- China

- /

- Electronic Equipment and Components

- /

- SZSE:300344

Subdued Growth No Barrier To Cubic Digital Technology Co.,Ltd. (SZSE:300344) With Shares Advancing 44%

Cubic Digital Technology Co.,Ltd. (SZSE:300344) shares have continued their recent momentum with a 44% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

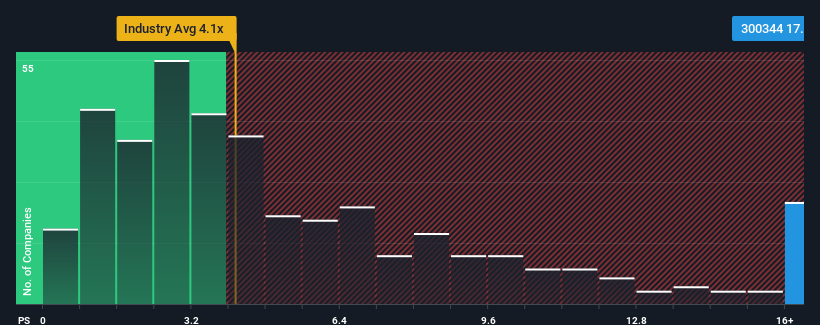

Following the firm bounce in price, Cubic Digital TechnologyLtd's price-to-sales (or "P/S") ratio of 17.6x might make it look like a strong sell right now compared to other companies in the Electronic industry in China, where around half of the companies have P/S ratios below 4.1x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Cubic Digital TechnologyLtd

What Does Cubic Digital TechnologyLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Cubic Digital TechnologyLtd has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Cubic Digital TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Cubic Digital TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Cubic Digital TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 99% last year. Still, revenue has fallen 31% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Cubic Digital TechnologyLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Cubic Digital TechnologyLtd's P/S?

Shares in Cubic Digital TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Cubic Digital TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 1 warning sign for Cubic Digital TechnologyLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on Cubic Digital TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300344

Cubic Digital TechnologyLtd

Manufactures and sells steel frame foamed cement composite boards in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives