- China

- /

- Electronic Equipment and Components

- /

- SZSE:300440

There's No Escaping Chengdu Yunda Technology Co., Ltd.'s (SZSE:300440) Muted Revenues Despite A 25% Share Price Rise

Despite an already strong run, Chengdu Yunda Technology Co., Ltd. (SZSE:300440) shares have been powering on, with a gain of 25% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

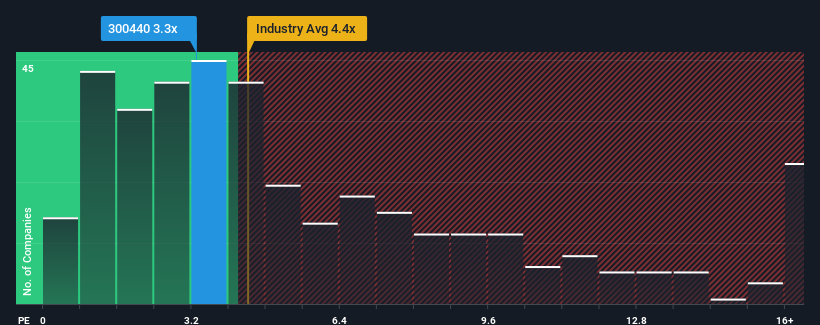

Although its price has surged higher, Chengdu Yunda Technology's price-to-sales (or "P/S") ratio of 3.3x might still make it look like a buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 4.4x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Chengdu Yunda Technology

How Has Chengdu Yunda Technology Performed Recently?

Revenue has risen firmly for Chengdu Yunda Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chengdu Yunda Technology's earnings, revenue and cash flow.How Is Chengdu Yunda Technology's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chengdu Yunda Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. This was backed up an excellent period prior to see revenue up by 37% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Chengdu Yunda Technology's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Chengdu Yunda Technology's P/S?

Chengdu Yunda Technology's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Chengdu Yunda Technology maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Having said that, be aware Chengdu Yunda Technology is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If these risks are making you reconsider your opinion on Chengdu Yunda Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300440

Chengdu Yunda Technology

Engages in the research and development, production, and sale of rail transit intelligent systems and solutions in China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives