- China

- /

- Electronic Equipment and Components

- /

- SZSE:300456

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season with mixed economic signals, small-cap stocks have shown resilience compared to their larger counterparts, despite broader indices like the Nasdaq Composite and S&P MidCap 400 experiencing fluctuations. In this context of cautious optimism and market volatility, identifying high growth tech stocks requires a focus on companies demonstrating robust fundamentals and innovative potential that can withstand shifting macroeconomic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the research, development, and production of biopharmaceutical products, with a market cap of approximately CN¥17.02 billion.

Operations: Zelgen Biopharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to CN¥488.45 million. The company's focus on biopharmaceutical products is reflected in its market presence and financial performance.

Suzhou Zelgen Biopharmaceuticals has demonstrated a robust revenue growth of 59.6% this year, outpacing the broader Chinese market's average of 14%. Despite current unprofitability, the firm is on a trajectory to not only achieve profitability within three years but also expects an impressive annual earnings growth rate of 125.6%. This financial revitalization is underscored by significant R&D investments, which are pivotal in driving innovation and potentially securing future market leadership in biotechnology. With recent earnings showing a reduction in net loss from CNY 202.09 million to CNY 97.9 million and sales climbing to CNY 384.12 million, the company's strategic focus on enhancing its product pipeline and operational efficiencies is evident. These factors collectively suggest that Suzhou Zelgen Biopharmaceuticals may soon transition from high-growth prospects to profitable sustainability, aligning with industry trends towards advanced therapeutic solutions.

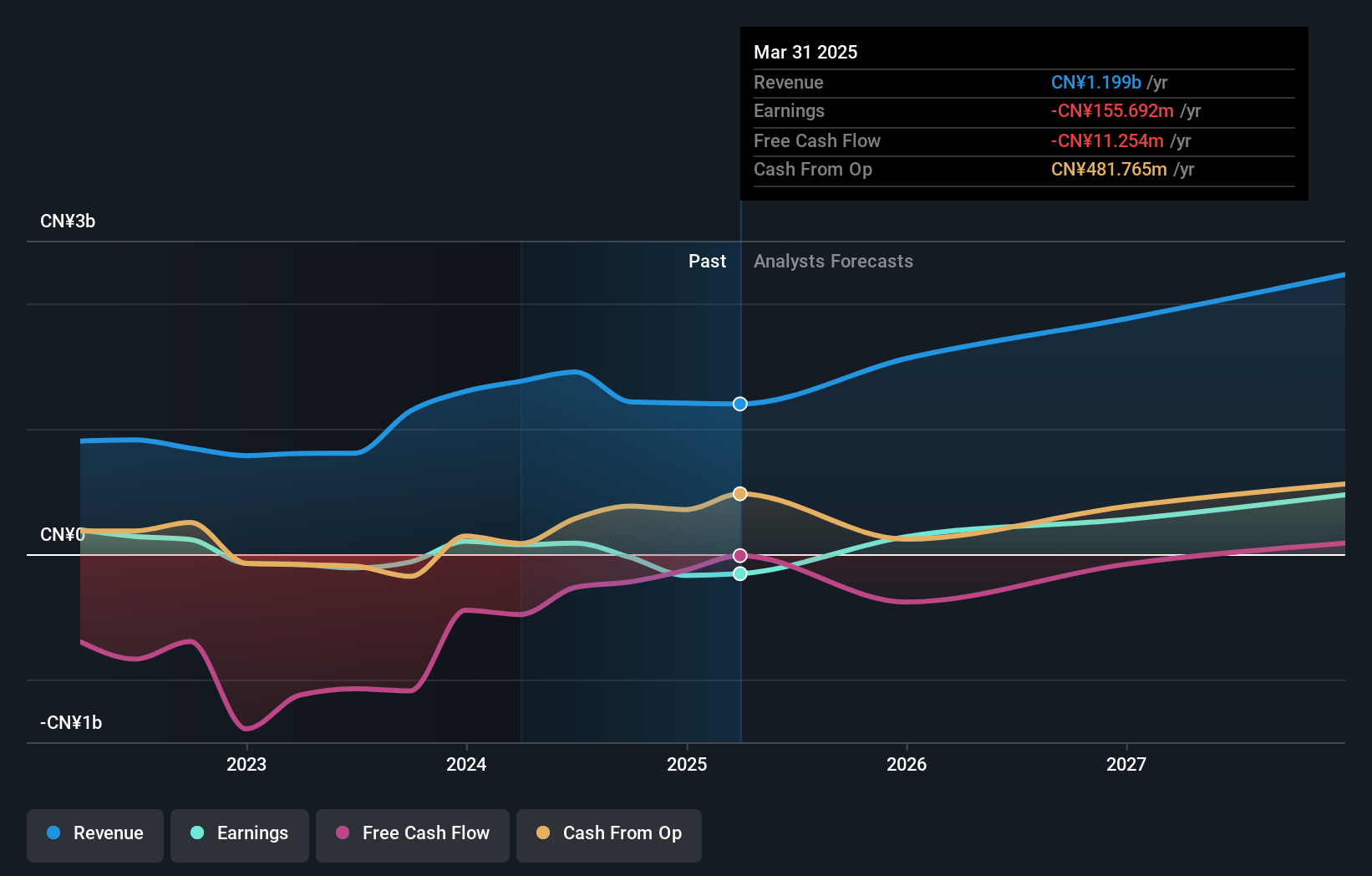

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinocelltech Group Limited is a biotech company focused on the research, development, and industrialization of recombinant proteins, monoclonal antibodies, and vaccines in China with a market capitalization of CN¥17.22 billion.

Operations: Sinocelltech Group generates revenue primarily from its Biological Drugs segment, which includes drugs and vaccines, amounting to CN¥2.45 billion. The company is involved in the industrialization of these biotechnological products within China.

Sinocelltech Group's recent shift from a net loss to a profit, with earnings soaring by 139.27% annually, signals a robust turnaround in its financial health. This transformation is underpinned by an aggressive R&D strategy, where the company invested significantly, aligning with its revenue growth forecast of 28% per year. These strategic moves not only reflect Sinocelltech's commitment to innovation but also position it well within the competitive landscape of tech and biotech sectors. Moreover, this year's sales surge to CNY 1.94 billion from last year’s CNY 1.38 billion exemplifies their capability to scale operations effectively amidst market challenges.

- Navigate through the intricacies of Sinocelltech Group with our comprehensive health report here.

Gain insights into Sinocelltech Group's past trends and performance with our Past report.

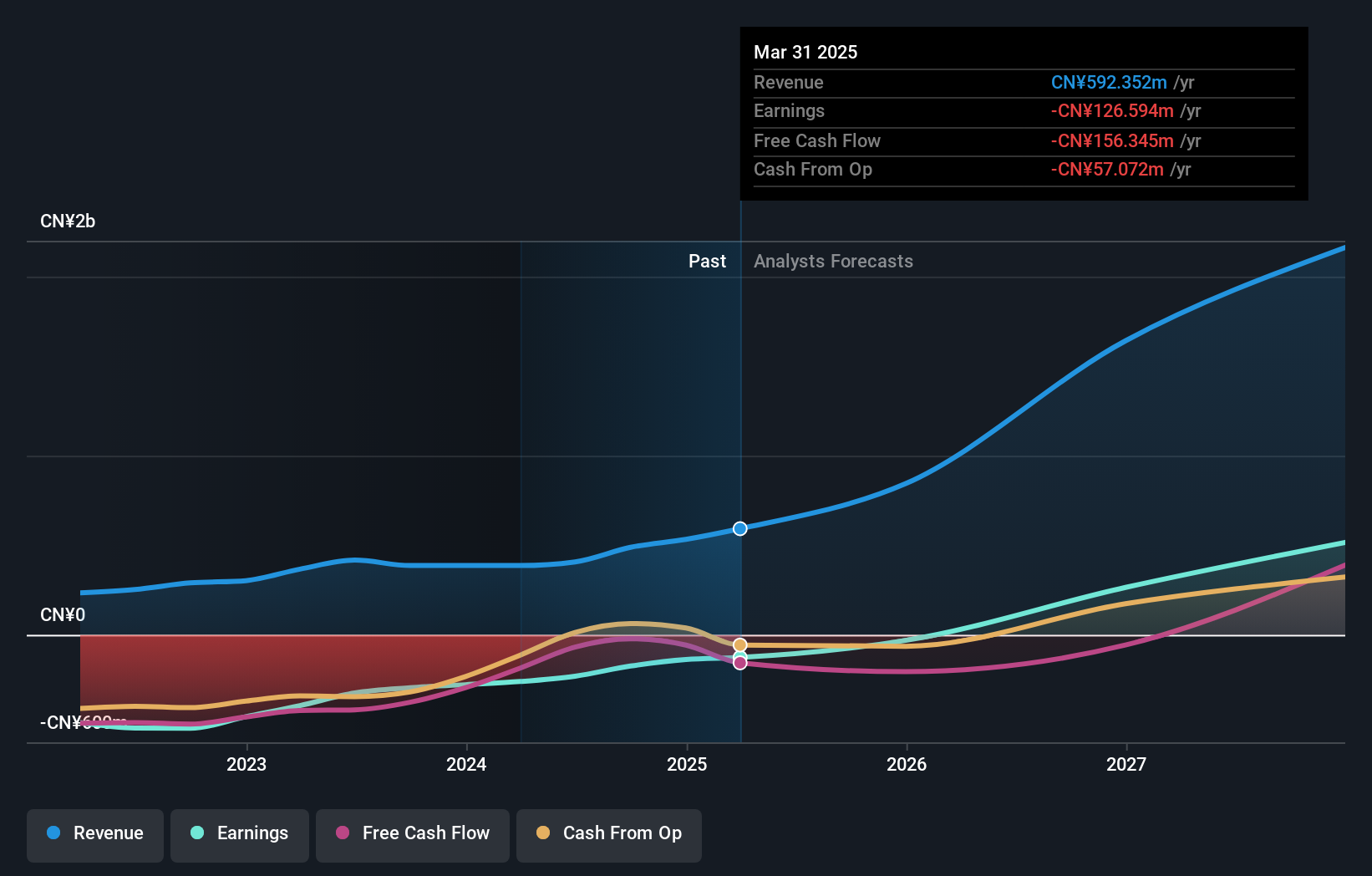

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. focuses on the development and sale of micro-electromechanical systems (MEMS) products in China, with a market capitalization of CN¥14.07 billion.

Operations: Sai MicroElectronics Inc. specializes in producing and selling MEMS products within China, emphasizing innovation in micro-electromechanical systems technology. The company operates with a market capitalization of CN¥14.07 billion, reflecting its significant presence in the sector.

Despite recent setbacks, Sai MicroElectronics showcases potential with a projected annual revenue growth of 30.1%, significantly outpacing the CN market average of 14%. This growth is supported by a robust R&D commitment, crucial for its recovery and future competitiveness in the tech sector. However, challenges persist as evidenced by a recent report indicating a shift from profit to a net loss of CNY 117.77 million over nine months. The company's aggressive pursuit of innovation through R&D, which aligns with an expected earnings surge of 71% per year, suggests resilience and an underlying strength that may yet redefine its market standing.

- Unlock comprehensive insights into our analysis of Sai MicroElectronics stock in this health report.

Explore historical data to track Sai MicroElectronics' performance over time in our Past section.

Where To Now?

- Get an in-depth perspective on all 1291 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300456

Sai MicroElectronics

Engages in development and sale of micro-electromechanical systems (MEMS) products in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives