- China

- /

- Communications

- /

- SZSE:300353

More Unpleasant Surprises Could Be In Store For Kyland Technology Co., Ltd.'s (SZSE:300353) Shares After Tumbling 26%

Kyland Technology Co., Ltd. (SZSE:300353) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 16%.

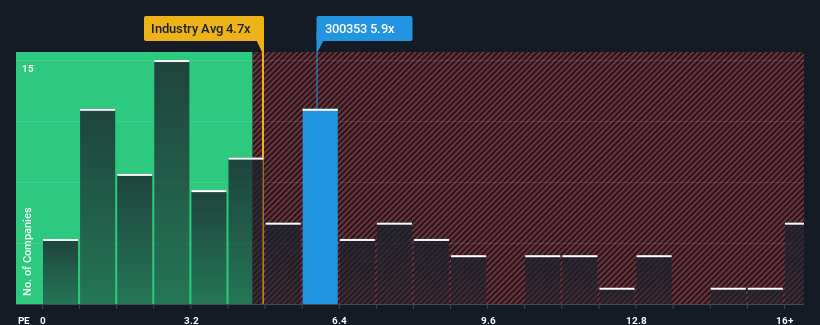

Although its price has dipped substantially, Kyland Technology may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.9x, when you consider almost half of the companies in the Communications industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Kyland Technology

What Does Kyland Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Kyland Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kyland Technology.How Is Kyland Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Kyland Technology would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.7%. Still, the latest three year period has seen an excellent 64% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the lone analyst following the company. That's shaping up to be materially lower than the 36% growth forecast for the broader industry.

With this information, we find it concerning that Kyland Technology is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

There's still some elevation in Kyland Technology's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Kyland Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Kyland Technology (2 are a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Kyland Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kyland Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300353

Kyland Technology

Provides industrial Ethernet technology in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives