- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

High Growth Tech Stocks in Asia for November 2025

Reviewed by Simply Wall St

As Asian markets navigate the evolving landscape of global economic shifts, recent easing of U.S.-China trade tensions has bolstered investor sentiment, pushing key indices like China's CSI 300 and the Shanghai Composite to notable highs. In this context, identifying high-growth tech stocks requires a keen eye for companies that not only innovate but also adapt to changing geopolitical dynamics and market demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 21.64% | 24.11% | ★★★★★★ |

| Giant Network Group | 34.13% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Eoptolink Technology | 40.70% | 37.57% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd offers application performance management services for enterprises in China, with a market capitalization of CN¥2.56 billion.

Operations: Bonree Data Technology Co., Ltd specializes in application performance management services aimed at enhancing enterprise efficiency in China. The company focuses on optimizing software applications, which forms the core of its revenue model.

Bonree Data Technology, amidst a challenging financial landscape, is navigating through its unprofitability with strategic shifts towards profitability anticipated within three years. Recent financials reveal a narrowing net loss to CNY 41.75 million from CNY 63.16 million year-over-year, underscoring effective cost management and operational adjustments. The company's commitment to innovation is evident in its R&D investments, crucial for staying competitive in the rapidly evolving tech sector of Asia. With revenue growth projected at an impressive 34.1% annually and earnings expected to surge by approximately 127% per year, Bonree is positioning itself as a resilient contender in the high-growth tech arena despite current volatility and market challenges.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market capitalization of approximately CN¥11.75 billion.

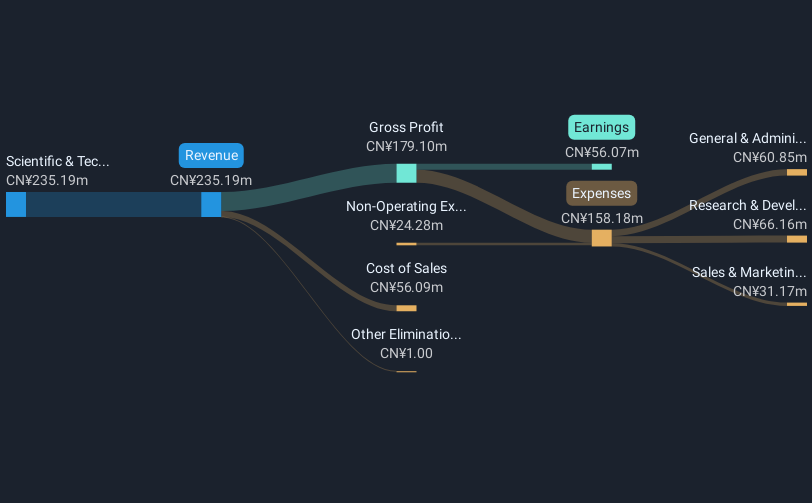

Operations: Naruida Technology generates revenue primarily from its Scientific & Technical Instruments segment, amounting to CN¥463.09 million. The company focuses on the production and sale of advanced radar systems in China.

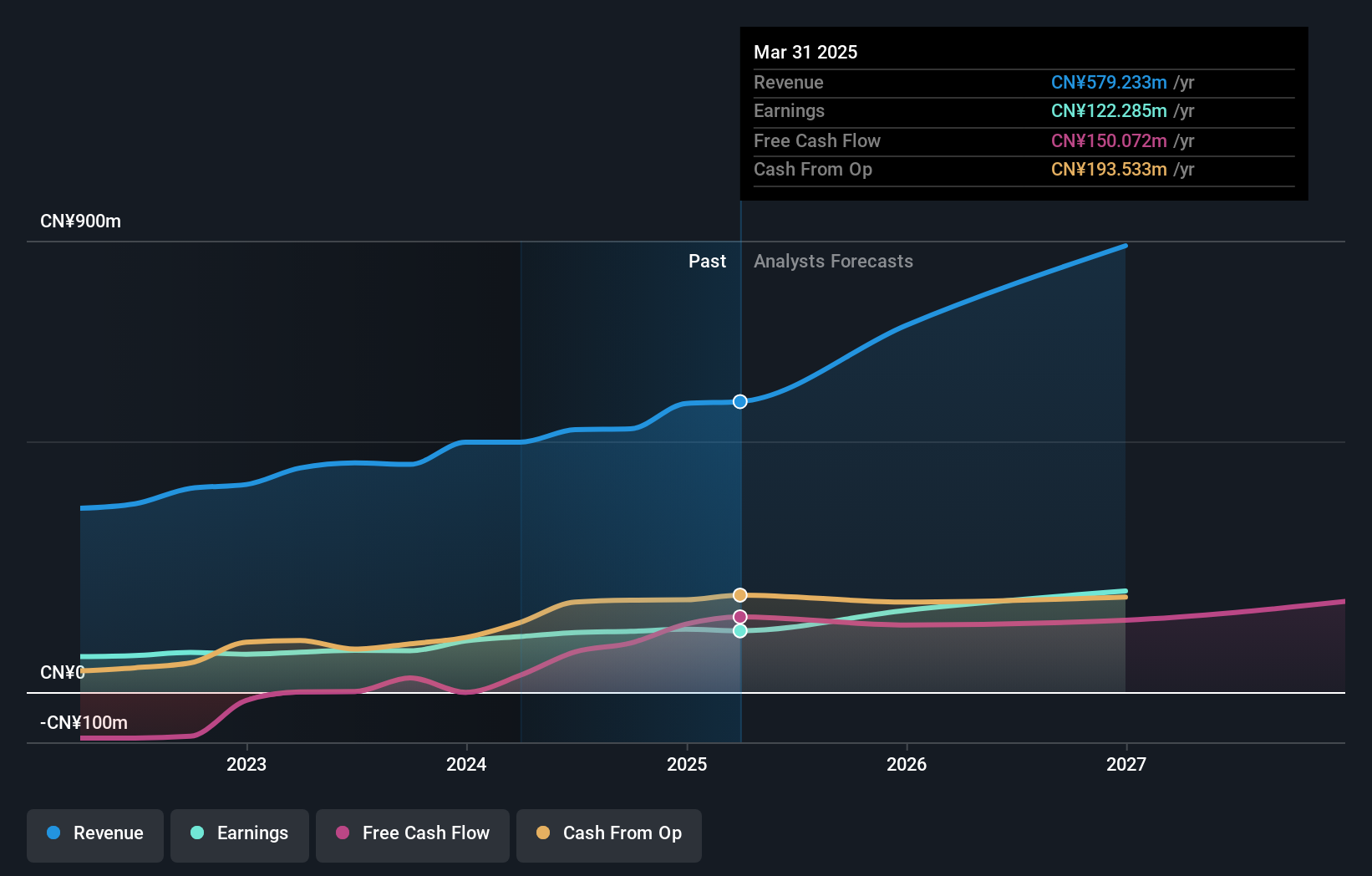

Naruida Technology's recent performance underscores its robust position in Asia's tech landscape, with a notable 120.7% surge in earnings over the past year, outpacing the electronic industry's growth of 9%. This dynamism is mirrored in its revenue, which almost doubled to CNY 254.02 million from CNY 136.2 million, and net income escalated to CNY 73.16 million from CNY 26.01 million within nine months. The firm invests heavily in innovation, evidenced by substantial R&D expenditures aligned with its aggressive growth metrics—forecasted annual revenue and earnings growth rates stand at an impressive 50.8% and 58.3%, respectively, significantly outstripping market averages.

- Click here and access our complete health analysis report to understand the dynamics of Naruida Technology.

Examine Naruida Technology's past performance report to understand how it has performed in the past.

Beijing ConST Instruments Technology (SZSE:300445)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing ConST Instruments Technology Inc. is engaged in the research, development, manufacture, and sale of digital testing instruments and equipment both in China and internationally, with a market cap of CN¥4.25 billion.

Operations: ConST Instruments specializes in creating and distributing digital testing instruments and equipment across domestic and international markets. The company focuses on leveraging its research and development capabilities to enhance its product offerings.

Beijing ConST Instruments Technology has demonstrated a solid trajectory in the tech sector, with its recent earnings report showing a revenue increase to CNY 393.99 million from CNY 358.21 million year-over-year, and net income rising to CNY 94.32 million from CNY 89.42 million. This growth is supported by significant corporate governance enhancements and strategic expansions discussed in their latest meetings, indicating a proactive approach towards scaling operations and refining internal systems. The company's commitment to R&D is evident from its consistent investment in innovation, positioning it well within Asia's competitive high-growth technology landscape despite not leading the market.

Taking Advantage

- Gain an insight into the universe of 184 Asian High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naruida Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688522

Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives