- China

- /

- Electronic Equipment and Components

- /

- SZSE:300479

Synthesis Electronic TechnologyLtd (SZSE:300479) pulls back 11% this week, but still delivers shareholders 20% return over 1 year

The Synthesis Electronic Technology Co.,Ltd. (SZSE:300479) share price has had a bad week, falling 11%. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 20%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Synthesis Electronic TechnologyLtd

Synthesis Electronic TechnologyLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Synthesis Electronic TechnologyLtd actually shrunk its revenue over the last year, with a reduction of 11%. The stock is up 20% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

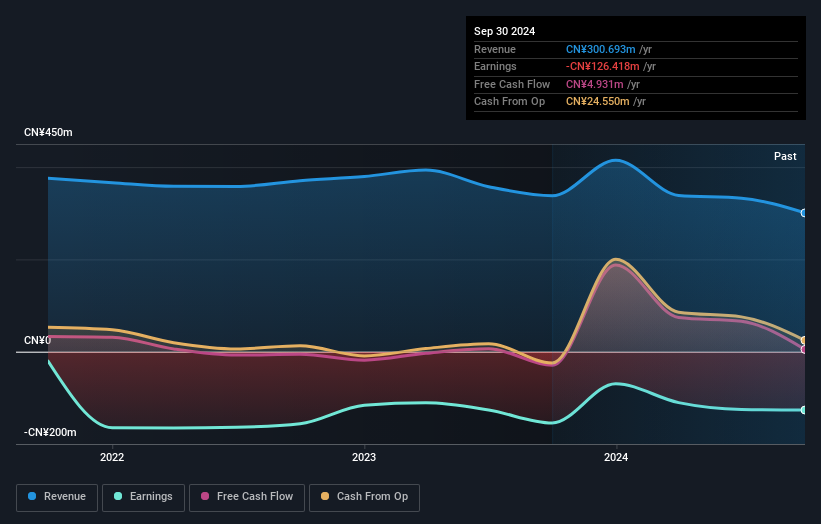

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Synthesis Electronic TechnologyLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Synthesis Electronic TechnologyLtd shareholders have received a total shareholder return of 20% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Synthesis Electronic TechnologyLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Synthesis Electronic TechnologyLtd , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300479

Synthesis Electronic TechnologyLtd

Engages in the offline identity authentication and Internet trusted identity authentication business in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives