- China

- /

- Communications

- /

- SZSE:300563

Risks To Shareholder Returns Are Elevated At These Prices For Shenyu Communication Technology Inc. (SZSE:300563)

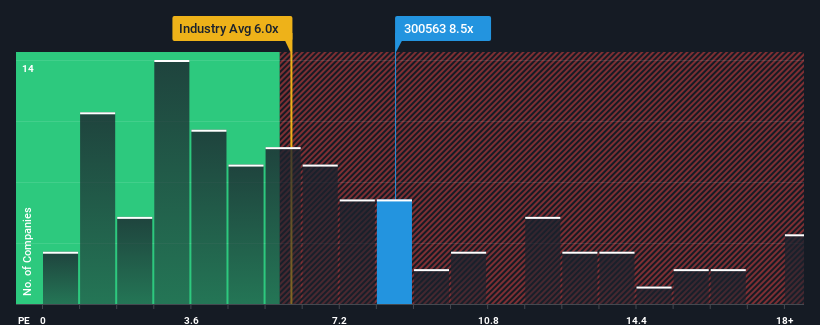

With a price-to-sales (or "P/S") ratio of 8.5x Shenyu Communication Technology Inc. (SZSE:300563) may be sending bearish signals at the moment, given that almost half of all Communications companies in China have P/S ratios under 6x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Shenyu Communication Technology

What Does Shenyu Communication Technology's Recent Performance Look Like?

The revenue growth achieved at Shenyu Communication Technology over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shenyu Communication Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Shenyu Communication Technology's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shenyu Communication Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Shenyu Communication Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Shenyu Communication Technology's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenyu Communication Technology revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shenyu Communication Technology that you should be aware of.

If these risks are making you reconsider your opinion on Shenyu Communication Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300563

Shenyu Communication Technology

Engages in the research and development, production, and sale of radio frequency (RF) coaxial cables in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026