- China

- /

- Electronic Equipment and Components

- /

- SZSE:300502

Slammed 27% Eoptolink Technology Inc., Ltd. (SZSE:300502) Screens Well Here But There Might Be A Catch

The Eoptolink Technology Inc., Ltd. (SZSE:300502) share price has fared very poorly over the last month, falling by a substantial 27%. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

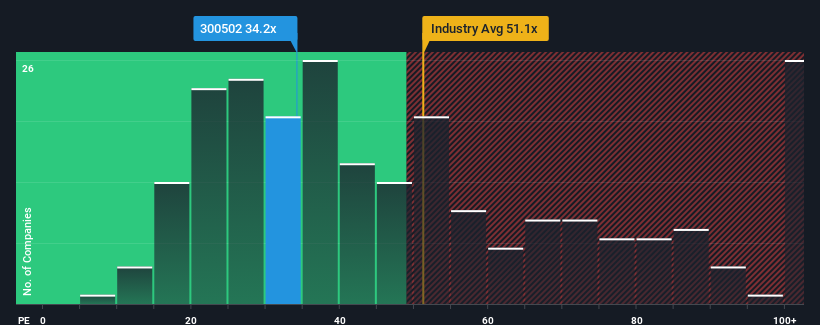

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Eoptolink Technology's P/E ratio of 34.2x, since the median price-to-earnings (or "P/E") ratio in China is also close to 37x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Eoptolink Technology has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Eoptolink Technology

Is There Some Growth For Eoptolink Technology?

The only time you'd be comfortable seeing a P/E like Eoptolink Technology's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 231% gain to the company's bottom line. The latest three year period has also seen an excellent 208% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 64% over the next year. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

With this information, we find it interesting that Eoptolink Technology is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price falling into a hole, the P/E for Eoptolink Technology looks quite average now. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Eoptolink Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Eoptolink Technology.

If you're unsure about the strength of Eoptolink Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eoptolink Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300502

Eoptolink Technology

Engages in the research and development, production, and sale of optical modules for optical communication applications in China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion