- China

- /

- Electronic Equipment and Components

- /

- SZSE:300557

Wuhan Ligong Guangke Co., Ltd.'s (SZSE:300557) Popularity With Investors Is Under Threat From Overpricing

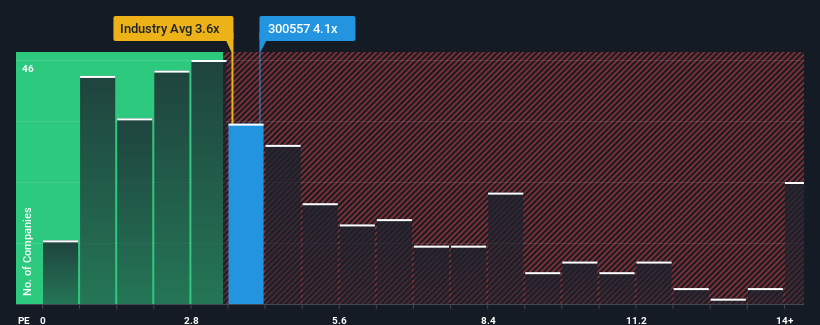

It's not a stretch to say that Wuhan Ligong Guangke Co., Ltd.'s (SZSE:300557) price-to-sales (or "P/S") ratio of 4.1x right now seems quite "middle-of-the-road" for companies in the Electronic industry in China, where the median P/S ratio is around 3.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Wuhan Ligong Guangke

How Wuhan Ligong Guangke Has Been Performing

Revenue has risen firmly for Wuhan Ligong Guangke recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Wuhan Ligong Guangke, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Wuhan Ligong Guangke's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. As a result, it also grew revenue by 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Wuhan Ligong Guangke's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Wuhan Ligong Guangke's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wuhan Ligong Guangke's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You always need to take note of risks, for example - Wuhan Ligong Guangke has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Ligong Guangke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300557

Wuhan Ligong Guangke

Provides optical fiber sensor products and Internet of Things solutions in the fields of security and fire protection in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives