- China

- /

- Tech Hardware

- /

- SZSE:300551

Shanghai Guao Electronic Technology Co., Ltd. (SZSE:300551) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

Unfortunately for some shareholders, the Shanghai Guao Electronic Technology Co., Ltd. (SZSE:300551) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

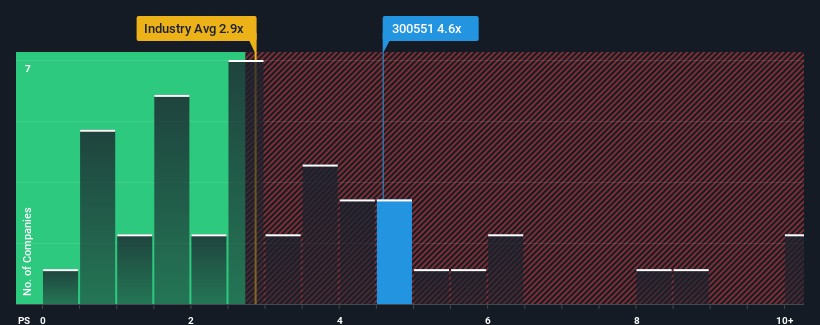

In spite of the heavy fall in price, given close to half the companies operating in China's Tech industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider Shanghai Guao Electronic Technology as a stock to potentially avoid with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Shanghai Guao Electronic Technology

How Shanghai Guao Electronic Technology Has Been Performing

For example, consider that Shanghai Guao Electronic Technology's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shanghai Guao Electronic Technology will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Shanghai Guao Electronic Technology?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shanghai Guao Electronic Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Still, the latest three year period has seen an excellent 77% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 18%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Shanghai Guao Electronic Technology is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Shanghai Guao Electronic Technology's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Shanghai Guao Electronic Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shanghai Guao Electronic Technology, and understanding these should be part of your investment process.

If you're unsure about the strength of Shanghai Guao Electronic Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300551

Shanghai Guao Electronic Technology

Shanghai Guao Electronic Technology Co., Ltd.

Flawless balance sheet very low.

Market Insights

Community Narratives