- China

- /

- Medical Equipment

- /

- SZSE:301093

Three Prominent Chinese Stocks Estimated To Be Undervalued By Between 40.2% And 47.3% On The Exchange

Reviewed by Simply Wall St

Amid a backdrop of slowing economic activity, as evidenced by recent underwhelming manufacturing data, China's stock market has shown signs of strain. However, this environment may present opportunities to identify stocks that are potentially undervalized, offering a compelling option for investors looking for value in a challenging market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.11 | CN¥33.87 | 49.5% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥30.22 | CN¥56.75 | 46.8% |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥25.10 | CN¥46.17 | 45.6% |

| Anhui Anli Material Technology (SZSE:300218) | CN¥13.30 | CN¥26.58 | 50% |

| DongHua Testing Technology (SZSE:300354) | CN¥31.06 | CN¥58.88 | 47.3% |

| INKON Life Technology (SZSE:300143) | CN¥7.58 | CN¥14.64 | 48.2% |

| China Film (SHSE:600977) | CN¥10.54 | CN¥20.16 | 47.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.88 | CN¥17.58 | 49.5% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.49 | CN¥18.84 | 49.6% |

| Yonyou Network TechnologyLtd (SHSE:600588) | CN¥9.00 | CN¥16.95 | 46.9% |

Let's explore several standout options from the results in the screener

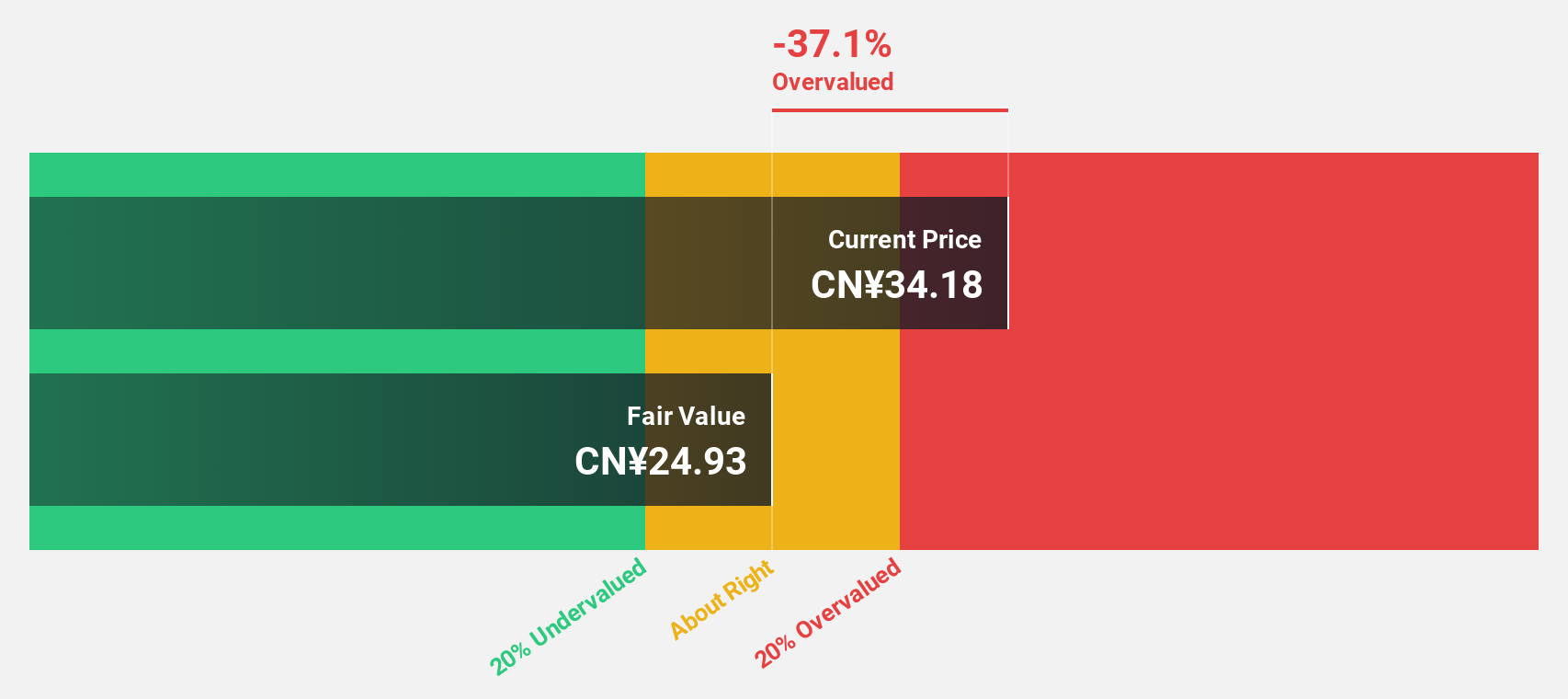

DongHua Testing Technology (SZSE:300354)

Overview: DongHua Testing Technology Co., Ltd. specializes in testing structural mechanical properties in China, with a market capitalization of approximately CN¥4.30 billion.

Operations: The company generates revenue primarily from its instrumentation testing segment, which brought in CN¥410.65 million.

Estimated Discount To Fair Value: 47.3%

DongHua Testing Technology is significantly undervalued based on DCF, trading at CN¥31.06 against a fair value of CN¥58.88, indicating a 47.3% undervaluation. The company's earnings and revenue are expected to grow at 37.29% and 33.4% per year respectively, outpacing the Chinese market averages significantly. Despite recent dividend decreases, robust profit growth forecasts and strong return on equity projections (25.4%) suggest potential for future appreciation in stock value amidst aggressive share buybacks.

- According our earnings growth report, there's an indication that DongHua Testing Technology might be ready to expand.

- Take a closer look at DongHua Testing Technology's balance sheet health here in our report.

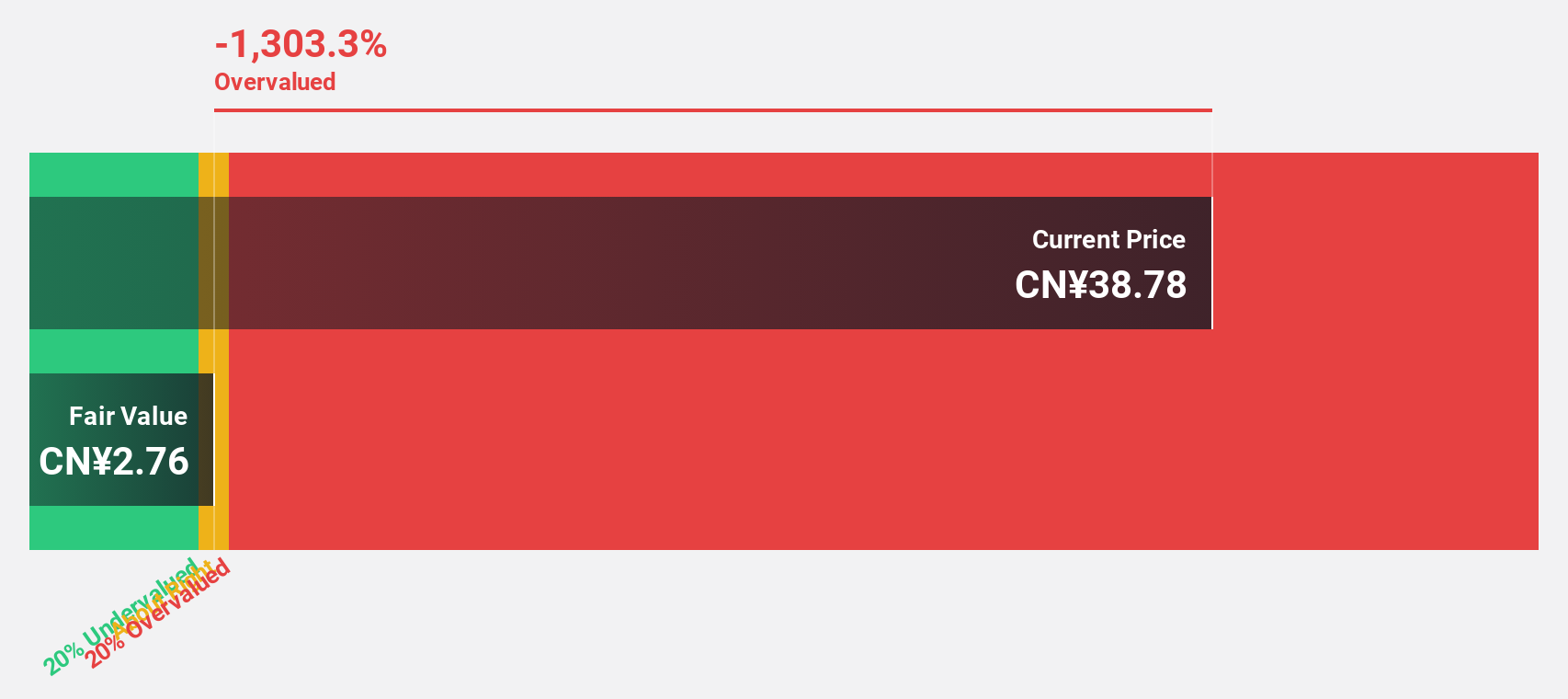

Doctorglasses ChainLtd (SZSE:300622)

Overview: Doctorglasses Chain Co., Ltd. operates as a retailer of eyewear in China, with a market capitalization of approximately CN¥2.02 billion.

Operations: The company generates its revenue primarily from the specialty retail segment, totaling CN¥1.16 billion.

Estimated Discount To Fair Value: 40.2%

Doctorglasses ChainLtd, trading at CN¥11.61, is significantly undervalued with a fair value estimate of CN¥19.42, reflecting a substantial discount. While its earnings growth of 21.6% per year trails slightly behind the market average, revenue growth at 16% annually surpasses the market's 13.6%. Recent corporate actions include dividend increases and amendments to company bylaws, enhancing shareholder returns and corporate governance respectively. However, the dividend coverage remains a concern with earnings not fully covering payouts.

- Our growth report here indicates Doctorglasses ChainLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Doctorglasses ChainLtd's balance sheet health report.

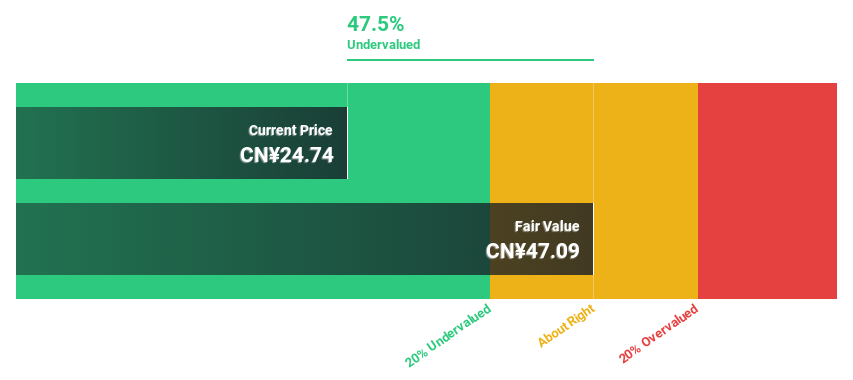

Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093)

Overview: Jiangsu Hualan New Pharmaceutical Material Co., Ltd. is a company engaged in the production of pharmaceutical materials, with a market capitalization of approximately CN¥2.33 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Estimated Discount To Fair Value: 44.4%

Jiangsu Hualan New Pharmaceutical Material Co., Ltd. is trading at CN¥18.1, significantly below its estimated fair value of CN¥32.55, indicating a potential undervaluation based on cash flows. The company's revenue and earnings are expected to grow at 24.1% and 33.9% per year respectively, outpacing the Chinese market averages significantly. However, its dividend sustainability is questionable as current cash flows do not adequately cover a 3.31% dividend yield, and its forecasted return on equity in three years is relatively low at 6.7%. Recent corporate activities include shareholder meetings addressing stock repurchase plans and changes in company bylaws to potentially enhance governance structures.

- Our earnings growth report unveils the potential for significant increases in Jiangsu Hualan New Pharmaceutical MaterialLtd's future results.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Hualan New Pharmaceutical MaterialLtd.

Make It Happen

- Delve into our full catalog of 97 Undervalued Chinese Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301093

Jiangsu Hualan New Pharmaceutical MaterialLtd

Jiangsu Hualan New Pharmaceutical Material Co.,Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives