- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

High Growth Tech Stocks In Asia To Watch April 2025

Reviewed by Simply Wall St

As trade tensions continue to impact global markets, Asian tech stocks are drawing attention amid hopes for economic stimulus and growth opportunities in the region. In this environment, identifying high-growth potential often involves looking at companies that can adapt to changing trade dynamics and leverage technological advancements effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 28.24% | 28.04% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.81% | 26.05% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.43% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| PharmaResearch | 20.73% | 27.75% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both within China and internationally, with a market capitalization of CN¥50.89 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diverse operations in the auto parts, Internet games, and cloud data sectors. The company leverages its presence both domestically and internationally to expand its market reach.

Zhejiang Century Huatong Group has demonstrated robust growth, with its revenue and earnings forecast to outpace the broader Chinese market. Specifically, annual revenue is expected to increase by 16.3%, significantly above the market average of 12.7%. Moreover, earnings are projected to surge by an impressive 49.6% annually. This financial trajectory is supported by strategic R&D investments which have positioned the company favorably within the tech sector. Despite a one-off loss of CN¥504.8 million last year affecting financial results, Huatong's commitment to innovation and operational adjustments signal strong future prospects in high-growth segments like digital entertainment and software development, aligning with industry shifts towards more integrated technology solutions.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

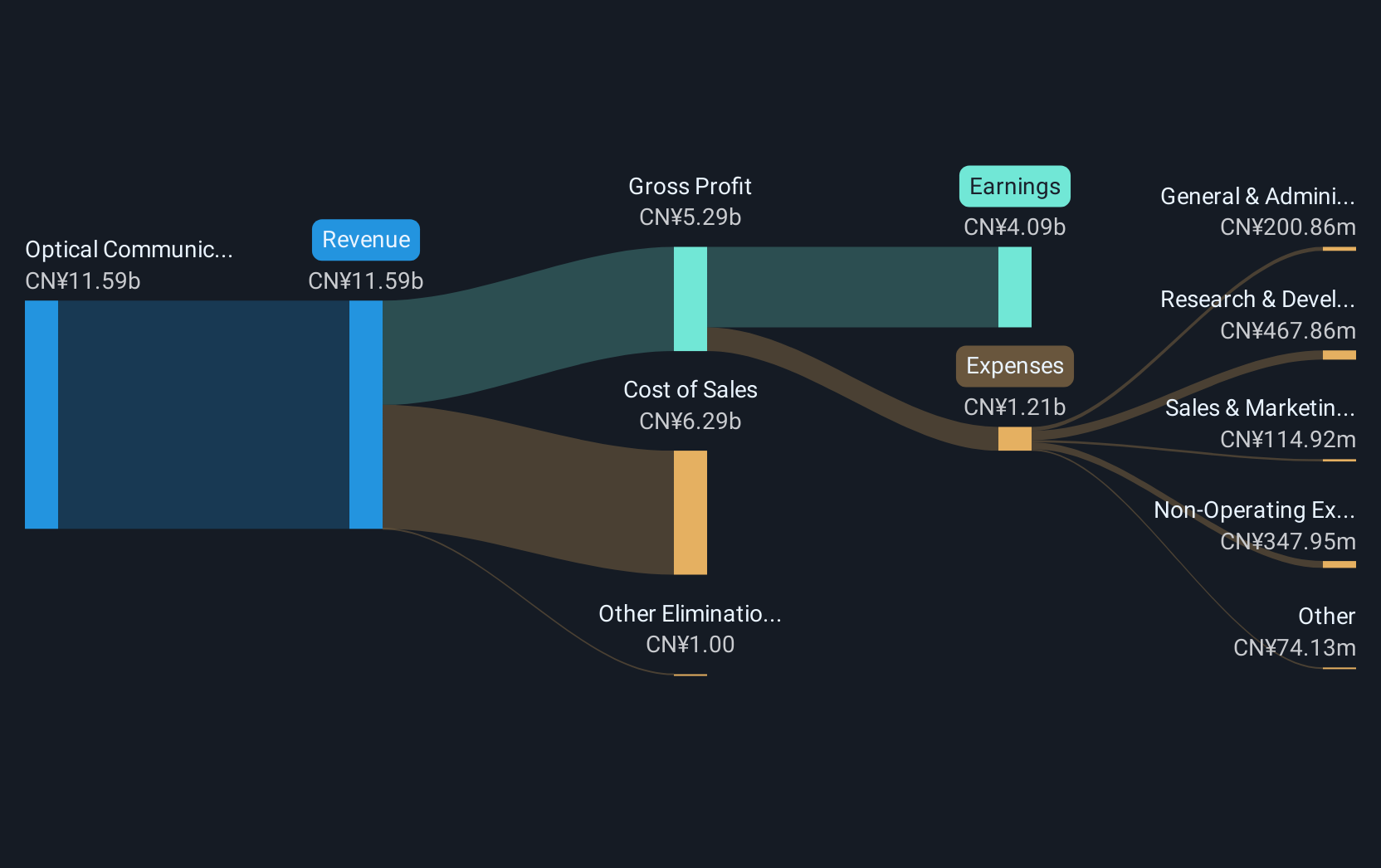

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market capitalization of CN¥55.68 billion.

Operations: Eoptolink focuses on the optical transceiver segment, generating revenue of approximately CN¥6.14 billion from its Optical Communication Equipment.

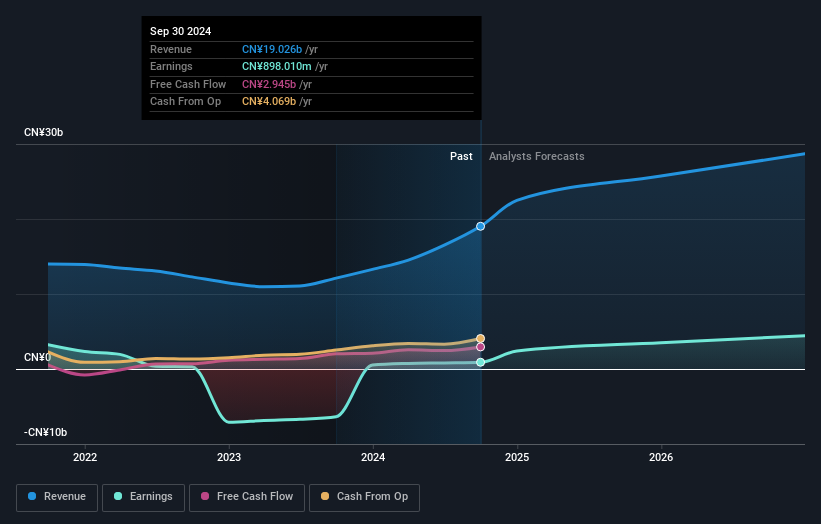

Eoptolink Technology Inc., Ltd. is setting the pace in the high-demand tech sector, particularly with its innovative 800G optical transceivers and 1.6T OSFP modules that cater to the burgeoning needs of data centers driven by AI workloads. The company's recent demonstrations at OFC 2025 highlight its leadership in reducing installation complexities and power consumption, crucial for sustainable growth in tech infrastructure. With a projected annual revenue growth of 43.2% and earnings surge at 38.7%, Eoptolink stands out not just for its financial performance but also for its strategic advancements in optical technology which are essential as digital communication infrastructures evolve rapidly worldwide.

- Take a closer look at Eoptolink Technology's potential here in our health report.

Explore historical data to track Eoptolink Technology's performance over time in our Past section.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

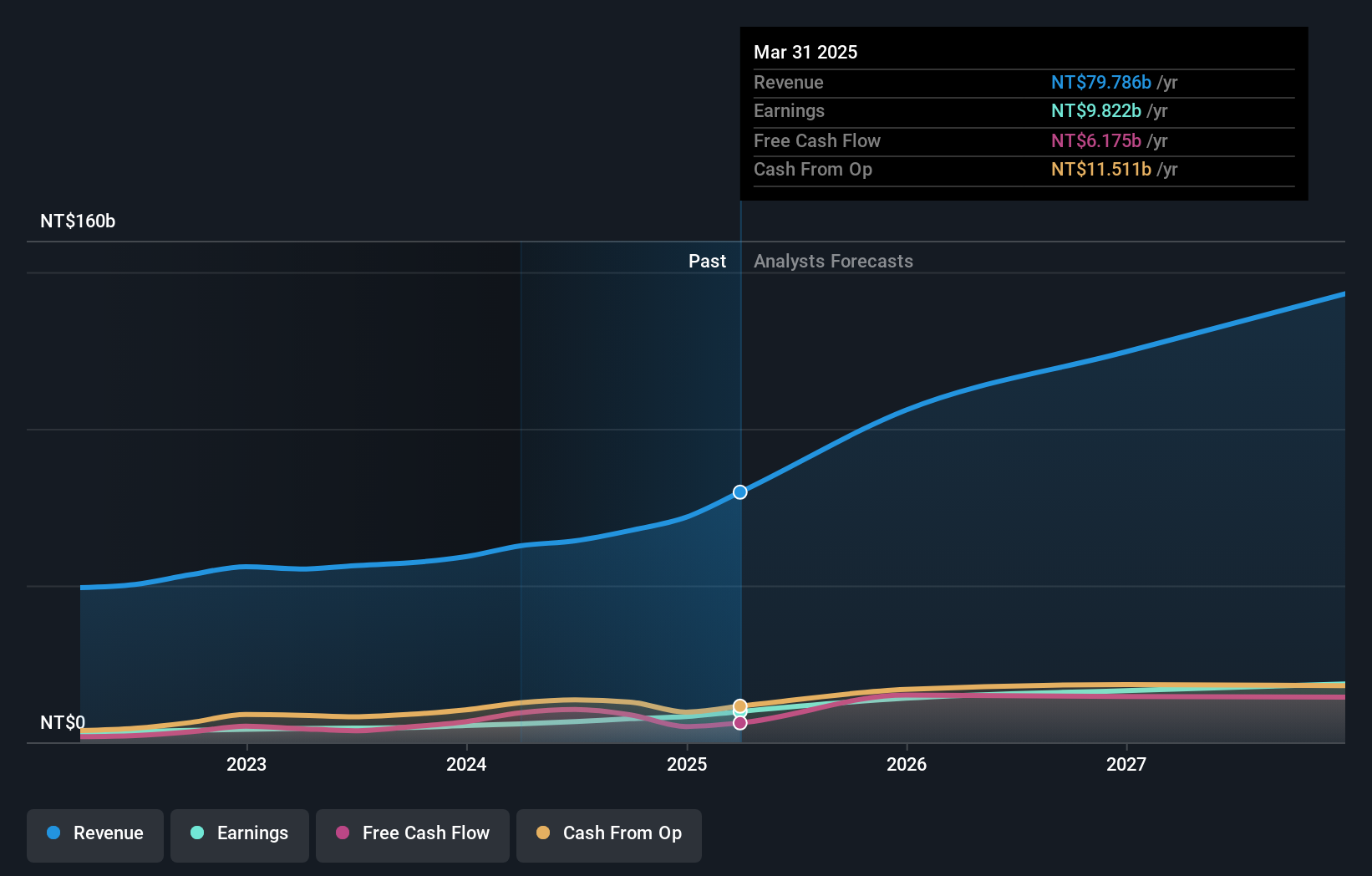

Overview: Asia Vital Components Co., Ltd. specializes in providing thermal solutions on a global scale, with a market capitalization of NT$168.59 billion.

Operations: The company generates revenue primarily through its Overseas Business Department, which contributes NT$81.45 billion, and the Integrated Management Division, adding NT$54.67 billion.

Asia Vital Components has demonstrated robust financial performance, with a notable increase in annual revenue by 22.6% and earnings growth of 28.9%. This growth trajectory is underpinned by significant R&D investment, aligning with its strategic focus on enhancing product offerings and maintaining competitive advantage in the tech sector. Recent corporate actions, including a proposed amendment to its Articles of Incorporation and an increase in dividends, reflect confidence in ongoing profitability and commitment to shareholder value. The company's participation in major industry conferences also underscores its active role in shaping tech innovations regionally.

Key Takeaways

- Click here to access our complete index of 494 Asian High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives