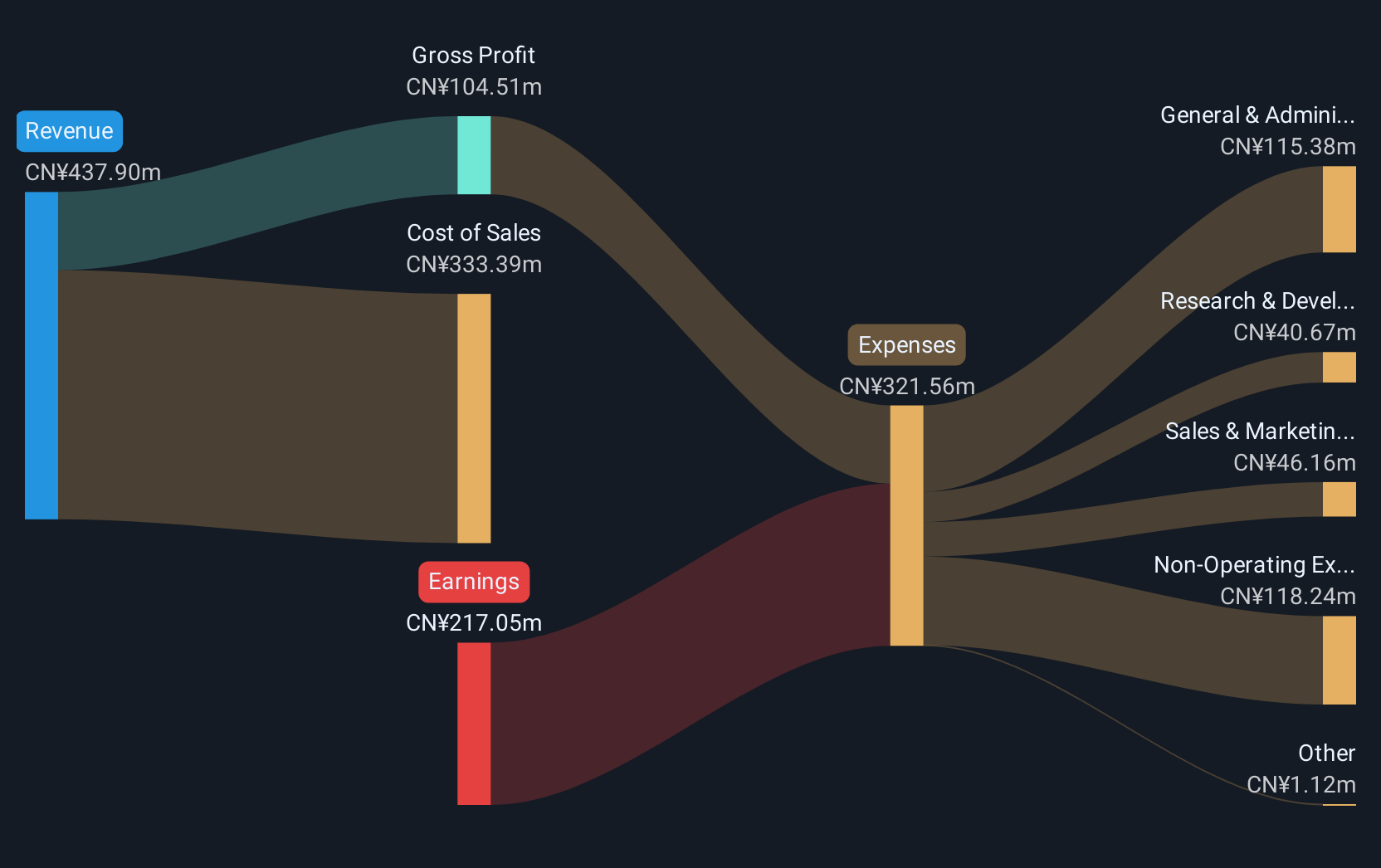

Overview: Shenzhen Anche Technologies Co., Ltd. specializes in providing motor vehicle inspection solutions in China, with a market cap of CN¥4.76 billion.

Operations: The company focuses on motor vehicle inspection solutions within China. It operates with a market capitalization of approximately CN¥4.76 billion, reflecting its position in the industry.

Shenzhen Anche Technologies, amidst a challenging quarter with a net loss of CNY 4.03 million from CNY 0.154 million net income year-over-year, still shows promise with expected revenue growth at an impressive rate of 41.4% annually. This growth trajectory is bolstered by the company's strategic focus on innovation and market expansion despite recent setbacks like the cancellation of a significant share transfer agreement. With earnings projected to surge by 135.9% annually, Shenzhen Anche is poised for recovery and potential profitability within three years, reflecting its resilience and adaptability in the fast-evolving tech landscape of Asia.

Where To Now?

- Dive into all 496 of the Asian High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300572

Shenzhen Anche Technologies

Provides motor vehicle inspection solutions in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion