- China

- /

- Communications

- /

- SZSE:300570

High Growth Tech Stocks To Watch For Potential Portfolio Strengthening

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year with U.S. equities experiencing declines, small-cap stocks have notably underperformed, dipping into correction territory amidst inflation concerns and political uncertainties. In this environment, identifying high growth tech stocks that demonstrate resilience and adaptability can be crucial for potential portfolio strengthening, especially as investors digest economic data and policy updates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.19% | 25.44% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

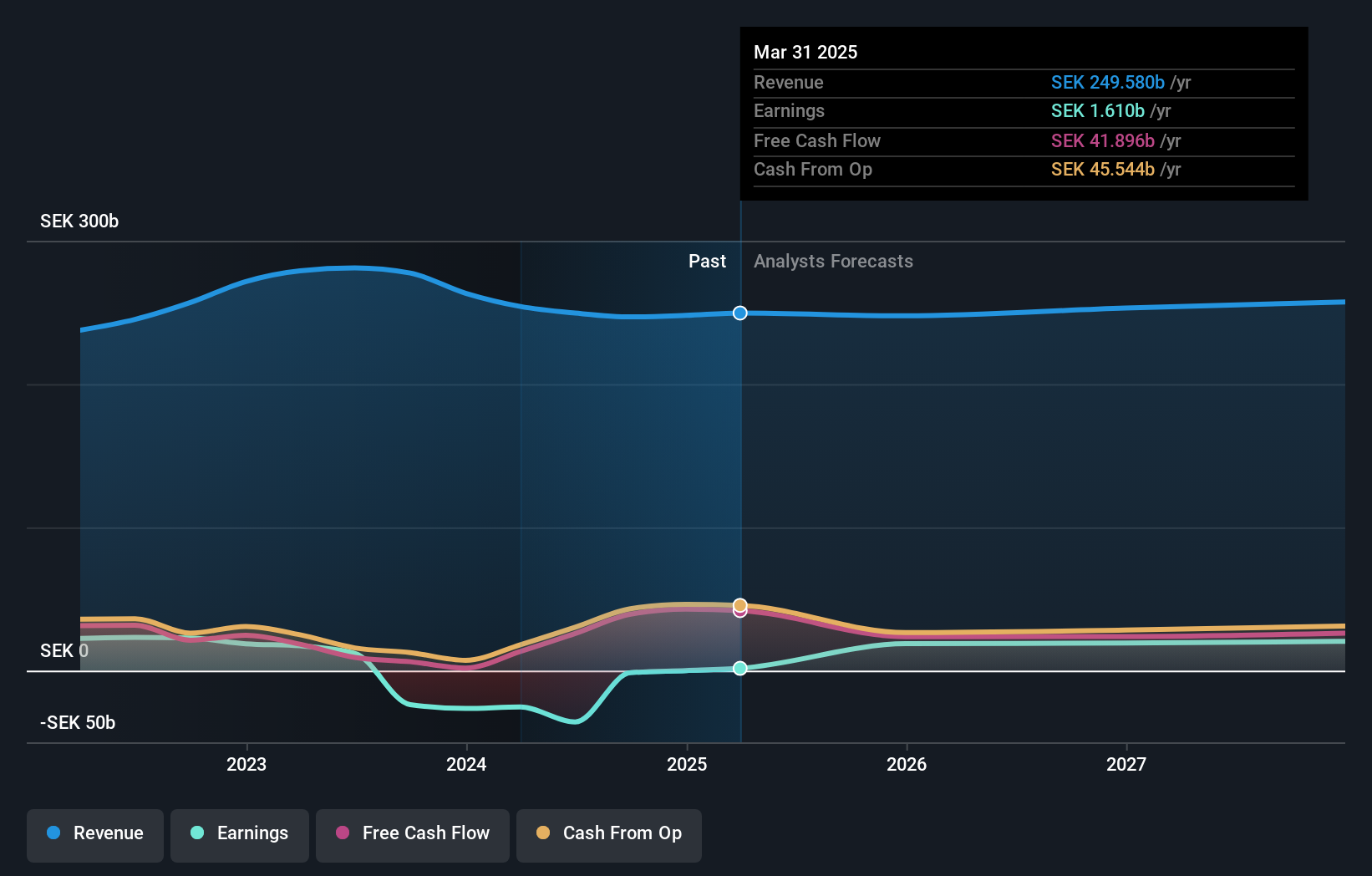

Overview: Telefonaktiebolaget LM Ericsson (publ) is a global provider of mobile connectivity solutions for telecom operators and enterprise customers across multiple regions, with a market capitalization of approximately SEK314.59 billion.

Operations: Ericsson generates revenue primarily from its Networks segment, which accounts for SEK156.41 billion, followed by Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion. The company serves telecom operators and enterprise customers across diverse regions including North America, Europe, and Asia.

Telefonaktiebolaget LM Ericsson, despite its modest annual revenue growth forecast at 1.9%, is making strategic advancements in the high-tech sector, particularly through its recent executive appointments and collaborations aimed at enhancing 5G and AI capabilities. The appointment of Anthony Bartolo as CEO of the new venture Aduna highlights a strategic move to scale global businesses effectively. Additionally, partnerships with companies like FPT Corporation to drive 5G adoption and digital transformation underscore Ericsson's commitment to leading technological advancements. These efforts are supported by substantial R&D expenses, which are crucial for maintaining competitiveness in rapidly evolving tech landscapes.

Lagercrantz Group (OM:LAGR B)

Simply Wall St Growth Rating: ★★★★☆☆

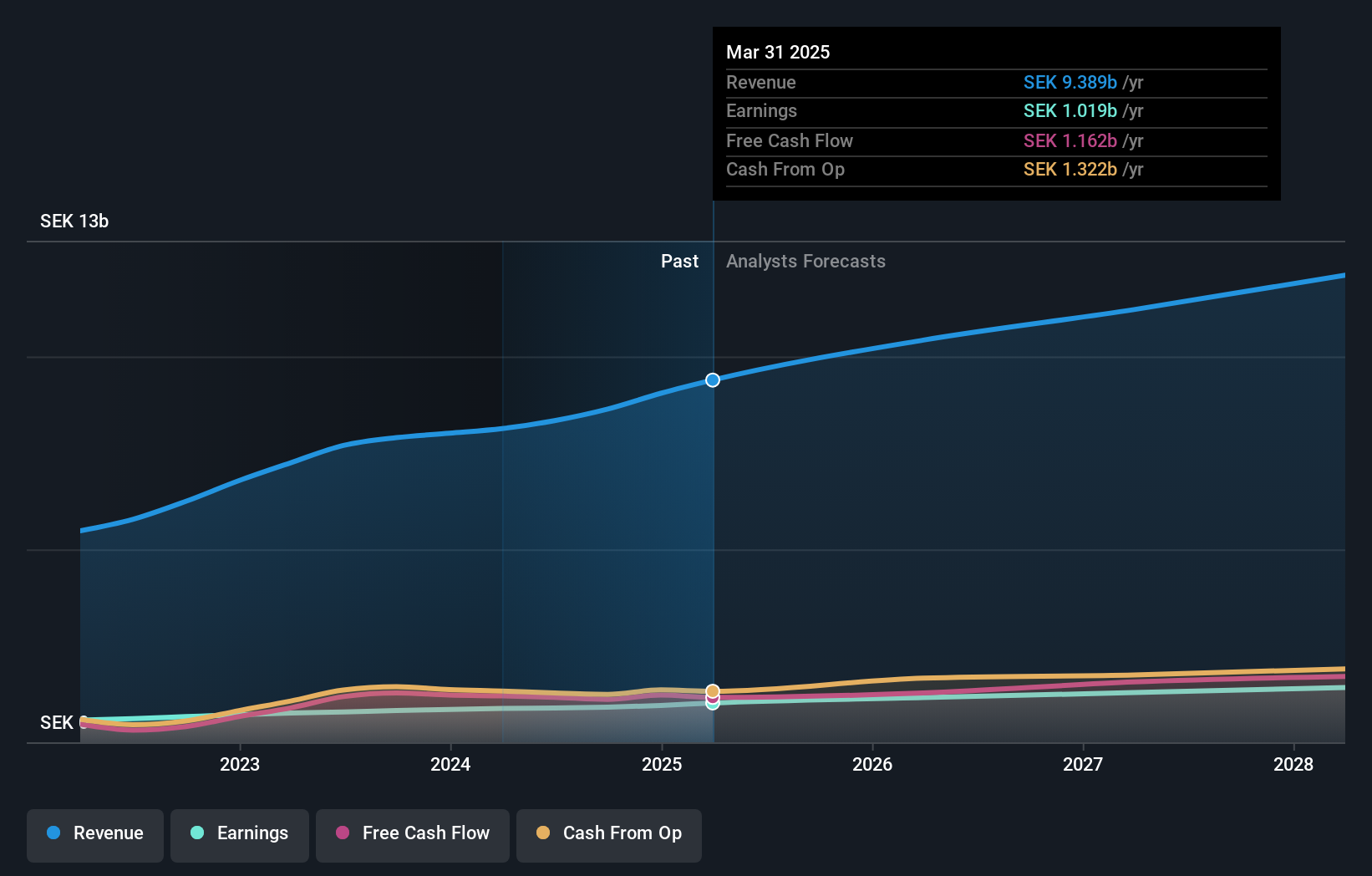

Overview: Lagercrantz Group AB (publ) is a technology company that operates internationally across various regions including Sweden, Denmark, Norway, and several others, with a market capitalization of approximately SEK43.36 billion.

Operations: The company generates revenue through five primary segments: Tecsec (SEK 2.11 billion), Control (SEK 831 million), Electrify (SEK 2.02 billion), International (SEK 1.54 billion), and Niche Products (SEK 2.18 billion). These operations span multiple regions, contributing to its diverse revenue streams in the technology sector.

Lagercrantz Group has demonstrated a solid trajectory in tech innovation, with its revenue forecasted to grow by 11.5% annually, slightly outpacing the Swedish market's growth. This growth is complemented by an expected annual earnings increase of 14.3%, aligning with market projections but noteworthy for its consistency over time. Recent financials reveal a robust upward trend, with sales hitting SEK 4.425 billion and net income rising to SEK 445 million in the last six months, reflecting a strategic focus on scalable tech solutions and efficient operational adjustments. The company's commitment to R&D is evident from its participation in industry conferences and earnings calls that emphasize technological advancements and market expansion strategies.

- Click here and access our complete health analysis report to understand the dynamics of Lagercrantz Group.

Understand Lagercrantz Group's track record by examining our Past report.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

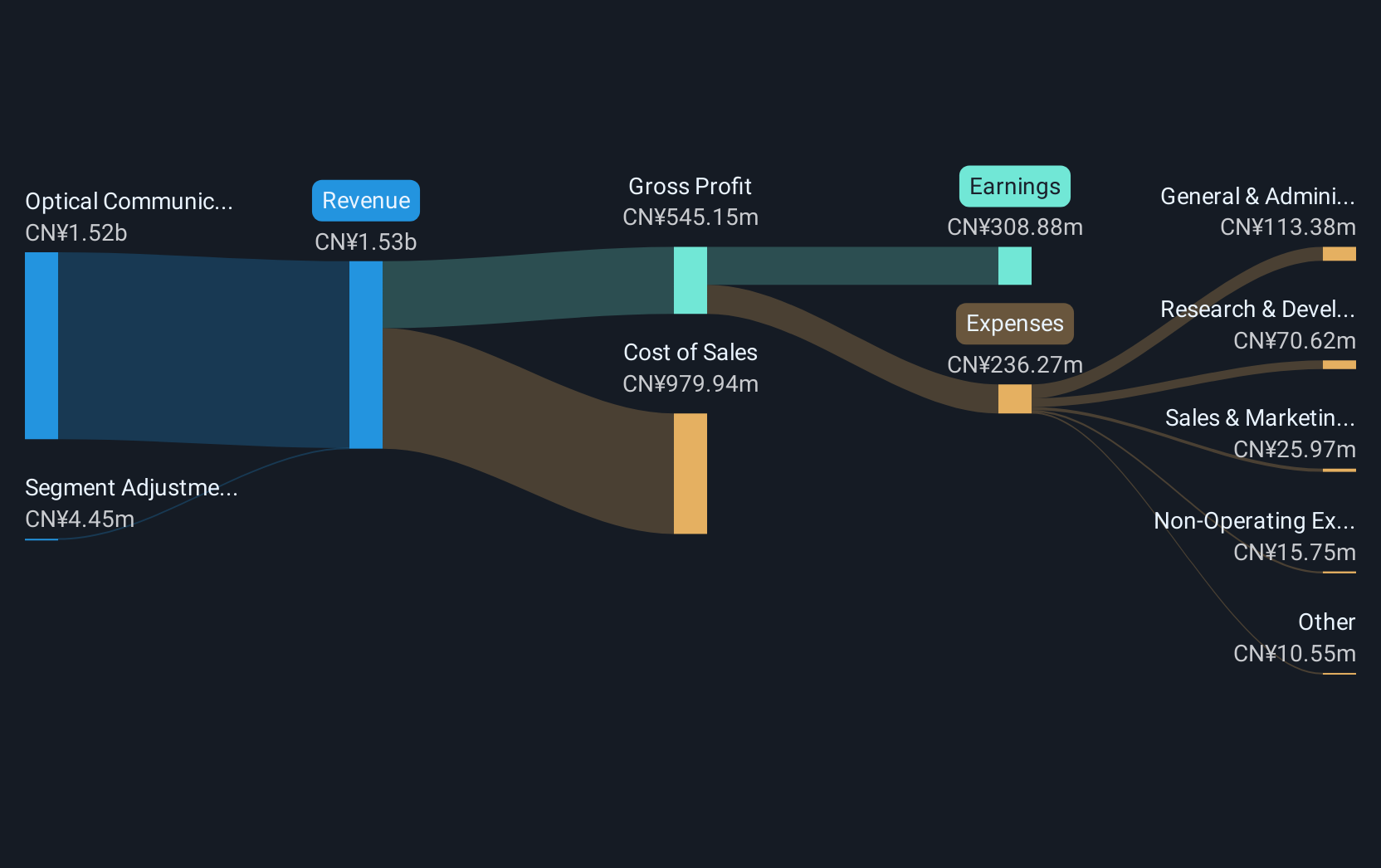

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in China, with a market cap of CN¥23.83 billion.

Operations: The company primarily generates revenue from its optical communication components segment, which accounts for CN¥1.17 billion.

T&S CommunicationsLtd. has showcased robust financial performance, with a notable increase in sales from CNY 623.05 million to CNY 915.87 million and net income improving from CNY 104.83 million to CNY 145.81 million over the past year, reflecting a dynamic growth trajectory in the communications sector. This growth is underpinned by an impressive annual revenue increase of 39.1% and earnings growth of 45.5%, significantly outpacing the broader Chinese market's averages of 13.9% and 25.3%, respectively. The company's commitment to innovation is evident as it continues to invest strategically in R&D, ensuring its competitive edge in a rapidly evolving industry landscape marked by increasing demand for advanced communication solutions.

Make It Happen

- Reveal the 1227 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T&S CommunicationsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300570

T&S CommunicationsLtd

Develops, manufactures, and sells fiber optics communication products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026