- China

- /

- Communications

- /

- SZSE:300548

Broadex Technologies Co., Ltd.'s (SZSE:300548) Stock Retreats 28% But Revenues Haven't Escaped The Attention Of Investors

Broadex Technologies Co., Ltd. (SZSE:300548) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 33% in the last year.

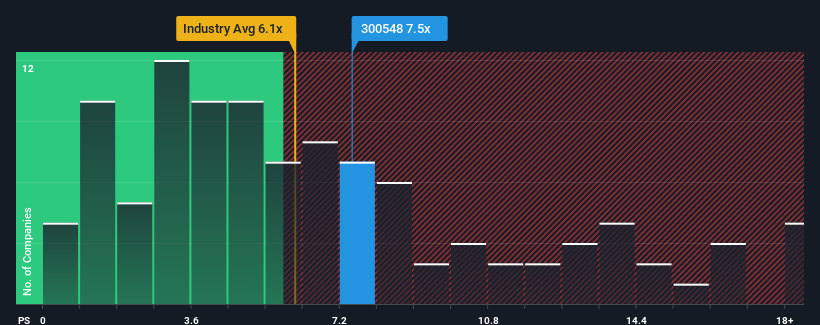

Although its price has dipped substantially, Broadex Technologies' price-to-sales (or "P/S") ratio of 7.5x might still make it look like a sell right now compared to the wider Communications industry in China, where around half of the companies have P/S ratios below 6.1x and even P/S below 3x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Broadex Technologies

What Does Broadex Technologies' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Broadex Technologies' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Broadex Technologies' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Broadex Technologies' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 47% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 32%, which is noticeably less attractive.

With this information, we can see why Broadex Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Broadex Technologies' P/S

There's still some elevation in Broadex Technologies' P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Broadex Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Broadex Technologies that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if EverProX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300548

EverProX Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success