- China

- /

- Electronic Equipment and Components

- /

- SZSE:300344

Cubic Digital Technology Co.,Ltd. (SZSE:300344) Shares May Have Slumped 29% But Getting In Cheap Is Still Unlikely

The Cubic Digital Technology Co.,Ltd. (SZSE:300344) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

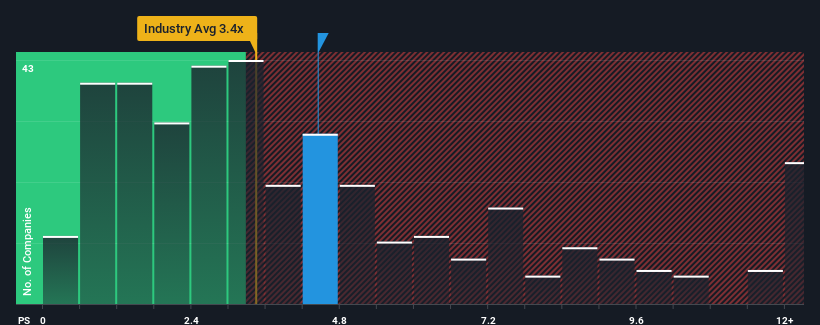

Although its price has dipped substantially, you could still be forgiven for thinking Cubic Digital TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.4x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Cubic Digital TechnologyLtd

How Cubic Digital TechnologyLtd Has Been Performing

As an illustration, revenue has deteriorated at Cubic Digital TechnologyLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cubic Digital TechnologyLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Cubic Digital TechnologyLtd's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 96% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's about the same on an annualised basis.

In light of this, it's curious that Cubic Digital TechnologyLtd's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Cubic Digital TechnologyLtd's P/S?

There's still some elevation in Cubic Digital TechnologyLtd's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cubic Digital TechnologyLtd revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Cubic Digital TechnologyLtd is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Cubic Digital TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300344

Cubic Digital TechnologyLtd

Manufactures and sells steel frame foamed cement composite boards in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives