High Growth Tech Stocks in Asia Featuring Three Prominent Companies

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade policy shifts and inflationary pressures, Asian tech stocks are drawing attention for their potential to thrive amidst these challenges. In this context, identifying high-growth companies requires a keen understanding of how they leverage innovation and strategic positioning to capitalize on evolving consumer demands and technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Growth Rating: ★★★★★☆

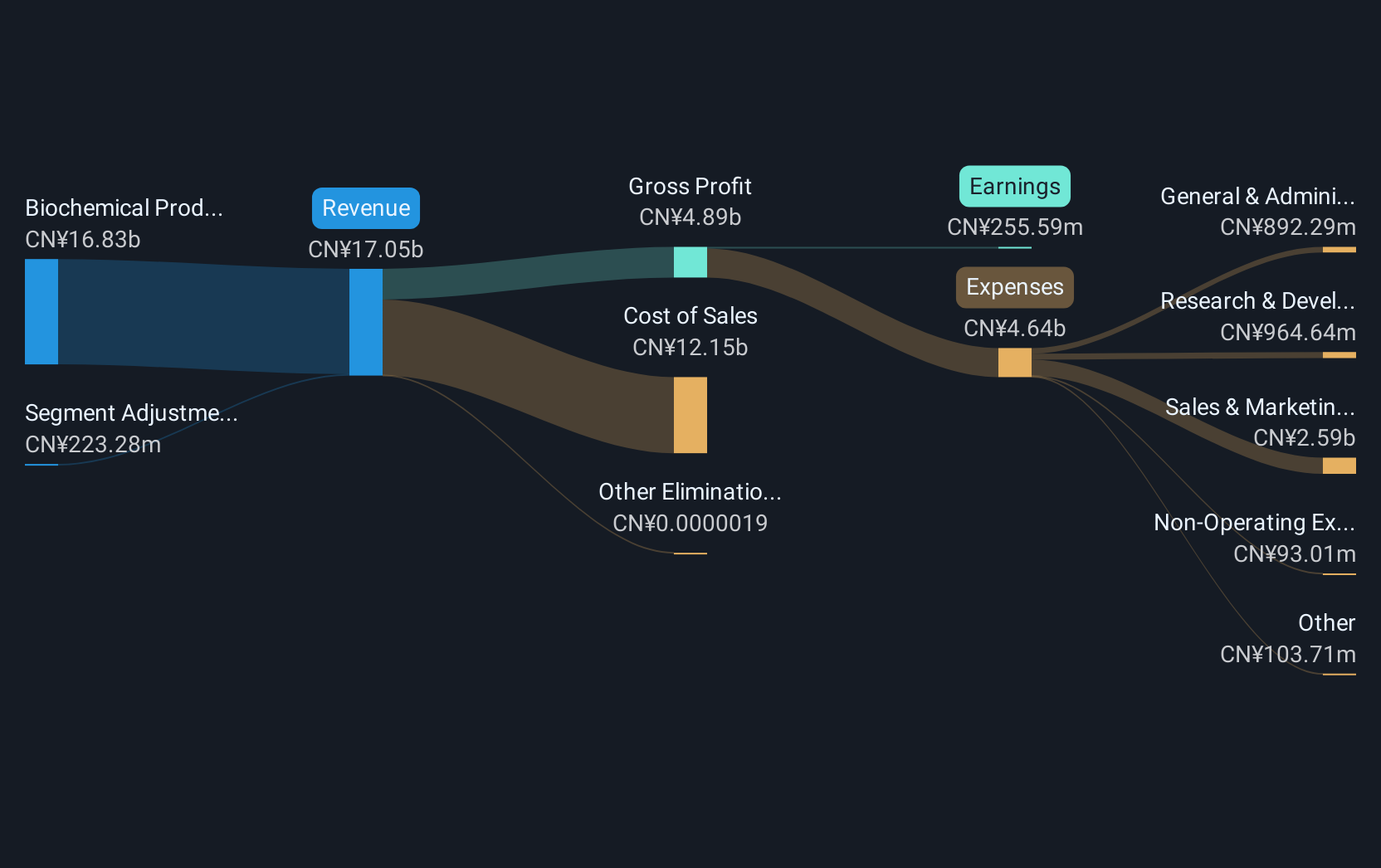

Overview: Chongqing Zhifei Biological Products Co., Ltd. is a Chinese company engaged in the research, development, production, and sale of vaccines and biological products with a market cap of approximately CN¥47.35 billion.

Operations: Zhifei Biological Products generates revenue primarily from its Biochemical Product segment, which accounts for CN¥16.83 billion. The company's market cap is approximately CN¥47.35 billion, reflecting its significant presence in the vaccine and biological products industry in China.

Chongqing Zhifei Biological Products, despite a challenging year with a significant revenue drop from CNY 52.92 billion to CNY 26.07 billion and net income plummeting from CNY 8.07 billion to CNY 2.02 billion, is forecasted for robust growth ahead. The company's earnings are expected to surge by an annual rate of 74.2%, outpacing the Chinese market's average of 23.4%. This growth trajectory is underpinned by a strategic focus on expanding its biotech innovations, potentially positioning it well against industry headwinds and enhancing its market competitiveness in Asia’s high-tech sector.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

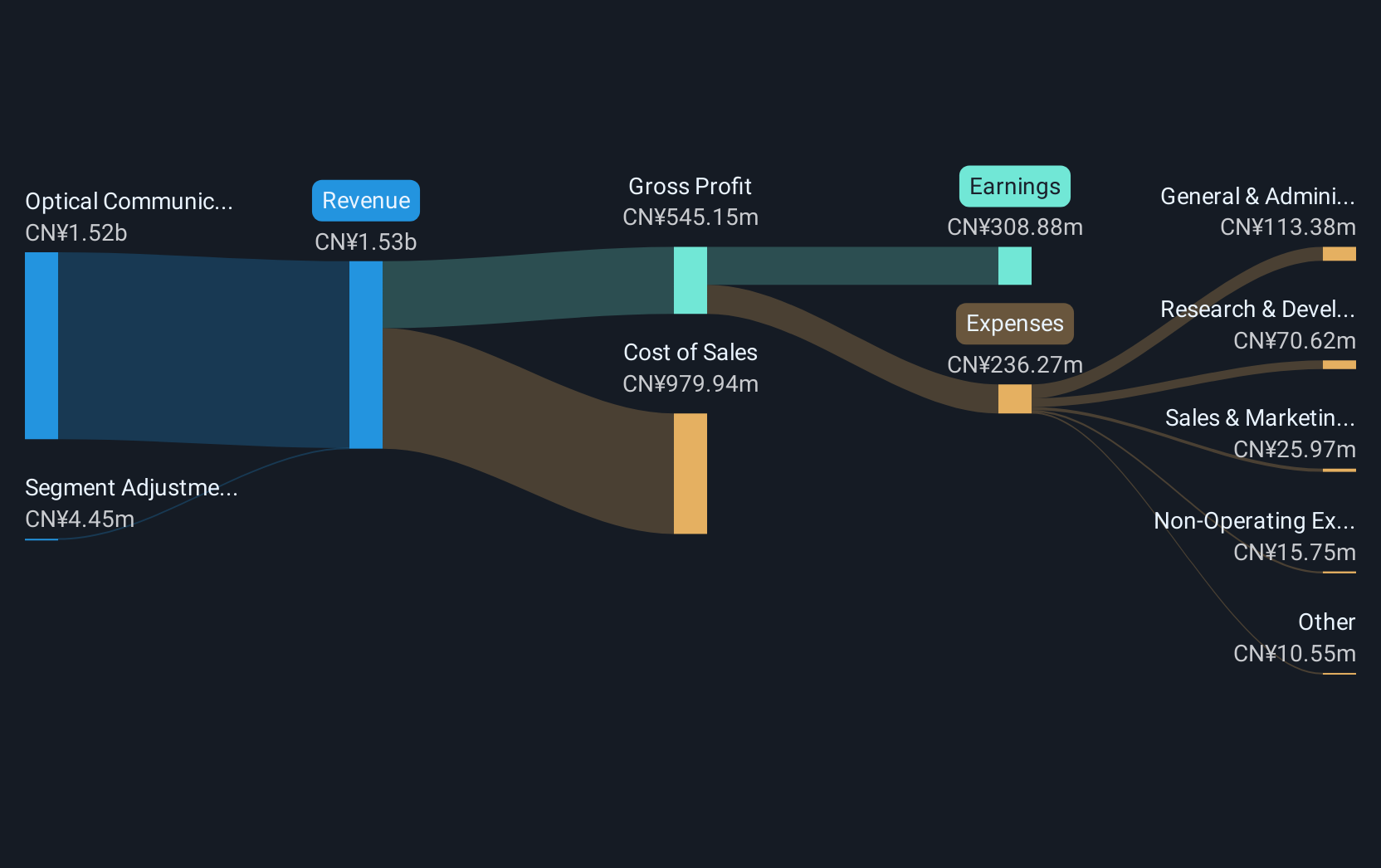

Overview: T&S Communications Co., Ltd. is a company that develops, manufactures, and sells fiber optics communication products in China, with a market capitalization of CN¥17.40 billion.

Operations: T&S Communications generates revenue primarily from its Optical Communication Components segment, which accounted for CN¥1.52 billion. The company's gross profit margin is a key financial metric to consider when analyzing its performance.

T&S CommunicationsLtd has demonstrated a remarkable growth trajectory, with revenue soaring by 30.9% annually, significantly outpacing the broader Chinese market's growth of 12.4%. This surge is mirrored in its earnings, which have expanded by an impressive 95.3% over the past year alone, far exceeding industry averages. The company's commitment to innovation is evident from its R&D investments, which have strategically fueled these gains and positioned it strongly within the competitive tech landscape in Asia. Recent strategic amendments to its bylaws and a robust dividend increase further underscore T&S’s proactive approach in fortifying its market stance while enhancing shareholder value.

- Navigate through the intricacies of T&S CommunicationsLtd with our comprehensive health report here.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company engaged in providing IT services and solutions, with a market capitalization of CN¥51.52 billion.

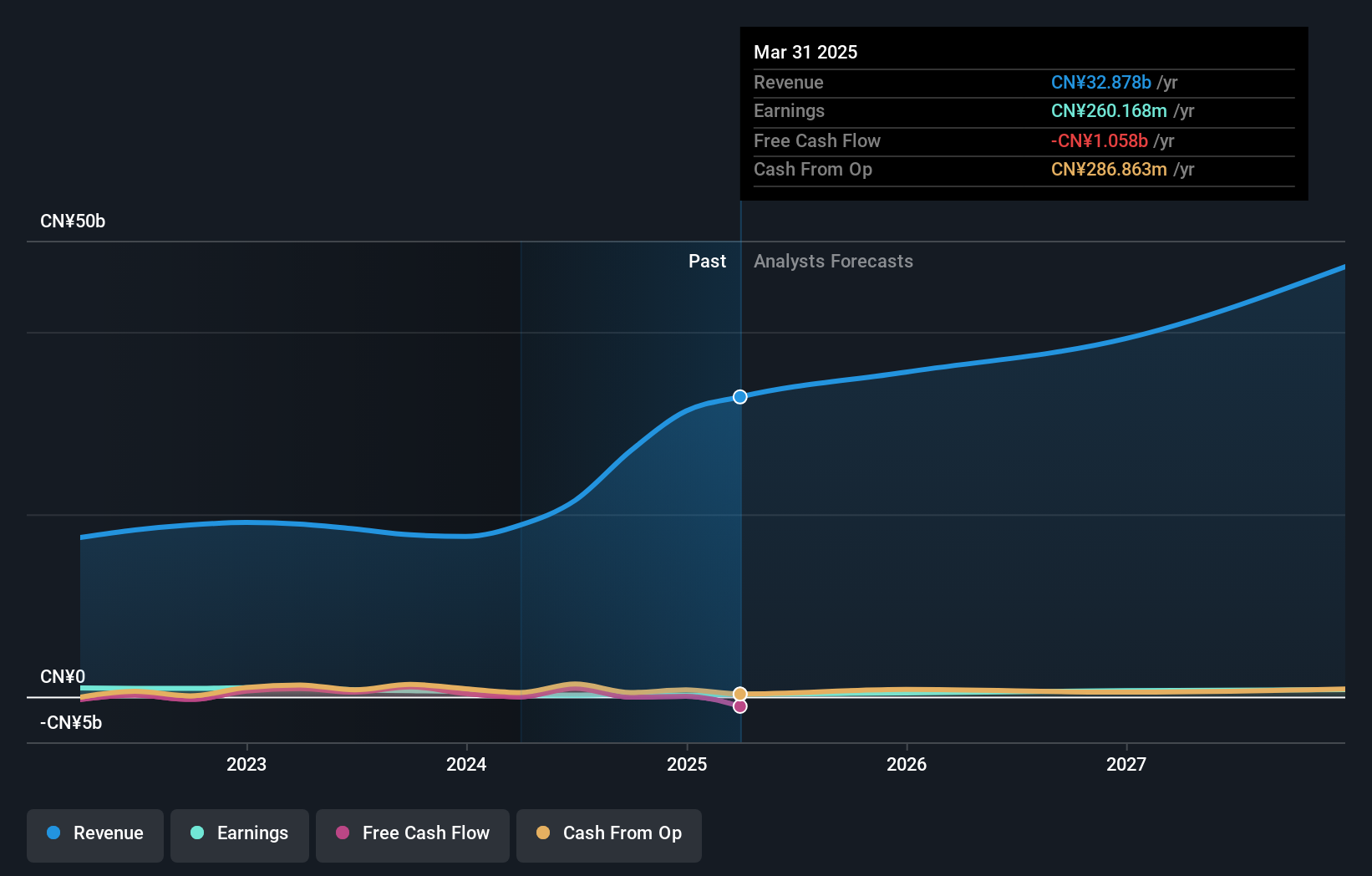

Operations: The company generates revenue primarily through IT services and solutions. The business model focuses on delivering technology-driven services, contributing to its financial performance in the tech sector.

iSoftStone Information Technology (Group) Co., Ltd. is navigating a transformative phase, marked by strategic private placements and amendments to its corporate bylaws aimed at bolstering its financial structure and market agility. Despite a challenging fiscal year with a net income drop to CNY 180.38 million from CNY 533.9 million, the firm's aggressive R&D spending has laid groundwork for future technological advancements, reflecting in its recent revenue jump from CNY 17.58 billion to CNY 31.32 billion annually. These maneuvers are pivotal as iSoftStone strives to enhance shareholder value and capitalize on emerging tech trends within Asia's competitive landscape.

Make It Happen

- Navigate through the entire inventory of 488 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion